Washington (AFP) - US aircraft manufacturer Boeing said Monday it had reached a deal to buy its subcontractor Spirit in a move the aviation giant argues will boost safety and quality control.

Under an all-stock transaction worth $4.7 billion, Boeing will bring back in house a key supplier that it had spun off nearly two decades ago.

Spirit, which also builds major airplane parts for Airbus, also reached an agreement with the European company over operations affecting its supply chain.

Boeing disclosed in March that it was in talks to potentially reacquire Spirit, which it spun off in 2005 to lower costs.

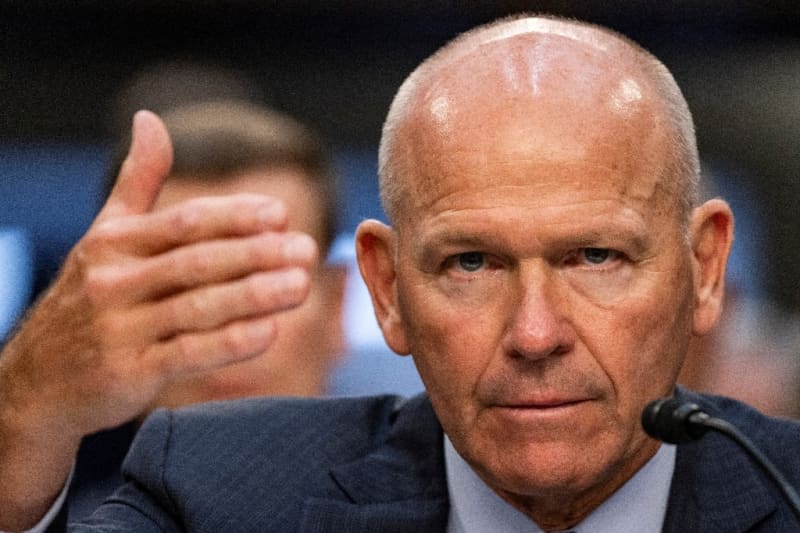

"We believe this deal is in the best interest of the flying public, our airline customers, the employees of Spirit and Boeing, our shareholders and the country more broadly," said Boeing president and CEO Dave Calhoun.

He said that by reintegrating Spirit, "we can fully align our commercial production systems", including safety and quality management systems, and "our workforce to the same priorities, incentives and outcomes -- centered on safety and quality."

Spirit AeroSystems builds fuselages and other significant parts for both Airbus and Boeing.

Airbus said separately that it would buy Spirit AeroSystems facilities that produce parts for its aircraft for a nominal fee of $1, and will be "compensated by payment of $559 million from Spirit AeroSystems" for the transaction.

This includes production sites related to the A350 in North Carolina and France, as well as the production of the A220's wings and mid-fuselage in Belfast and Casablanca in Morocco.

It would also cover the A220 pylons which are made in Kansas in the United States.

Airbus said the agreement "aims to ensure stability of supply for its commercial aircraft programmes through a more sustainable way forward, both operationally and financially."

Safety concerns

Boeing is by far Spirit's biggest customer, with around 70 percent of its revenue coming from the American plane maker in 2023.

The two companies have faced intense scrutiny since a near-catastrophic incident on January 5 when a fuselage panel blew off a 737 MAX operated by Alaska Airlines mid-flight.

The Alaska Air debacle revived concerns about the MAX following two fatal crashes in 2018 and 2019.

But the January 5 incident was only the most serious after a series of manufacturing problems bedevilling both Boeing and Spirit in recent years.

Boeing has been under heavy scrutiny from regulators at the Federal Aviation Administration, which has required the company to address safety concerns, including oversight of contractor Spirit AeroSystems, which builds fuselages on the MAX.

Boeing announced operational changes on March 1 intended to improve its interfacing with Spirit AeroSystems. These have included assigning additional Boeing staff to work at Spirit's facilities in Wichita, Kansas.

Peter McNally, an analyst at Third Bridge, said buying Spirit would not be a "quick fix" to Boeing's woes.

"A meaningful part of the challenges at Spirit has been the lack of a skilled workforce--a challenge that Boeing itself has faced for years," McNally said in a note.

"The industrial logic of integrating the supply chain is sound, but the reality could prove more challenging as Boeing has faced challenges in its own manufacturing and assembly operations."

Shares of Boeing rose 1.5 percent in mid-morning trading, while Spirit gained 2.6 percent. In Paris, Airbus climbed 2.7 percent.

Boeing this week also faces a key turning point with the Department of Justice, which concluded in May that Boeing could be prosecuted for violating a 2021 deferred prosecution agreement reached following the two fatal 737 MAX crashes.

A lawyer for the victims' families said Sunday that the DOJ is offering Boeing a plea deal that will allow it to avoid a trial related to two crashes.

Victims' families have called for the criminal prosecution of Boeing and its executives, and are seeking a nearly $25 billion fine.

burs-rl-jmb/dw