The breathtaking rally in mega-cap stocks, fueled in large part by the artificial intelligence (AI) frenzy, has exceeded the expectations of even the most optimistic analysts. While the likes of Nvidia (NVDA), Microsoft (MSFT), Meta (META), Amazon (AMZN), and Google (GOOGL) have been the flag-bearers of this massive surge that has carried the overall markets higher, many investors - eyeing the steep price gains in these names already - are now looking for the “next” Nvidia, or “next” Microsoft.

However, there are still breakout growth opportunities among mega-caps for investors to capitalize on, as the next set of up-and-coming contenders race towards the coveted $1 trillion market cap club. To that end, here are three big-name stocks that should be on the investors' radar as we head into the second half of 2024 - all of which have earned positive ratings from the analyst community, with significant upside potential from current levels.

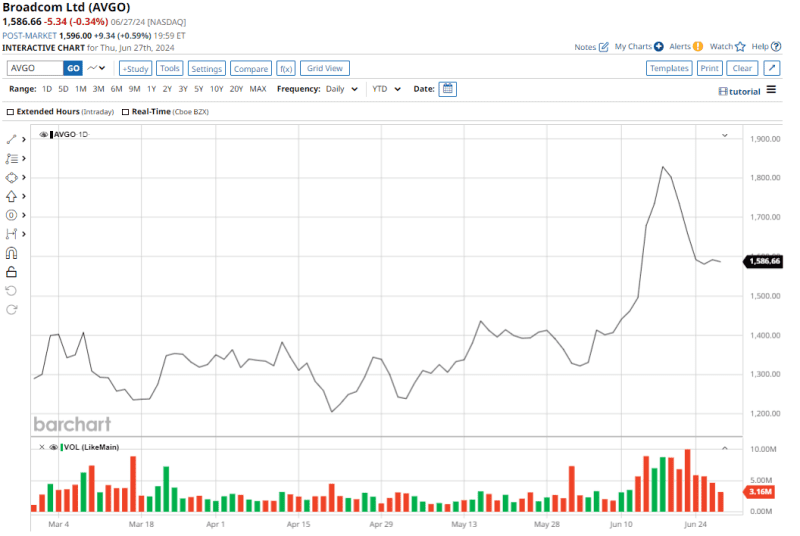

#1. Broadcom

Founded in 1991 and based out of San Jose, Broadcom (AVGO) is one of the leading semiconductor companies in the world. They design, develop and supply a wide range of analog and digital integrated circuits and other related products. In simpler terms, they make the tiny chips that power many of our electronic devices, and also develop software for data center networking. The company currently commands a mammoth market cap of $738.5 billion.

AVGO stock is up 43.8% on a YTD basis, and it offers a dividend yield of 1.32% - above the tech sector median. Notably, Broadcom has been raising its dividends consistently over the past 14 years, and with a payout ratio of 46.73%, there's plenty of scope for continued dividend growth in the years ahead.

Broadcom's numbers for the latest quarter were impressive, with both revenue and earnings surpassing estimates. Revenues for the fiscal second quarter were reported to be $12.49 billion, which denotes a yearly growth of 43%. Adjusted EPS rose by 6.2% over the same period to $10.96, surpassing the consensus estimate of $10.85. In fact, Broadcom's EPS have topped expectations in each of the past five quarters.

Longer term, over the past 10 years, the company's revenues and EPS have clocked CAGRs of 31.33% and 32.65%, respectively.

For Q2, the company reported cash flow from operations and free cash flow of $4.58 billion and $4.49 billion, respectively. The company closed the quarter with a healthy cash balance of $9.81 billion.

Broadcom's positive momentum looks poised to continue, fueled by its dominance in the AI market. Sales of AI-related chips skyrocketed 280% year-over-year to $3.1 billion last quarter, capturing 25% of revenue. Broadcom's chips are in seven of the top eight hyperscale AI clusters deployed today, solidifying their leadership. Furthermore, they hold a commanding 60% market share in custom ASICs, a market projected to surge to over $30 billion, with a 20% annual growth rate.

The tech giant is also expanding its reach in wireless with a multi-year, multi-billion dollar deal with Apple (AAPL) for 5G components, strengthening its presence in 5G handsets. Additionally, they're addressing storage connectivity and broadband weaknesses by increasing content per server and capitalizing on cloud data center growth.

Overall, analysts have deemed AVGO stock a “Strong Buy,” with a mean target price of $1,828.30 - which indicates an upside potential of about 13.8% from current, pre-split levels. Out of 31 analysts covering the stock, 28 have a “Strong Buy” rating and 3 have a “Hold” rating.

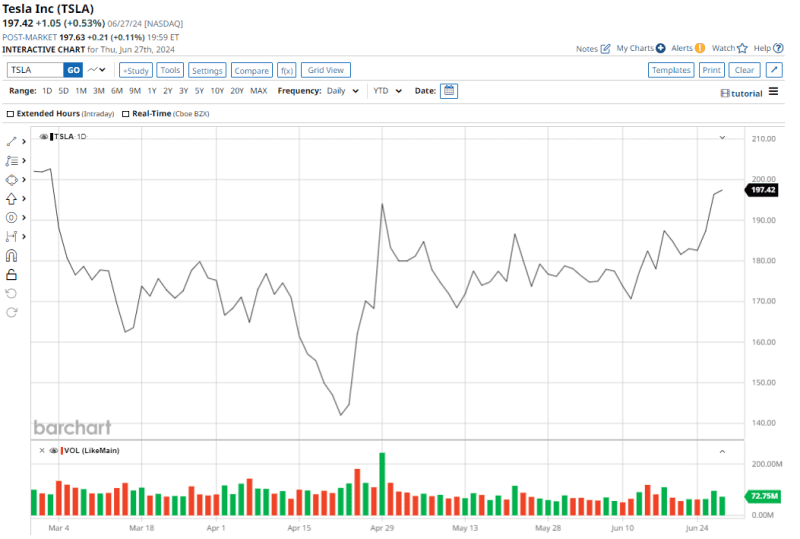

#2. Tesla

Helmed by its charismatic, maverick CEO Elon Musk, Tesla (TSLA) is a leader in the transitioning electric vehicle (EV) market. The Austin-headquartered company is a leading manufacturer of EVs, solar panels, and battery storage systems. They aim to accelerate the world's transition to sustainable energy. Tesla's market cap, which years ago surpassed the $1T mark at its peak, currently stands at $629.6 billion.

Tesla stock is down 20.4% on a YTD basis, as the company has been posting disappointing delivery and margin numbers this year.

Plus, Tesla's latest results for Q1 included a miss on both the revenue and earnings front. The company reported revenues of $21.30 billion, down 9% from the previous year, as core automotive revenues slowed down by 13% on a YoY basis to $17.38 billion. EPS registered an even sharper drop of 47% to $0.45, missing the consensus estimate of $0.49. This marked the third consecutive quarterly earnings miss by Tesla amid the ongoing EV price war.

Production and deliveries at 433,371 vehicles and 386,810 vehicles fell by 2% and 9% on a YoY basis, respectively.

However, the company's liquidity position remained solid, as it closed the quarter with a cash balance of $26.86 billion - much higher than its debt levels of $9.91 billion.

Tesla's disappointing results over the past few quarters have been attributed by the company to multiple factors, including sticky inflation, cheap Chinese EVs, geopolitical conflicts, and an arson attack at Gigafactory Berlin. All of these would appear to be issues Tesla can recover from, given its strong positioning in the competitive EV market.

Tesla is currently still the world's largest EV seller globally, holding roughly 51% of the U.S. electric vehicle market by the end of 2023, with plans to sell 20 million EVs by 2030. Outside the usual crop of TSLA bulls, none other than Goldman Sachs (GS) seemed bullish on the prospects for a new low-cost EV model priced between $25,000 and $30,000, suggesting it could provide a substantial boost to annual volumes.

Beyond that, Tesla is investing heavily in the autonomous driving market, a sector expected to grow at a blistering 28.6% CAGR by 2032. To dominate this space, they've already poured $1 billion in capex for AI infrastructure. Tesla is diligently refining its software and hardware to create self-driving cars and ride-hailing services, leveraging an AI network trained on a massive dataset of real-world driving data.

In fact, in a recent note, Wedbush analyst Dan Ives wrote, “Ultimately, the key to reaching a $1 trillion+ valuation is the autonomous and FSD vision taking hold for Tesla, which appears to be turning a corner with this latest FSD v12.4 and now China FSD testing underway.”

Overall, analysts have a consensus “Hold“ rating for TSLA stock. The shares have already outpaced their average price target, while the Street-high target of $310 indicates an upside potential of about 56.7% from current levels.

Out of 33 analysts covering the stock, 9 have a ”Strong Buy” rating, 2 have a “Moderate Buy” rating, 15 have a “Hold” rating, and 7 have a “Strong Sell” rating.

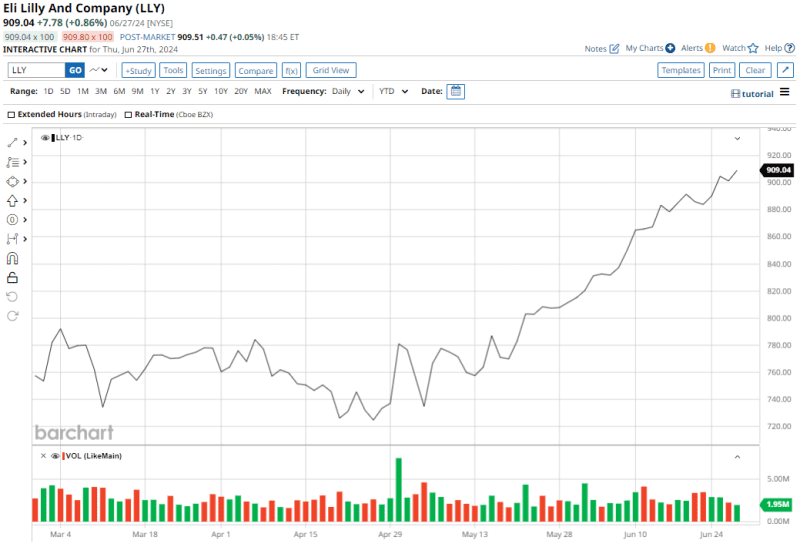

#3. Eli Lilly

We conclude our list of mega caps with Eli Lilly (LLY). Founded in 1876 and based in Indianapolis, Eli Lilly is a global healthcare leader in discovering, developing, manufacturing, and marketing medications to treat various diseases. Its focus areas include oncology, diabetes, immunology, and neurology. The company currently commands a market cap of $863.9 billion.

LLY stock has rallied 55.3% on a YTD basis, and nearly doubled over the past year. The stock has been powered higher by blowout sales for its blockbuster GLP-1 drugs, Mounjaro for diabetes and Zepbound for weight loss. LLY also pays a modest dividend yield of 0.57%.

Lilly's results for the latest quarter were marked by a beat on both revenue and earnings, along with double-digit yearly growth. Revenues for the first quarter rose by 26% from the previous year to $8.8 billion while earnings shot up by 59.3% to $2.58 per share, surpassing the consensus estimate of $2.47. Notably, over the past five quarters, the company's EPS has topped expectations on four occasions.

Overall, over the past five years, the company's revenue and EPS have expanded at a CAGR of 10.69% and 19.26%, respectively.

Lilly generated net cash from operating activities of $1.17 billion, and closed the quarter with a cash and equivalents balance of $2.46 billion.

The pharma giant looks set for continued growth, too. A new study conducted by Lilly has revealed that the company's diabetes treatment drug, Mounjaro, appeared to reduce the severity of sleep apnea, along with reducing weight and improving blood pressure and other health measures, in patients with obesity who took the drug for a year.

Adding to the excitement, Eli Lilly's Alzheimer's drug, donanemab, is inching closer to approval. On June 10, a key FDA advisory committee reviewed the drug. Lilly's data showed a 35% slowdown in cognitive decline (measured by iADRS), surpassing competitor Biogen's (BIIB) Leqembi. This bodes well for potential approval and market share leadership.

Lilly also has other drugs on the pipeline, including orforglipron for type 2 diabetes and retatrutide for weight loss.

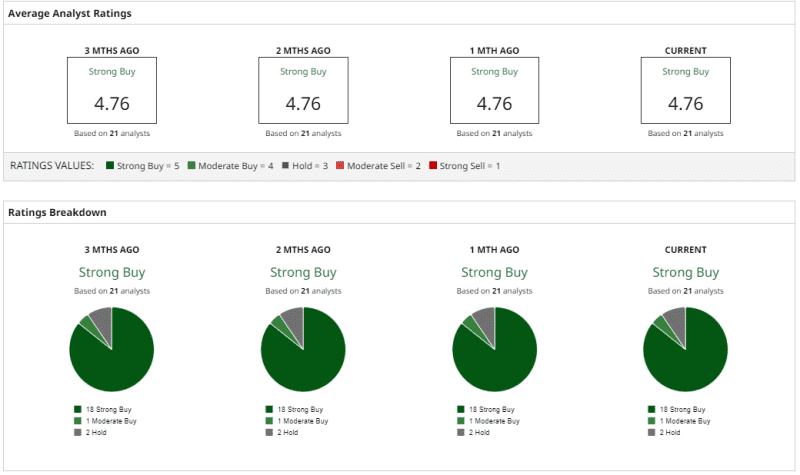

Analysts have an overall rating of “Strong Buy” for LLY stock, which has already outstripped its mean price target of $832.18. The Street-high price target of $1,023 implies expected upside potential of roughly 13% from current levels. Out of 21 analysts covering the stock, 18 have a “Strong Buy” rating, 1 has a “Moderate Buy” rating and 2 have a “Hold” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.