S&P 500 shook off another record making inflation reading, and bond markets couldn‘t be happier. Volatility is back down, but the option traders turned cautious – that‘s fodder for the next upswing eventually. Many signs are pointing towards it – emerging markets rising with the dollar on the defensive, for example. Yes, the dollar with yields are key to watch now.

Q1 2021 hedge fund letters, conferences and more

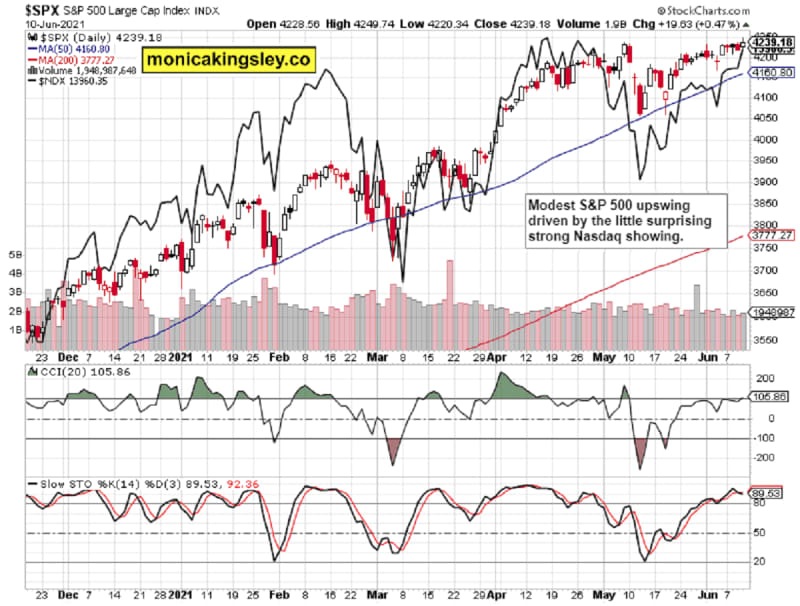

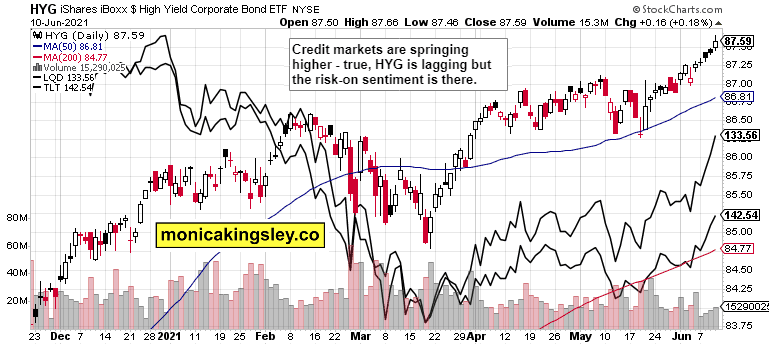

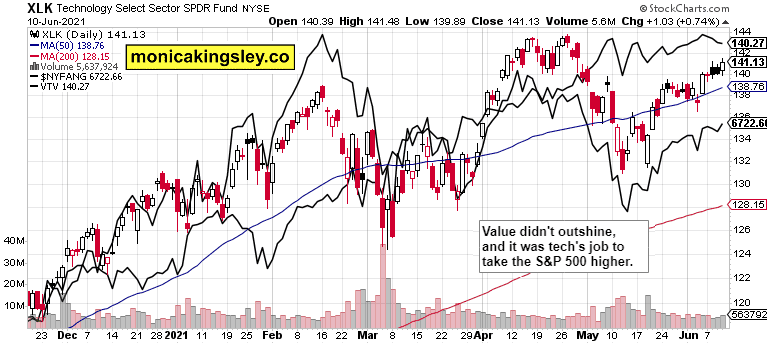

S&P 500 was led higher by Nasdaq, which more than welcomed further retreat in yields. The tech led rally is here, and value while not down and out, is taking a breather. Especially financials don‘t like the move in yields, and we aren‘t at the 1.40% mark on 10-year Treasury bond yet. The summer lull in bonds is here, and my views on inflation getting permanently elevated, Fed‘s taper plays, bond yields retreat, inflation rearing its ugly head later this year before a growth scare strikes, can be found in the Latest Highlights and this week‘s articles amply discussed.

So, stocks don‘t look like retreating, as the bond market momentum doesn‘t favor much downside, and tech would likely overpower that.

Let‘s briefly check the reactions of other markets to yesterday‘s well telegraphed CPI springboard theme in stocks and precious metals.

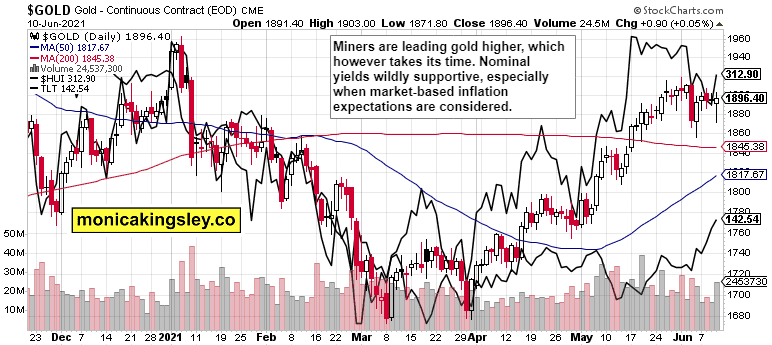

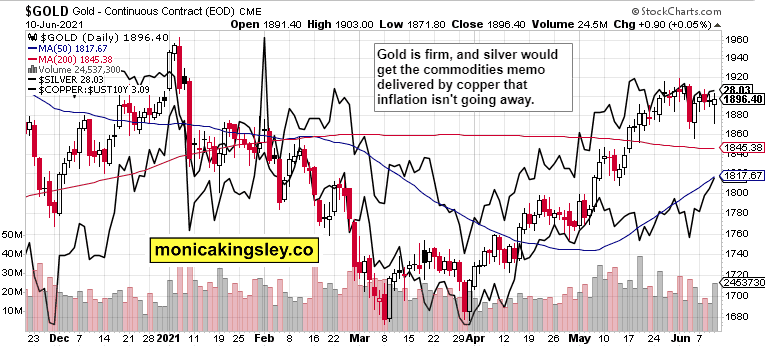

Gold moves better be viewed through the leading miners – these recovered from their prior underperformance. The yellow metal‘s swings best be viewed now through the optics of how much inflation is perceived as burning, declining TIP:TLT ratio notwithstanding. And the premarket moves throughout commodities mean that the marketplace isn‘t convinced about the Fed‘s seriousness in tackling inflation, justifying my earlier deep skepticism on the taper smoke and mirrors games.

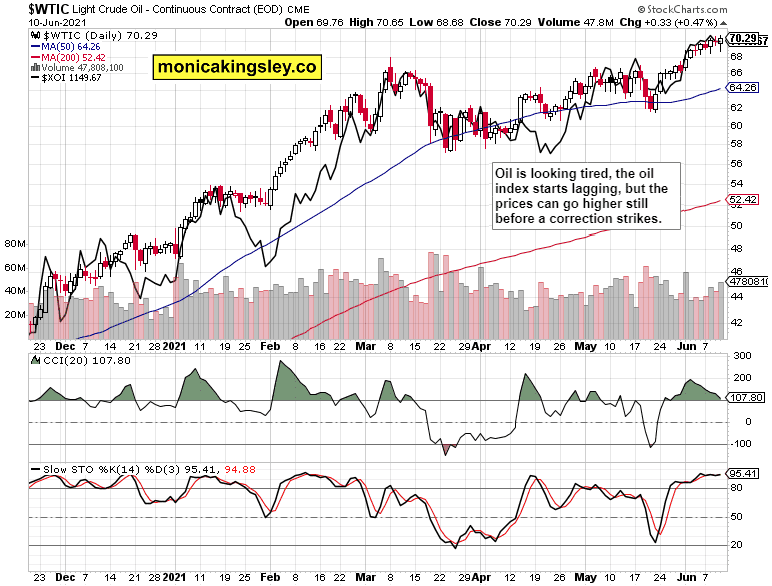

Crude oil chart is about decreasing upside momentum, and rising volume smacking of distribution as the lower knots show. I‘m looking for relatively shallow drop maximunm, and a correction in time rather than in price.

Bitcoin is still challenging the declining resistance line connecting May and Jun rebound highs, and Ethereum isn‘t confirming Bitcoin‘s strength. The bears have an opportunity to strike, weekend including.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

S&P 500 upswing was clearly driven by the Nasdaq surge, which is a defensive reaction to retreating yields taking their toll on high beta plays.

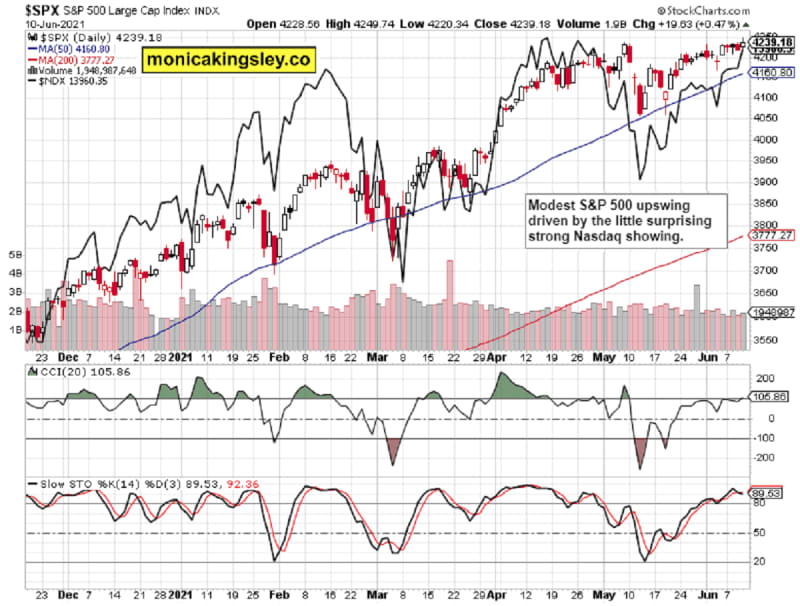

Credit Markets

High yield corporate bonds have underperformed on the day, but the picture doesn‘t uproot the risk-on trades in the least.

Technology and Value

Technology including $NYFANG was again in the driver‘s seat as value just can‘t take to the sharply retreating yields.

Gold, Silver and Miners

Miners rising is the most important feature, with gold reliably refusing its premarket decline coming in as second. Look for passing the baton between gold and silver alongside the inflationary winds affecting commodities.

Silver isn‘t visibly outperforming, and the copper to 10-year yield ratio is increasingly putting a firm floor below precious metals declines.

Crude Oil

Crude oil is hanging in the balance, but a sharp correction isn‘t favored.

Summary

S&P 500 remains well positioned to survive and thrive in the inflation fears as it‘s too early these take a toll on P&L or bring about doubts about economic growth.

Gold and silver are well positioned to reap the benefits of higher inflation and lower real rates, and the miners keep confirming.

While ripe for a breather, crude oil would probably trade in tandem with other commodity inflation trades, so look for shallow pullbacks only.

Bitcoin and Ethereum are stuck at the moment, and break higher above resistance or its rejection, would reveal the next short-term direction.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the four publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

The post Inflation Bets – Squaring or Not appeared first on ValueWalk.