The first half of 2024 is over. While the artificial intelligence (AI) fire isn't burning as bright as it was last year, the growth opportunities it provided for semiconductor companies remain intact.

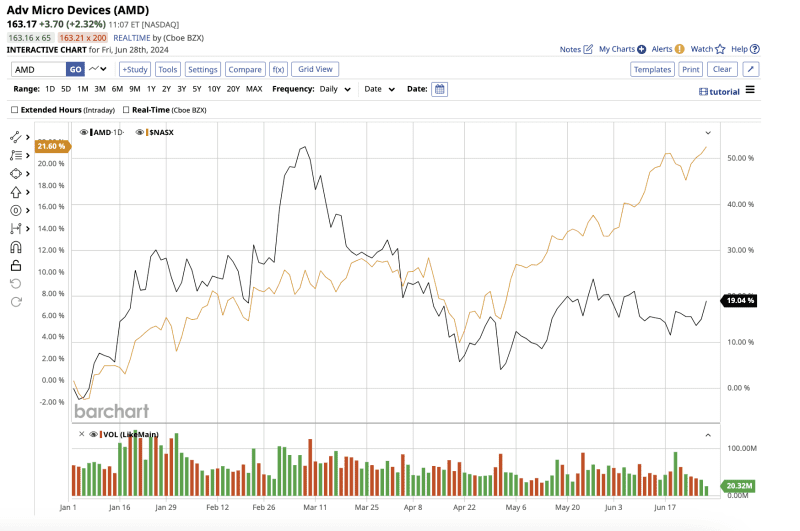

Semiconductor company Advanced Micro Devices (AMD), otherwise known as AMD, is renowned for its innovative processors and graphics cards. Last year, the stock rode the AI wave of innovation, rising 127% to outperform the S&P 500's ($SPX) 25% gain.

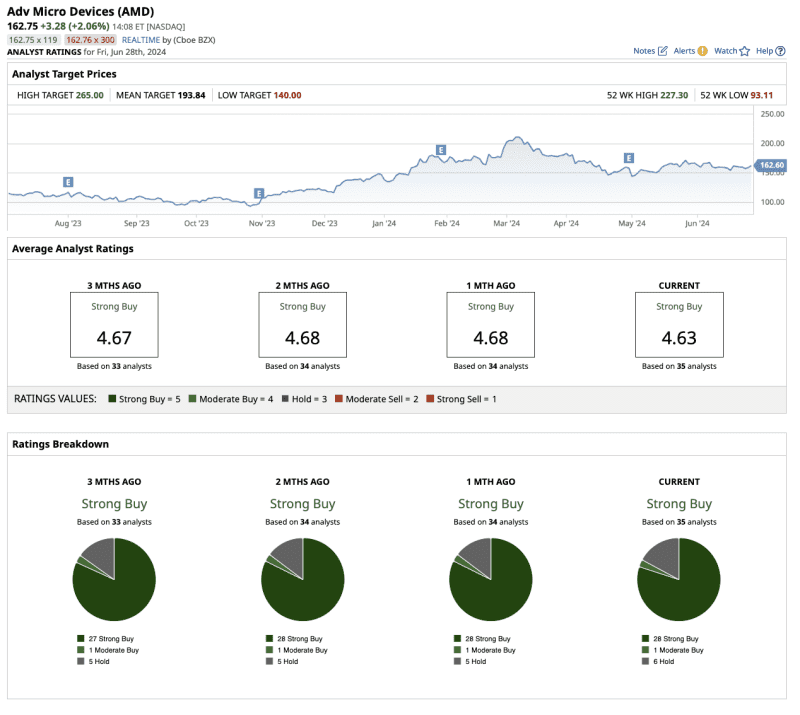

Six months into 2024, AMD stock has gained only 10%, trailing the tech-heavy Nasdaq Composite's ($NASX) gain of 18%. On Wall Street, the stock is deemed a "strong buy." Let's see if this AI stock can match last year's success.

AMD’s Financials Are Strengthening

While Nvidia's (NVDA) dominance in the semiconductor industry remains untouched, AMD has been working to catch up. The company’s progress in the CPU and GPU markets, with Ryzen processors and Radeon graphics cards, has been impressive.

AMD's data center business has recovered significantly, with revenue up by 80% year on year to $2.3 billion in the first quarter of 2024. Furthermore, the Client segment's revenue increased by 85% to $1.4 billion.

Both segments experienced impressive growth due to increased MI300 AI accelerator shipments and the adoption of AMD's AI-powered Ryzen and EPYC processors.

However, revenue in the company's other two segments, Gaming and Embedded, fell 48% and 46%, respectively, from the year-ago quarter. Total revenue increased by 2% in the first quarter to $5.4 billion. Adjusted net income stood at $1.0 billion, compared to a loss of $970 million in the year-ago quarter.

Discussing the Q1 results, CEO Dr. Lisa Su emphasized that AMD continues to ramp up the “data center business and enable AI capabilities” across its entire product portfolio.

AMD has forged strategic partnerships with Lenovo, Dell Technologies (DELL), Super Micro Computer (SMCI), and Sony Semiconductor Solutions to broaden its AI offerings to the cloud, automotive, enterprise, embedded, and PC markets.

The company expects second-quarter revenue to be $5.7 billion (plus or minus $300 million), in line with analysts' expectations of $5.72 billion. While management did not provide full-year guidance, analysts predict a revenue increase of 12.7% in 2024 and 27.8% in 2025. Earnings are expected to grow by 32.1% in 2024 and 58.8% in 2025.

What’s Wall Street’s Outlook on AMD Stock?

Recently, Stifel analystRuben Roy reiterated a “buy” rating on AMD stock with a price target of $200. Roy believes AMD will benefit from a number of short-term tailwinds, including "AI-infrastructure investment, continued x86 CPU share gains," and an "AI-driven PC refresh cycle."

More recently, BofA Securities ranked AMD among their "best of breed" stocks for Q3 2024. These stocks are top investment choices, according to analysts at BofA Securities, due to their "high quality, liquidity, earnings growth, and margin upside when compared with peers."

Given the company’s strengthening financials, AMD has a majority of analysts on its side, rating it a “strong buy” overall. Of the 35 analysts that cover the stock, 28 rate it a “strong buy,” with one “moderate buy” rating and six “hold” ratings.

Its average target price of $193.84 implies the stock could rally by 19.5% over the next 12 months. Its high target price of $265 implies the stock could surge by 63.4% from current levels.

The Bottom Line on AMD Stock

The growing adoption of cloud computing, AI, and 5G technologies drives demand for advanced processors and GPUs. Furthermore, while the gaming segment struggled in Q1, AMD's Ryzen processors and Radeon GPUs are well-positioned to benefit from the growing gaming market.

The semiconductor industry remains highly competitive, with almost every financially capable player able to upgrade their products with AI. To maintain and grow its market position, AMD will need to consistently innovate and execute.

With a strong product portfolio, strategic acquisitions, and a commitment to advancing computing capabilities, I believe AMD has the potential to thrive in this field, making it one of the best AI stocks to buy right now.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.