Shares of Bitcoin mining stocks have trailed the broader markets in recent months due to the Bitcoin (BTCUSD) halving event. The last BTC halving occurred in April this year, reducing the supply of the digital asset by 50%, and cutting mining rewards in half.

For instance, shares of Marathon Digital Holdings (MARA), one of the largest BTC mining companies, are down 37% from 52-week highs, valuing the company at a market cap of $6.3 billion. Marathon Digital is a crypto miner, which means its stock price performance is tied in large part to the asset it mines, which is Bitcoin.

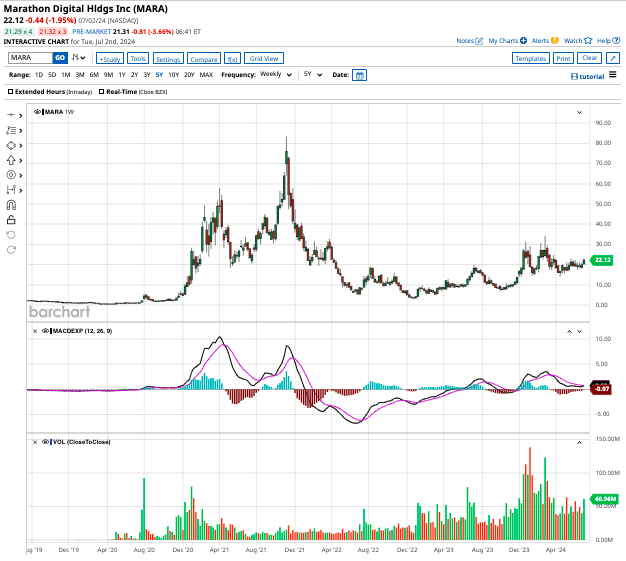

MARA stock rose from lows around $0.91 in June 2020 to highs around $76 in November 2021, making it one of the hottest stocks on the planet during the last Bitcoin bull run.

However, due to Bitcoin's volatility, Marathon Digital is diversifying its revenue base. Let’s see how.

Marathon Holdings Begins Mining Kaspa

Last month, Marathon Digital said it will begin mining Kaspa (KAS), a proof-of-work digital asset that should diversify its mining portfolio. With a market cap of $3.9 billion, Kaspa is the fifth largest proof-of-work cryptocurrency. The digital asset is fairly liquid, with a circulating supply of 24 billion KAS. Miners are rewarded with 103.93 KAS for every block validated on the network, and its terminal supply is capped at 28.7 billion KAS.

The Kaspa utilizes a BlockDAG (directed acyclic graph) that enables multiple blocks to be produced simultaneously. This network processes one block every second, which results in faster transactions, while providing miners an opportunity to earn more block rewards in a given time frame.

Marathon first evaluated Kaspa as a way to diversify its revenue in May 2023 and utilized its existing infrastructure in digital asset compute. It began deploying Kaspa ASICs (application-specific integrated circuits) last September, after which it began scaling operations.

Given the current network difficulty rate and the price of one KAS token, Marathon's ASICs should deliver margins of 95%. As of June 25, Marathon has mined 93 million KAS tokens, which are currently valued at $15 million.

By mining Kaspa, Marathon has created a revenue stream that’s diversified from Bitcoin, but still tied to the company’s core competencies in digital asset compute. The mining heavyweight is positioned to mine Kaspa and capitalize on higher margins compared to peers.

Is MARA Stock a Good Buy Right Now?

While this diversification is notable, investors should understand that Bitcoin prices will continue to impact the performance of Marathon stock in the near term, as the world’s largest cryptocurrency accounts for the majority of revenue.

While the company missed estimates in Q1, it more than tripled revenue year over year to $165 million during the quarter. While the number of BTC mined fell by 34% on a sequential basis, its net income rose over 100% to $337 million.

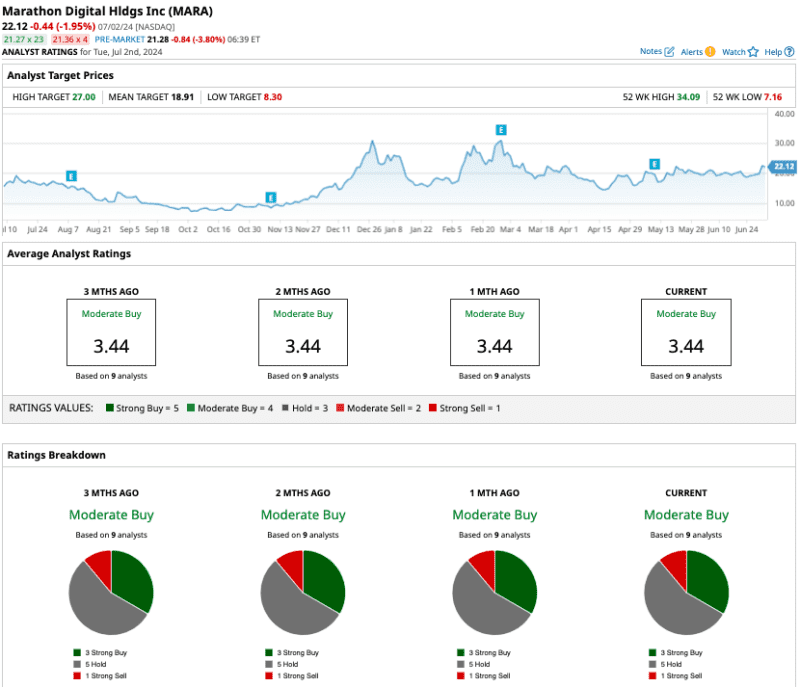

Out of the nine analysts tracking MARA stock, three recommend “strong buy,” five recommend “hold,” and one recommends “strong sell.”

The average target price for MARA stock is $18.91, which is a discount to Tuesday's closing price.

Analysts expect Marathon to end 2024 with a price-to-earnings multiple of $1.06. So, priced at 22x forward earnings, MARA stock is not too expensive.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.