PepeCoin (PEPE) displayed bearish actions today, as it seems to have lost the steam that propelled it to ATH recently.

Nonetheless, the themed token flashed recoveries as a cryptic post from asset manager VanEck catalyzed a considerable buzz within the crypto community.

VanEck’s PEPE-related post

The investment company shared a meme featuring a frog surrounded by other animals.

The frog attracted attention as it stood on the table, with other animals attempting to grab its attention.

Meanwhile, VanEck’s caption about vital topics discussed triggered speculations within the meme crypto space.

PepeCoin experienced significant volatility following the cryptic post.

The themed token dipped to daily lows of $0.00001213 before VanEck’s message.

Nonetheless, it capitalized on the social media hype for a swift bounce back.

VanEck remains on the crypto community’s radar following its latest Solana ETF application.

While the odds of a PEPE exchange-traded fund soon could be nearly zero, VanEck’s cryptic post stirred optimism within the meme coin sector.

PEPE’s current price action

VanEck’s post saw PEPE gaining over 3.5% to trade at $0.0000122 at press time.

The meme token gained more than 10% within the previous week, displaying resilience despite broad market bearishness.

PepeCoin’s market cap is $5.13 billion, while its daily trading volume dipped by 30% to $454 million.

PEPE has seen significant price fluctuations since hitting the record highs in May.

The altcoin lost 44% after hitting the peak toward the $0.00000968 foothold on 24 June.

Meanwhile, analysts remain confident about PEPE’s potential rebound.

For instance, Altcoin Sherpa expects a remarkable bounce back as the altcoin “is at a solid bounce area. “

The analyst has PepeCoin in his crypto portfolio, showcasing his trust in the meme token’s future performance.

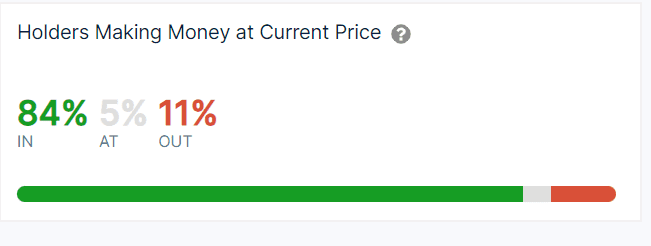

IntoTheBlock data shows that 84% of PEPE investors are profitable at current prices.

Meanwhile, 11% experience losses, while 5% are at break-even.

Thus, many holders might sell to realize returns upon price surges, possibly triggering heightened volatility and price dip.

The 4H chart shows that PEPE broke a bullish flat setup that has formed since late May.

Nevertheless, the ascending channel’s barrier offered resistance, suggesting a potential slight dip in the near term.

PEPE’s current struggle comes as the broad market endures bearishness. A solid bull run will see PepeCoin maintaining its outperformance in the crypto space.

The post PepeCoin price eyes recovery as VanEck teases dialogs around PEPE appeared first on Invezz