After years of being in the doghouse, Wall Street is finally buying what Gap (GPS) is selling. The company is the largest specialty retailer in the U.S., and has four main divisions: Old Navy, Banana Republic, Gap, and Athleta.

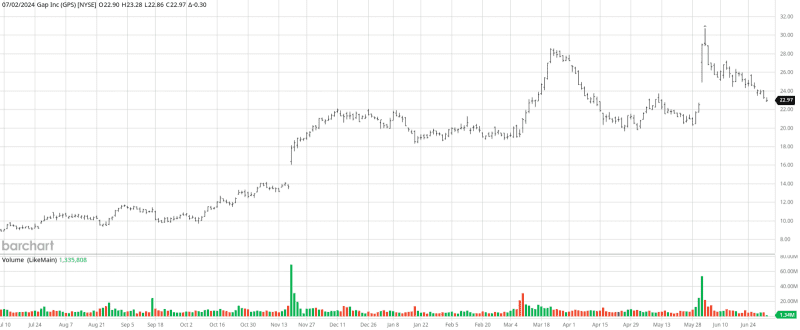

On May 31, the fashion retailer’s shares jumped more than 28% — the most since November 2023. This followed a blowout earnings report that showed a fashion overhaul by relatively new CEO Richard Dickson is working.

Dickson became known in the past few years as the main force behind the revitalization of the Barbie franchise for Mattel (MAT). Last August, he was brought on by Gap to turn its fortunes around.

His strategy is to introduce trendier styles across its brands, and ramp up marketing efforts to attract choosy shoppers. To do so, Dickson has embraced celebrity marketing, paired up with a few independent labels, and hired fashion designer Zac Posen as creative director for its mass-market Old Navy stores.

Gap’s Turnaround

To anyone paying attention, there were earlier indications that the turnaround strategy at Gap was working. In the last quarter of 2023, Gap surprised analysts by posting its first quarter of revenue growth after four consecutive quarters of decline.

In the most recent quarter, the company posted revenue of $3.4 billion, beating the average estimate from analysts. Gap's quarterly store sales jumped 3% from a year ago, while online sales rose 5% to $5.5 billion, accounting for 38% of total sales. This helped offset the poor productivity at some of its stores.

All of Gap’s brands posted comparable sales gains and outperformed expectations. The company also gained market share for the fifth consecutive quarter. And management raised its outlook, now seeing net sales “up slightly” this year, compared with an earlier, “roughly flat” projection.

Gap also lifted its fiscal 2024 margin forecast to at least 150 basis points growth. This compared with a prior target of only as much as 50 basis points expansion.

The company ended the quarter with a leaner inventory, down 15% compared with last year. And in a huge cleanup effort, Gap closed unproductive stores and worked to improve the quality of the goods sold. I believe Gap will continue to shutter some Gap and Banana Republic stores, while more Old Navy and Athleta stores will be opened in the years ahead.

Gap also said new products and advertising efforts are paying off. Linen clothing for women did particularly well at the company’s namesake brand. And operational performance is improving at Old Navy, which contributes the biggest portion of revenue to the parent company.

According to Euromonitor, Old Navy was the second-largest apparel brand, after Nike (NKE), in the U.S. in 2023. The discount apparel sector - in which it competes - has been healthier than other areas of apparel retail.

I view Gap’s goal of $10 billion in annual sales for Old Navy (up from $8.2 billion in 2023) as achievable by the end of the decade.

The Gap’s recent results look like a textbook retail company recovery - sales improved, margins expanded, and all of its brands gained market share.

Gap Stock is a Buy

Gap shares have more than doubled in value since Dickson took over last August. However, they remain down more than 50% from their 2014 highs, and trade at just 13.7 times forward earnings. That compares with around 20 times for Lululemon (LULU) and Abercrombie & Fitch (ANF).

I believe Gap’s comeback has barely begun. Gap defined American casual cool in the 1990s, but has been in steady decline over the past two decades. Profits and sales slid amid competition from other fast fashion brands.

Undoing merchandising missteps across the four very different brands will take time. So will shrinking the company’s physical stores footprint. That 15% drop seen in the year on year inventory in the first quarter, as well as lower commodity costs, gave Gap’s gross margin a bump up to 41.2%. Gap’s fashion makeover should continue this trend.

Gap ended the quarter with cash, cash equivalents and short-term investments of $1.7 billion, an increase of 48% from the prior year. Its debt is manageable, with no debt maturing until 2029. That means the cash flow it generates can be used for dividends and share repurchases.

Add it all up, and Gap stock is a speculative buy anywhere near its current price of $23 per share.

On the date of publication, Tony Daltorio did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.