WASHINGTON – Short column today. Tuesday’s market action is so boring that I’m actually falling asleep at my computer’s virtual trading desk. All three major averages have remained near flatline since this morning’s opening bell. And now, just an hour-and-a-half from the 4 p.m. final bell, all three are up just 0.15% or less. Why? Some pundits speculate that the much-ballyhooed Delta variant of the increasingly overhyped Covid-19 virus has investors scared stiff.

Our friends at ZeroHedge opine.

“While sentiment remains buoyant, investors are growing concerned by the latest evolution of the Delta variant, which is increasingly seen as a growing threat to the ongoing economic recovery in many areas, said Pierre Veyret, a technical analyst at ActivTrades. Even if the economic impact is ‘unlikely to be significant’ in developed countries, ‘the inconsistency in vaccination campaigns in other parts of the world is likely to lead to an uneven recovery,’ he said.

“Others echoed this sentiment: ‘The Delta variant has also emerged in our client conversations as a potential threat to reflation/inflation,’ JPMorgan Chase & Co. strategists led by Marko Kolanovic said. ‘The economic consequences are likely to be limited given progress on vaccinations across developed market economies. It could, however, pose some risk of a delay in the recovery in countries where vaccination rates remain lower.’

What do doctors say?

To paraphrase an old TV commercial from the 1986, I’m not a doctor, and I don’t play one on TV.** (See video clip below.)

Given the fecklessness and lies we regularly encounter from the fraudsters running WHO and CDEC, it’s worth stating once again that, like the common flu, some form of Covid-19 will now be with us forever. So freaking out about each variant, whether real of a figure of the Deep State’s imagination, is not worth destroying the world’s economy, and the livelihoods of hundreds of millions of people across the globe. For a second time in less than 2 years, no less. That’s what my internal doctor tells me. And so do many actual doctors of my acquaintance. Off-the-record, of course. People are also afraid to tell the truth today for fear they’ll be canceled and their families ruined.

But, in other words, this week’s thus-far stultifyingly dull market action more than likely reflects utter confusion on the part of traders and investors, not to mention the general public, which has been consistently lied to by their “representatives” in Washington for what now seems like decades.

Also Read: Red State economies vs Blue States: You already know who’s better off

Things fall apart

Things are actually falling apart around the world in many ways, increasingly due to the daily terrorization of the public by politicians, government bureaucrats and a reprehensible version of the media that can only sell commercials and grossly overstuffed “stimulus” programs to the populace if the average voter is suffering from post-Covid PTSD, or something similar.

This has led to an environment where few people on either side of the increasingly muddy political spectrum have any confidence in the future, which leads those individuals and institutions who still trade and invest for a living to keep all their accounts opportunistically churning away while always looking for the exit signage, just in case.

Compounding the problem of ritual Covid-19 “variant” scares, like the Delta variant – as if we don’t have a new variant of the flu every year – is the fact that, beyond even a liberal-progressive doubt, America’s holograph of a president has led to the weakest, most corrupt government this country has ever endured, a fact that makes even this country’s enemies nervous. Every day in Washington has now become a Bizarro-World version of “Anything Can Happen Day” on the old 1950s Mickey Mouse Club. Except that today, anything that can happen will likely turn out bad or worse than what’s happening today.

The Delta variant: A return of Jimmy Carter’s “malaise”

This political miasma, Delta variant and otherwise – maybe Jimmy Carter’s “malaise” might suit this situation better – continues to rob investors and entrepreneurs alike of the confidence they need to forge ahead. And it robs traders and investors of the confidence – for the most part – to place aggressive bets on the future of America. Because only God knows whether this robust country has a real future now or not.

This whole mess colors the investment landscape in uncertain ways. But the “malaise” is there. And the situation is hair-trigger enough to violently disrupt the plans of bulls and bears alike if some kind of nasty surprise comes out of the woodwork.

People are afraid

Washington is totally dysfunctional and everybody knows it. Worse, pretty much everybody, including many liberals, now totally realize that America’s once free and fair electoral system went off the rails in 2020 in an epic fashion, with results far more damaging than the last real electoral crisis back in 1876.

This kind of cosmic, once-in-a-lifetime chaos weighs heavily on Wall Street in ways that many refuse to comprehend. We remain ¾ invested right now, with remaining funds in cash only. We’re marking the exit doors. We’re still bullish for the long term. But we’re ready to bolt for the doors when the cheap political glue holding Washington’s elites together suddenly melts. At that point, the wild rumpus of the latest Fourth Turning really begins.

** Meanwhile, to lighten the mood, let’s play back that old 1986 commercial. The idiocy of its initial “argument from authority” premise reminds us of our Federal government in 2021. Enjoy.

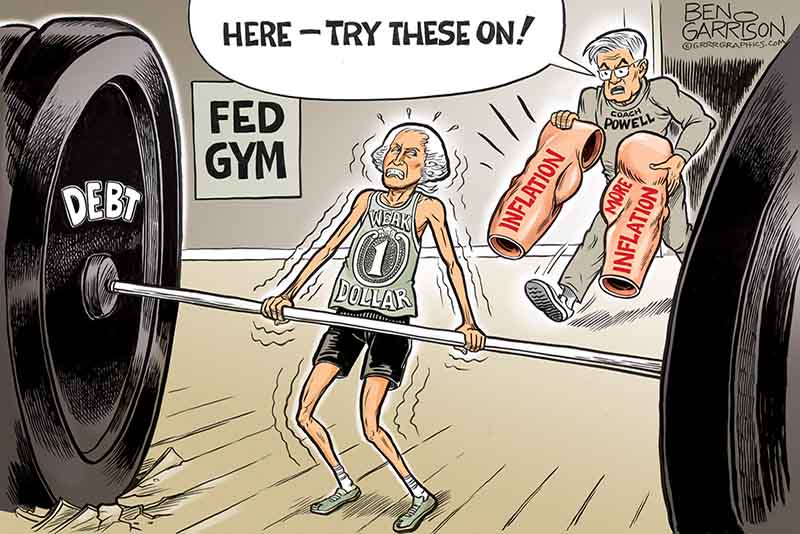

-Headline graphic link: Cartoon courtesy of Grrrgraphics.com.