In hisDaily Market Notes report to investors, while commenting on the 10-year treasuries cracking 1.5%, Louis Navellier wrote:

Q1 2021 hedge fund letters, conferences and more

Treasuries Crack

The big news this week is that the 10-year Treasury bond yield "cracked" 1.5% on Wednesday. Falling Treasury bond yields amidst rising inflation is considered ironic many market observers, but more unusual with record low corporate bond yields, which are supported by record corporate earnings. Furthermore, in Europe, 10-year government bond yields are negative in Germany, so there is a desperate search for yield around the world. The 10-year government bonds are at about 0.39% in Spain and 0.82% in Italy. In 2020, Spain’s deficit as a percentage of GDP was 10.97%, while Italy came in a 9.47%. Amidst, high budget deficits and record low government bond yields, no wonder corporate bond yields are falling: a corporation with robust earnings growth is deemed safer by many investors than investing in government debt.

I cannot stress enough how bullish the current low interest rate environment is for stocks. Not only are companies selling debt at ultra-low yields to pay off higher yielding debt, but many companies are also bolstering their cash reserves and boosting their stock buyback activity. In other words, the current low interest rate environment is helping to set the stage for another launch when the second quarter results are announced in July. In the meantime, so far in June, small capitalization stocks continue to perform exceptionally well, bolstered by the excitement surrounding the annual Russell realignment.

Stick With Gold Bullion

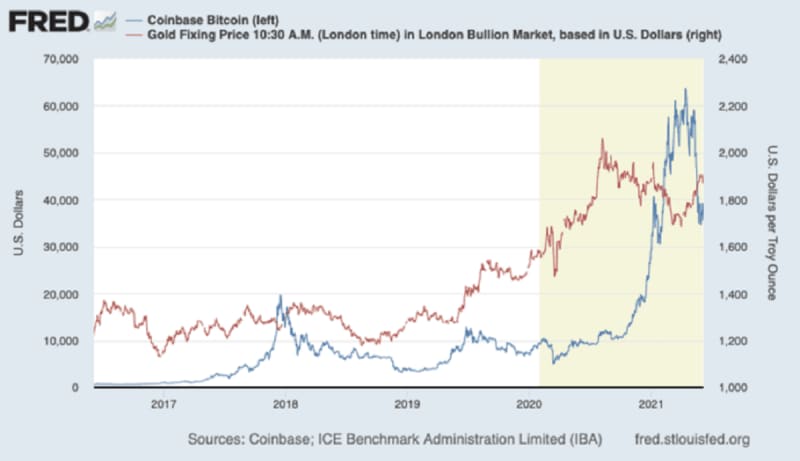

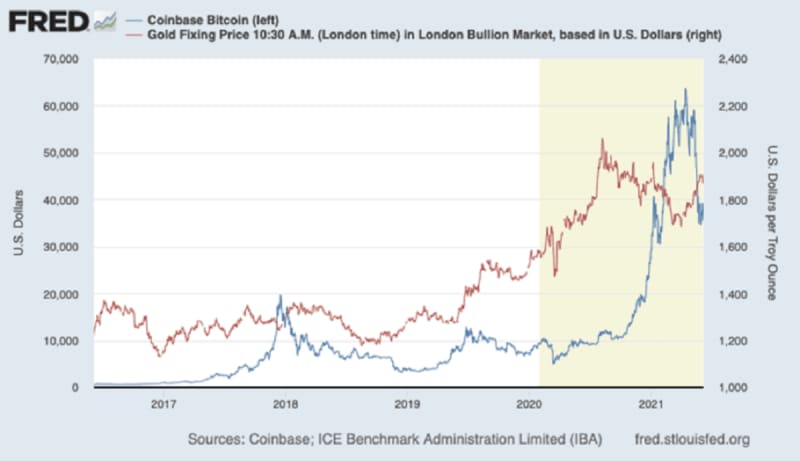

The month of May was intriguing as bitcoin formed a rather powerful head and shoulders top, and broke the neckline, as traders like to say, while gold bullion has been remarkably firm. There have been too many investors that bought bitcoin just because it was going up, so it stands to reason that they will be selling it just because it is going down, making it go down even more.

The biggest problem with bitcoin is that it can be legislated into oblivion. If bitcoin is that great of an idea, why are the Chinese looking to crack down on bitcoin mining, two-thirds of which is done in China? The Chinese can crash bitcoin at will by quickly phasing out bitcoin mining – it’s as simple as that – and if they refuse to accept bitcoin, how will bitcoin be valuable? If large economies don’t accept it in payment, what is its worth?

Plus, it does not help that the ransomware attacks on the Colonial Pipeline and JBS meat processing operations are for-profit attacks, only possible because of cryptocurrencies. Bank transfers are easy to track, but not bitcoin transfers.

You cannot legislate gold bullion away. It has been tried many times for 5,000 years and it didn’t work, but legislation against bitcoin has not even begun yet.

Despite a lot of bad news at Tesla, some good news is that its China sales in May resurged to 21,936, up sharply from 11,671 in April. The company’s sales tend to spike at the end of each quarter, and as an example, Tesla sold 35,478 vehicles in China in March, which was the strongest month ever in China. This is raising expectations for very strong China sales in June, especially now that the Model Y is being manufactured in Shanghai. Interestingly, since most Chinese Teslas are now made with iron phosphate batteries, these vehicles have lower range than its lithium cobalt vehicles, but its iron phosphate vehicles are cheaper and now increasingly being exported to Europe.

The post 10-Year Treasuries Crack 1.5%; Gold vs Bitcoin appeared first on ValueWalk.