WASHINGTON — According to a US Labor Department last week, the economy added another 638,000 jobs in October. While this number is lower than the number of job increases in prior months, it does show that the V-shaped recovery that started in May continues. Its V-shape, however, flattened somewhat in September and October. Better yet, the October jobs report included additional encouraging information.

Evidence? The private sector added 908,000 October jobs, meaning the private sector is continuing to grow strongly. The government sector lost 268,000 mostly from temporary census workers.

More encouraging is news that the labor force participation rate grew by 0.3%. That means that nearly half of a million discouraged workers re-entered the job market.

Over half of workers losing their jobs during the pandemic have returned to work.

Taking the October jobs number into account, 12 million of the 22 million workers who lost their jobs during the short-lived spring recession have been re-hired. That means over half the jobs lost during the recession returned in just the last six months. This is an unprecedented number, indicating an unusually strong recovery.

Depending on economic policy next year, we could see a complete recovery of all lost jobs before the end of 2020. That would mean it took just over a year and half for the job market to completely recover job losses triggered by the coronavirus lockdowns.

Also Read: NewsMax and RSBN: Streaming video channels that covered Trump fairly

After 2008-2209 Great Recession, it took four years to recover all of the job losses. The subsequent recovery remained halting and under-par by historical standards.

So why was the Obama / Biden Recovery so anemic?

To end a recession and begin a rapid economic recovery, national economic policy must set growth as its top priority. In 2009, the Obama / Biden administration did not do that. Instead, they funded programs to “cure” perceived social injustices as their prime directive. This is otherwise known generally as income redistribution. By pushing time and money wasting social programs, that administration kept economic growth in the slow lane, damaging middle- and working-class families in the process.

Monetary Policy during the Obama/Biden recovery.

In 2009, Monetary Policy was actually very expansive. The Federal Reserve vastly increased the money supply and dropped interest rates to near zero,through their Quantitative Easing programs. This should have stimulated the economy. But the Obama / Biden administration persisted in prioritizing dubious social programs and income redistribution, even as the Fed repeatedly asked for a more stimulative approach to add velocity to the central bank’s own efforts.

Worse, because the administration convinced Congress to pass the highly restrictive Dodd/Frank bill, Monetary Policy became even more ineffective. Why?

The answer: The administration and the then Democrat majority in Congress decided to prioritize the alleged social injustices practiced for at least a decade by the banking and mortgage industries. In the lead-up to the Great Recession, these institutions routinely granted “predatory” mortgages, often based on “liar loans,” to households that could really not afford them. These were precisely the mortgages that failed first.

The business killing effect of Dodd-Frank over-regulation

The mortgage lending house of cards built earlier by largely Democrat-led Clinton-era policies rapidly collapsed under the weight of this ever-growing mass of foreclosure. This, in turn, was largely what triggered the financial crisis that morphed into the Great Recession.

To its credit, the Dodd/Frank legislation ended predatory and liar loans. But at the same time, the law’s new regulations severely reduced all lending, particularly to small businesses and the middle class. By damaging this key sector, still the source of most new jobs in America, Dodd-Frank effectively throttled the greater economic expansion most economists had expected.

Even more problematic, when banks aren’t lending to these key sectors, there is no multiplying effect to effectively turbo-boost the Federal Reserve’s expansive monetary policy. This served to render the Fed’s policy essentially ineffective.

When is a stimulus not a stimulus? When it emphasizes “free stuff.”

In 2009, the Obama / Biden administration’s fiscal policy initially appeared just as expansive as the Fed’s. The administration convinced Congress to pass a nearly $800 billion stimulus package. That large increase in government spending should have stimulated the economy and sped-up the recovery. That would have been similar to how the stimulus package passed by Congress in May 2000 and signed by President Trump quickly ended the current recession. Unfortunately, most of this earlier “stimulus” simply provided payoffs to major Obama supporters like the teachers unions. In other words, that $800 billion “stimulated” nothing. It was a lost opportunity.

What was the effect of the more carefully aimed 2020 stimulus? The surprisingly rapid V-shaped recovery that the US enjoys today as it races back to where it left off in February of this year. That, in turn, is a major reason behind the continuing economic and employment increases we just saw in the October jobs numbers.

The ACA raised taxes.

Making matters worse, rather than keeping taxes low, the Obama / Biden administration determined that expanding healthcare coverage for about 6% of the population was a higher priority than economic growth. The administration convinced Congress to pass the budget-busting Affordable Care Act (ACA), usually known today as “Obamacare.” This eventually did provide health insurance to about 20 million Americans. But it did so at great cost, particularly to middle-class policy holders. And in the end, it simply turned out to be yet another income redistribution project. This time the giveaway was “free” healthcare underwritten by the middle- and working-classes.

Another problem with the ACA / Obamacare was that it required 21 new or increased taxes. This tends to slow economic growth further. In addition, the legislation required virtually all employers to pay for health insurance for their employees or pay a $3,000 per employee fine, something not dissimilar from raising taxes by $3,000 per employee for the firm. Once again, large added cost burdens like this also tend to slow economic growth.

Toward more effective economic stimulus… and a V-shaped recovery

By way of contrast, our current 2020 recovery from the coronavirus pandemic is robust and effective. That’s largely because Congress repealed the most negative aspects of Dodd/ Frank. In doing so, Congress and the president ensured that US monetary policy becomes more effective. That’s the kind of policy that leads to a rapid, V-shaped recovery.

The GOP tax plan reduced tax rates for all income earners and corporations in 2018. They remain at the lower level today. Such reductions tend to lead to higher GDP growth rates. As for the future, economic growth will depend on the policy set by next year’s administration.

As long as tax rates remain low and banks remain free to lend, the V-shaped recovery will continue. If a future Congress or administration reverses the GOP’s 2018 tax cuts or if they increase other tax rates like the rate on capital gains, economic growth will once again slow.

Let’s hope the government and the Fed renew their efforts to set next year’s economic policies on the continuing growth path charted by the Trump administration prior to the coronavirus setback. Otherwise, we may again suffer from a very slow recovery similar to what the country endured after the Great Recession.

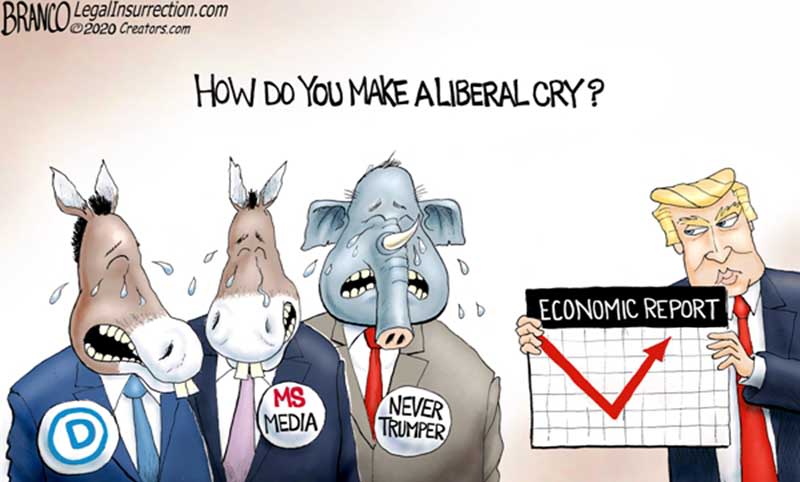

— Headline image: Cartoon by Branco. Reproduced with permission and by arrangement with Legal Insurrection.