Del Principe O’Brien Financial Advisors commentary for the month ended March 2021, discussing their portfolio holdings and their recent investment in Biogen Inc (NASDAQ:BIIB).

Q1 2021 hedge fund letters, conferences and more

Dear Fellow Investors,

“There's nothing particularly earth-shattering about what we try to do. We believe the market often misprices stocks due to neglect, emotion, misinterpretation or myopia, so our value-add comes from bottom-up stock selection. We're trying to buy at low prices relative to our current estimate of intrinsic value and we want to believe that intrinsic value will grow.” – Steve Morrow

Though many of us were eager to put 2020 in our rear view and focus on the road ahead, we can look back with a sense of accomplishment and gratitude for the things that DID go well. We were fortunate to realize substantial gains in the midst of a hard year.

The volatility of 2020 was a good reminder of what we stand for as value investors and the discipline we practice. For example, when stocks go low and everybody runs from them, that’s our time to lean in and look closely. We analyze them and assess their value. We wait for the right time to invest.

Now is a good time to remind ourselves of the fundamentals of value investing. Our equity and bond portfolios are full of companies that we consider strong and worthy of investment based on their intrinsic value – not because they’re a big name or popular with the day-trading crowd. If you have questions about our investment philosophy and why we do what we do, please ask. As always, we’re here to serve you.

You will notice that we added a few more visual elements to our letter this time around. Let us know what you think.

News from Our Portfolio

“It is occasionally possible for a tortoise, content to assimilate proven insights of his best predecessors, to outrun hares that seek originality or don’t wish to be left out of some crowd folly that ignores the best work of the past. This happens as the tortoise stumbles on some particularly effective way to apply the best previous work, or simply avoids standard calamities. We try more to profit from always remembering the obvious than from grasping the esoteric. It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.” –Charlie Munger

Broadcom Inc (NASDAQ:AVGO) | Ownership: 1%– 7 %

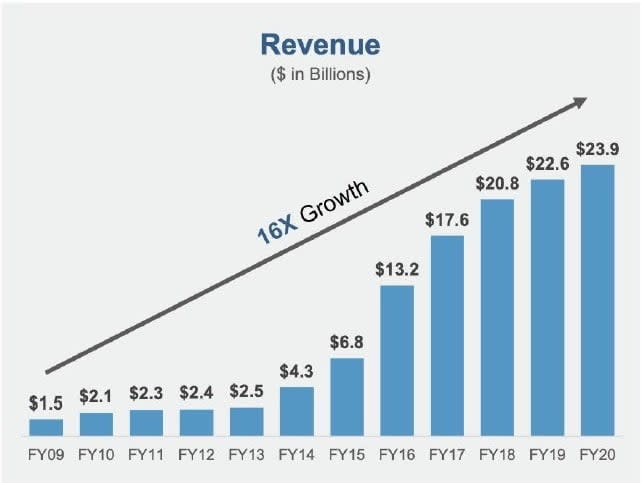

We continue to be impressed with the growth of this U.S.-based technology leader. At the time of their IPO in 2009, Broadcom’s reported revenue was just around $1.5 billion. At the end of fiscal year 2020, the company’s reported revenue was nearly $24 billion – that’s 16x growth in 11 years’ time. (See chart below. Source: Broadcom Networking Overview, J.P. Morgan 19th Annual Tech/Auto Forum, January 12, 2021).

This level of growth was achieved in part by Broadcom’s penchant for acquisitions, which we have highlighted in previous letters. Besides their impressive revenue growth and wise capital allocation strategies, we like Broadcom for the wide economic moat they have created through their commitment to research and development ($5 billion in fiscal year 2020) and their extensive intellectual property portfolio, which currently includes more than 23,000 patents. According to Broadcom, 99.9% of all internet traffic crosses at least one of their chips.

Discovery Communications Inc. (NASDAQ:DISCA) | Ownership: 1%– 5 %

In January, Discovery Communications, Inc., launched a new subscription streaming service in the U.S. called discovery+. The service, which functions like Netflix or Disney Plus, offers “non-fiction, real-life” programming from Discovery’s existing portfolio of networks including the Discovery Channel, HGTV, Food Network, TLC, Travel Channel, Animal Planet, OWN: Oprah Winfrey Network, and the forthcoming Magnolia Network, which features content from the brand of Chip and Joanna Gaines of F ixer Upper fame.

“There is nothing like [discovery+] in the market today,” said David Zaslav, President and CEO of Discovery, Inc. “We launch significant advantages, including the world’s greatest collection of non-fiction brands and content, built over more than 30 years across popular and enduring verticals, as well as powerful partnerships with leading distributors and platforms.” Among these distributors and platforms are Amazon Fire TV, iPhone, Apple TV, Chromecast and other Android phones and tablets, Microsoft Xbox One, the Roku platform, and many Samsung Smart TVs, as well as a partnership with Verizon to offer discovery+ to new and existing customers of the communications provider.

This new streaming service only adds to the value of Discovery, Inc., which already has powerful brands, global reach (see graphic below) and unique, unreplicable content. All of these factors speak to the company’s intrinsic value and indicate continued growth.

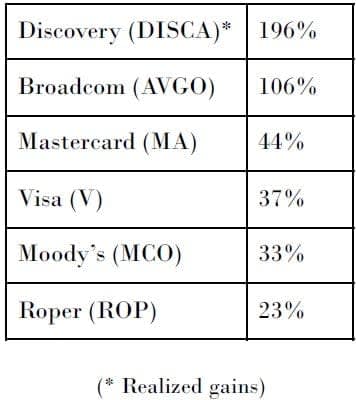

As of March, we have realized gains of approximately 196% in Discovery, w hich makes it our secondlargest holding. For clients that are Accredited Investors, we purchased LEAPS (Long-Term Equity Anticipation Securities) in Discovery, Inc. (DISCA, 20230120, 32.5, CALL, Option, SMART, USD) at $4.50. T hat same call option is currently trading at $35.50, which gives our clients a return of 689% annualized. (Please remember that past performance is not indicative of future results.)

New Purchase

Biogen Inc (NASDAQ:BIIB) | Ownership: 1%– 1 0%

Positioning themselves as “pioneers in neuroscience” and “one of the world’s first global biotechnology companies,” Biogen, Inc., develops and manufactures therapies for treating neurological and neurodegenerative diseases and other serious medical conditions, including multiple sclerosis (MS), non-Hodgkin’s lymphoma, chronic lymphocytic leukemia, and plaque psoriasis. The company has achieved strong profitability thanks to its oncology collaboration with pharmaceutical company Roche and its diversified treatments for MS. Having a portfolio that serves specialty markets and a product pipeline focused on neurological therapies has created a wide economic moat for the company – a quality we like to see.

There have been some recent hang-ups in the approval process for a new drug in the Biogen pipeline to treat Alzheimer’s disease, which affected its stock price. However, we do not believe the delay diminishes the company’s intrinsic value. Some analysts have voiced concern that a new balance of power in the Senate may result in changes to U.S. drug policy that would affect the bottom lines of pharmaceutical companies. However, at this point (though we have no crystal ball, of course), we anticipate only moderate changes that are not likely to affect a company like Biogen in any major way.

Since Biogen is a biotech company with a strong specialty pharmaceutical portfolio and a promising pipeline, they may present a major merger opportunity for another big pharmaceutical company. We are excited about this investment and look forward to monitoring Biogen’s value in the coming months and years.

On Deck

“When you come to a fork in the road, take it.” - Yogi Berra

In addition to our new purchase, we have a healthy list of companies that we consider “on deck.” These are great organizations that are not valued fairly by the market at the moment, but we are monitoring them for future investment. As volatility creeps in, we will follow our investing principles and purchase these businesses at a margin of safety well below their intrinsic value. Having good companies on deck served us well last year. When other investors ran in the first quarter of last year, we capitalized. As of the writing of this letter, we have unrealized gains as explained in the table below.

These calculations do not leave out any investments that we purchased during the COVID-19 pandemic. In most cases, we purchased more of what we already owned.

JDP Bond Portfolio

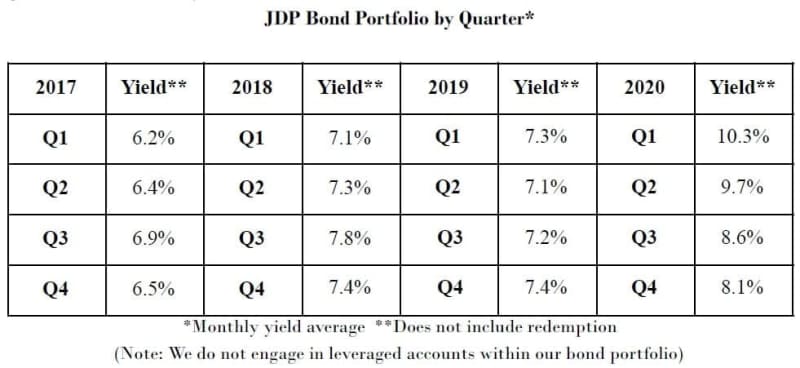

The following table provides a brief summary of how the JDP Bond Portfolio has performed on average over the last three years:

Several of the bonds within our portfolio are trading at a premium. We continue to realize gains when they become substantially overvalued, though we do not include this in our bond yield numbers.

Also worth noting: Because of when the bonds in our portfolio pay, our June and December yield disbursements are equal to the other 10 months. We do not purchase bonds based on the payment of the coupon date; we purchase them based on what they pay (coupon), if they will pay (quality), and their yield (value).

Spring Will Come

“Never cut a tree down in the wintertime. Never make a negative decision in the low time. Never make your most important decisions when you are in your worst moods. Wait. Be patient. The storm will pass. The spring will come.” –Robert H. Schuller

No one appreciates the wisdom in the saying “Patience is a virtue” as much as we value investors do. While we exercise patience and wait for the right time to invest, we also exercise prudence by analyzing the value of companies, not following trends. As always, thank you for your trust in this process and your trust in me. I will always do what I can to remain worthy of it.

Cordially,

Joseph Del Principe

The post Del Principe O’Brien Financial Advisors March 2021 Commentary: Biogen Inc appeared first on ValueWalk.