Overseas markets were lower overnight on the chatter of Covid variants and the ECB. The S&P 500 is lower by over 60 handles in early NY cash trading.

Q2 2021 hedge fund letters, conferences and more

ECB Raising Their Inflation Goal To 2%

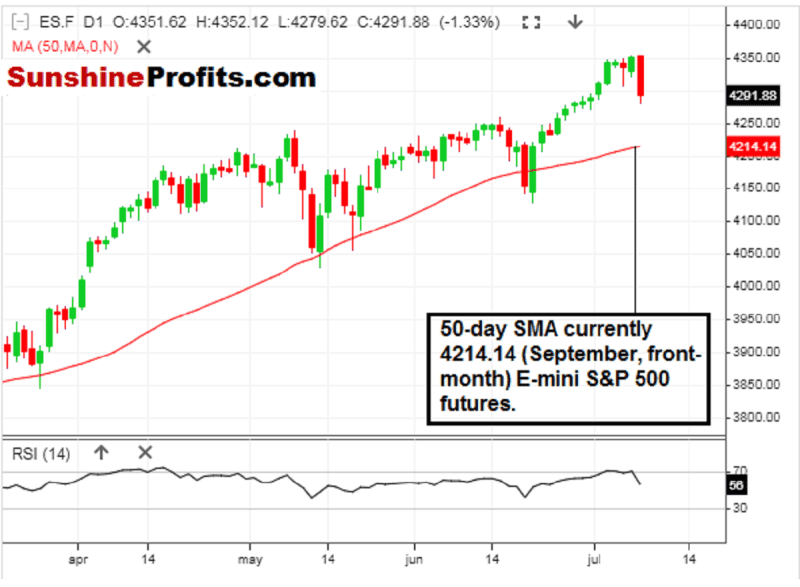

US equity futures were lower overnight ahead of the cash open with several headlines moving the market; the ECB confirms that they are raising their inflation goal to 2%, there is talk of Covid variants, and a potential spectator-free Olympic games. It is one of those mornings. To put matters into perspective, let’s take a look at a daily candlestick chart of the S&P 500.

Figure 1 - E-Mini S&P 500 Futures March 13, 2021 - July 7, 2021, 8:42 AM, Daily Candles Source stooq.com

After the slow grind higher, we finally have a meaningful pullback so far at the open today. It was hard to see that one coming, and we will find out if the pullback has any legs to it throughout the day. The 50-day SMA is still quite a distance away (4214.14), so I would not be in any rush to buy the index here, and also don’t see any reason to get emotional and sell into it, either.

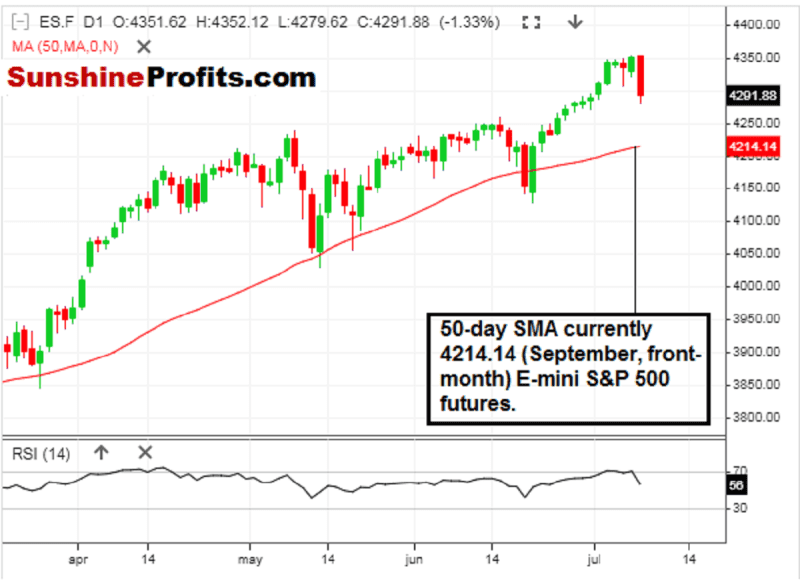

Figure 2 - Ten-Year Treasury Note Yield September 16, 2020 - July 7, 2021, 9:04 AM, Daily Candles Source stockcharts.com

Is Bond Buying The Right Thing To Do?

It is a somewhat rough open today, with capital fleeing into Bonds (even further) and the S&P 500 opening down ~1.4%. Is rushing into buying bonds (expecting lower yields) the right thing to do right now?

I don’t think so. Taking all of the emotion out of the market, the 10-year note yields are in oversold daily territory and hitting a 61.8% retracement level, with the 200-day moving average in sight.

Yesterday, the ten-year yield gapped lower and looked like it was putting in a low, with a doji candle formation after gapping down on the session. As it turns out, today may be an even more favorable day to consider getting long interest rates in one shape, form, or fashion.

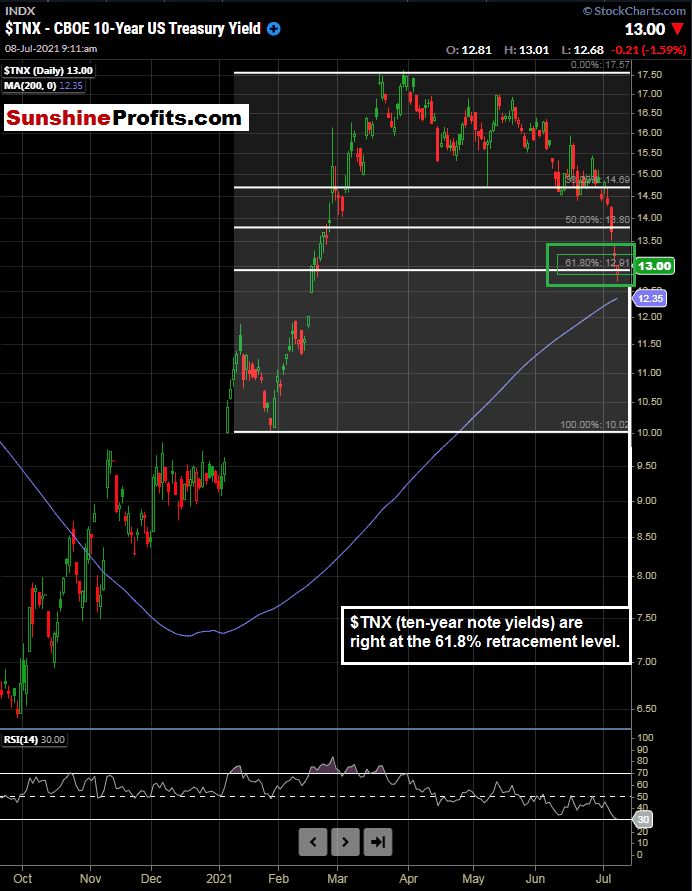

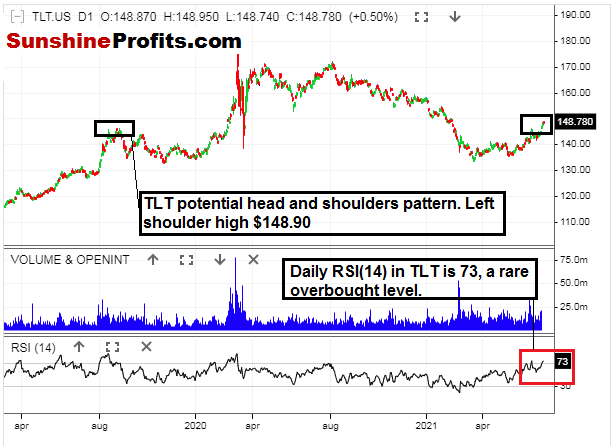

Speaking of bond yields, we examined them yesterday, and they are indeed lower again this morning. We looked at TLT, and let's take a look early this morning.

Figure 3 - TLT iShares 20+ Year Bond ETF September 10, 2018 - July 7, 2021, DailyCandles Source stooq.com

The Head And Shoulders Formation In Treasuries

This potential head and shoulders (long-term) formation in TLT has a left shoulder high of $148.90. We are currently trading higher than this as I write this, at $149.24. It is up by 0.83% on the day so far. It is not the biggest up day in the world, but not too much fun when short from $148.00.

Emotions and trading do not mix. Today, all of the talking heads are making it sound like the sky is falling with capital moving out of stocks and into bonds. The SPX was up for eight of the last nine sessions, I believe, and the index is currently trading where it was last Monday. Is that really a big deal? That is why I love to consult the charts and technicals; there is no human emotion in there.

Another key observation: The Ten-Year note yield has not had a daily RSI(14) level this low (29) since the Covid-19 meltdown. Oversold much?

Now, let’s cover the stop loss, take profit, and other key levels in TLT, along with analyses on the other eight markets we are covering for Premium Subscribers.

Not a Premium subscriber yet? Go Premium and receive my Stock Trading Alerts that include the full analysis and key price levels.

Thank you for reading today’s free analysis. I encourage you to sign up for our daily newsletter - it's absolutely free and if you don't like it, you can unsubscribe with just 2 clicks. If you sign up today, you'll also get 7 days of free access to the premium daily Stock Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Thank you.

Rafael Zorabedian

Stock Trading Strategist

Sunshine Profits: Effective Investment through Diligence & Care

This content is for informational and analytical purposes only. All essays, research, and information found above represent analyses and opinions of Rafael Zorabedian, and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. You should not construe any such information or other material as investment, financial, or other advice. Nothing contained in this article constitutes a recommendation, endorsement to buy or sell any security or futures contract. Any references to any particular securities or futures contracts are for example and informational purposes only. Seek a licensed professional for investment advice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Information is from sources believed to be reliable; but its accuracy, completeness, and interpretation are not guaranteed. Although the information provided above is based on careful research and sources that are believed to be accurate, Rafael Zorabedian, and his associates do not guarantee the accuracy or thoroughness of the data or information reported. Mr. Zorabedian is not a Registered Investment Advisor. By reading Rafael Zorabedian’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Trading, including technical trading, is speculative and high-risk. There is a substantial risk of loss involved in trading, and it is not suitable for everyone. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment when trading futures, foreign currencies, margined securities, shorting securities, and trading options. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Rafael Zorabedian, Sunshine Profits' employees, affiliates, as well as members of their families may have a short or long position in any securities, futures contracts, options or other financial instruments including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice. Past performance is not indicative of future results. There is a risk of loss in trading.

The post S&P 500 Lower in Early NY Trade, Bonds Bid Near Key Levels appeared first on ValueWalk.