What’s New In Activism

In a potential early signal of success for issuers this proxy season, Delek US Holdings Inc (NYSE:DK) and Tegna emerged from last week’s meetings unscathed, while Prescience Point dropped its fight at MiMedx Group Inc (NASDAQ:MDXG).

Q1 2021 hedge fund letters, conferences and more

Shareholders at Delek rejected three directors nominated by Carl Icahn-controlled CVR Energy and elected management's entire slate after proxy advisory firms Institutional Shareholder Services and Glass Lewis made recommendations to back the incumbent board. Tegna also gained approval for all 12 of its board candidates, including CEO David Lougee, who recently came under fire from Standard General over alleged racial bias.

Meanwhile, Prescience Point said that its long-standing campaign has led to governance and strategy progress at MiMedx, rendering a proxy fight unnecessary. Only hours after publishing a presentation on the issues the activist believes are plaguing MiMedx, Prescience hailed the company’s leadership for taking steps in the right direction in recent weeks.

Activism Chart Of The Week

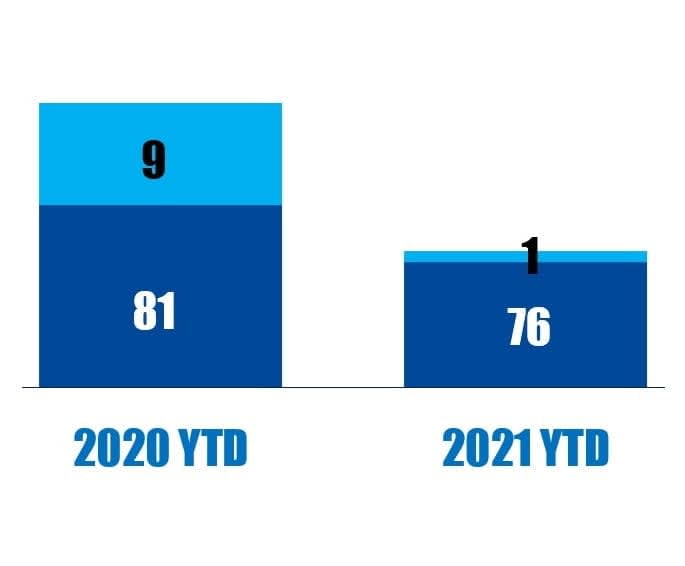

So far this year (as of May 6, 2021), 76 out of the 77 seats won by activist nominees at U.S.-based companies were gained via settlement. That is compared to 81 out of 90 in the same period last year.

Source: Insightia (Activist Insight Online)

What's New In Proxy Voting

BlackRock published its global Q1 2021 report last Wednesday, highlighting a dramatic increase in support for environmental and social shareholder proposals, as well as the fund manager’s primary reasons for opposing director elections.

BlackRock engaged with 712 companies about climate oversight in the first quarter of 2021. The fund manager also engaged with 468 companies relating to board quality and effectiveness, 406 concerning strategy and financial resilience, 308 regarding incentives aligned with value creation, and 231 relating to company impacts on stakeholders.

It has supported 12 of the 16 (75%) environmental and social shareholder proposals put to a vote in 2021 so far, compared to 8.5% last year.

This increase in support is attributable to the fund manager revising its proxy voting policies for 2021 to generally support shareholder proposals concerning environmental and social issues if they are deemed a material business risk.

Proxy chart of the week

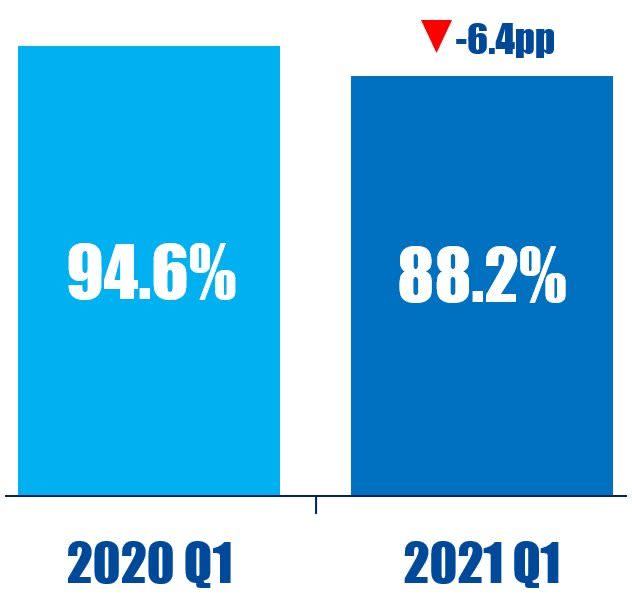

Glass Lewis support for binding remuneration policies in the U.K. has fallen from 94.6% in 2020 Q1 to 88.2% in 2021 Q1.

Source: Insightia (Proxy Insight Online)

What's New In Activist Shorts

Soren Aandahl secured $25 million in assets under management for The Blue Orca Global Activism Fund and lined up a potential further $30 million in committed capital, according to Bloomberg.

The hedge fund is a first for Aandahl, who is planning to use it to find accounting malpractice and overvalued stocks worldwide.

"We’re ready to publish new ideas right off the bat," Aandahl said. "The plan is to look for really fraudulent names, as well as ideas where we think there’s a strong accounting angle."

Aandahl’s Blue Orca Capital, founded in Austin, Texas, took its first shot at Samsonite in 2018 and has since targeted 10 more companies, including China Medical System Holdings (HKG:0867) and Seek, according to Activist Insight Shorts data.

Shorts Chart Of The Week

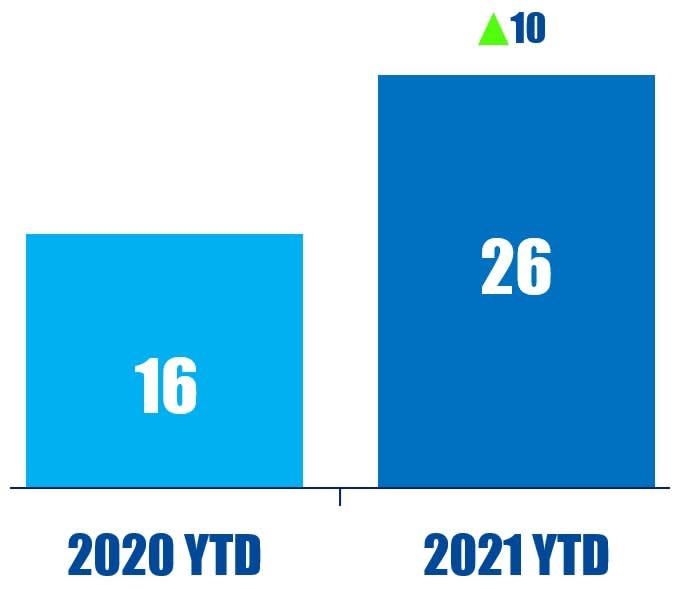

So far this year (as of May 07, 2021), 26 public activist short campaigns have prompted a direct response to by the company. That is up from 16 in the same period last year.

Source: Insightia (Activist Insight Shorts)

The post Delek Rejects Board Nominations By Icahn-Controlled CVR appeared first on ValueWalk.