For many of those voting in the upcoming general election, pensions legislation is a key issue on people's minds.

The Conservatives have questioned whether Labour will bring in a retirement tax, and Labour has not yet said they would match the Conservative triple lock plus policy.

The triple lock plus policy would raise the personal tax-free allowance for pensioners to £13,710 from 2027 to 2028.

But, how does the UK's state pension fare with the rest of Europe?

Figures from Almond Financial show that the UK is lagging behind many European countries in how generous pensions are relative to living costs.

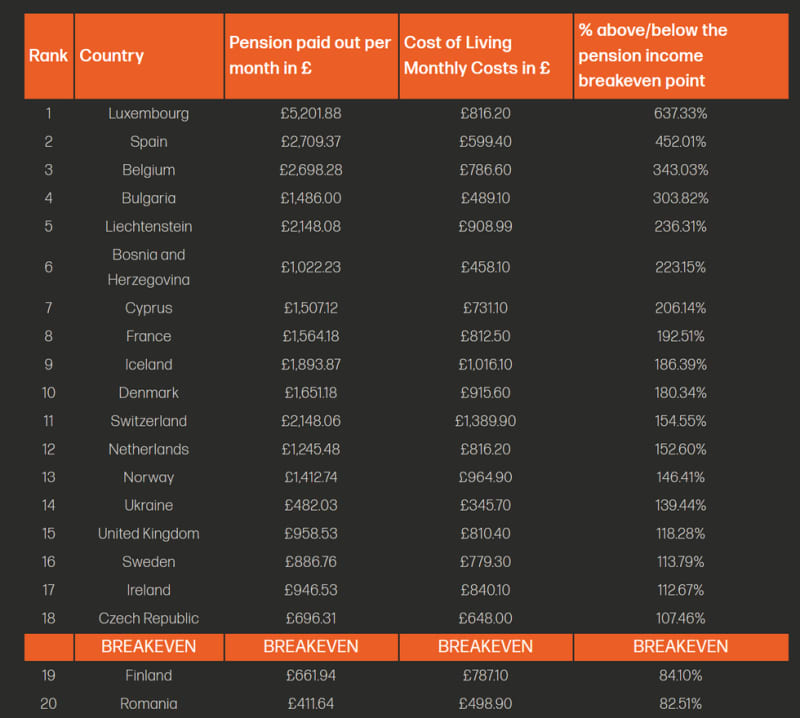

Almond Financial looked at the pension systems in all of Europe's 50 countries to establish which country offers pensioners the most.

Numbeo data was used to calculate the average cost of general living expenses, excluding rent.

Luxembourg topped the European Pension Breakeven Index paying out an average of £5,211.20 and with a relatively low cost of living. Pensioners in Luxembourg expect a comfortable retirement with a pension income of 538.47 per cent over the breakeven point.

The United Kingdom was placed in fifteenth place on the list, dragging behind countries like Bosnia and Herzegovina, Cyprus and Ukraine.

According to Almond Financial, UK state pensioners on the full new state pension receive £958.53 each month and the average monthly cost of living was calculated as £810.40.

Meanwhile, Spain came in second place, with the country's pension system paying out a maximum of £2,709.37, while the cost of living is £599.40 per month.

LATEST NEWS:

- Nigel Farage booed by sneering industry as he's crowned Presenter of the Year: 'You'll be seeing more of me'

- 'We need a government who can tell the banks how to keep inflation down,' says John Redwood

- Labour lies on immigration and tax will be exposed from July 5 - by then its too late - Kelvin MacKenzie

At the bottom of the list in 30th place is Armenia, paying pensioners £74.20 per month, while the cost of living is £505.80.

Commenting on the results, Principal Financial Adviser at Almond Financial, Sam Robinson said: "The UK has a system that is just above the breakeven point which means at present, there isn’t much room to manoeuvre for those battling the cost of living crisis.

"And while it is positive that the UK finds itself among the top half of countries, for how much longer is the question.

“Although the increase in the state pension was well intended, it works out at just £33 more per month compared to last year’s pension.

"It’s clear that those over 66 need to look at other options rather than just relying on the state pension."