Deep-pocketed investors have adopted a bullish approach towards Roku (NASDAQ:ROKU), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in ROKU usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 14 extraordinary options activities for Roku. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 64% leaning bullish and 21% bearish. Among these notable options, 5 are puts, totaling $204,945, and 9 are calls, amounting to $491,932.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $40.0 to $75.0 for Roku during the past quarter.

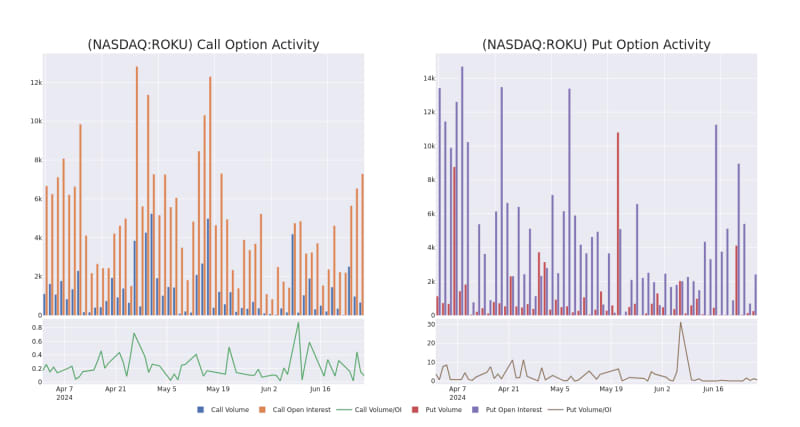

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Roku's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Roku's whale activity within a strike price range from $40.0 to $75.0 in the last 30 days.

Roku Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

About Roku

Roku enables consumers to stream television programming. It has more than 80 million streaming households and provided well over 100 billion streaming hours in 2023. Roku is the top streaming operating system in the US, reaching more than half of broadband households, according to the company. Roku's OS is built into streaming devices and televisions that Roku sells and on connected televisions from other manufacturers that license Roku's name and software. Roku also operates the Roku Channel, a free, ad-supported streaming television platform that offers a mix of on-demand and live television programming. Roku generates revenue primarily from selling devices, licensing, and advertising, and it receives fees from subscription streaming platforms that sell subscriptions through Roku.

Following our analysis of the options activities associated with Roku, we pivot to a closer look at the company's own performance.

Current Position of Roku

- Trading volume stands at 3,794,244, with ROKU's price up by 1.45%, positioned at $60.01.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 27 days.

What Analysts Are Saying About Roku

In the last month, 2 experts released ratings on this stock with an average target price of $87.5.

- An analyst from Wedbush downgraded its action to Outperform with a price target of $75.

- An analyst from Needham downgraded its action to Buy with a price target of $100.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Roku, Benzinga Pro gives you real-time options trades alerts.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.