Paper currencies are losing trust during this world health crisis and climate change. Today, investors both new and seasoned are moving into real assets to safeguard against rising inflation. Cryptocurrencies, for one, are easy to get into and get out of. Both gold and crypto offer this benefit. However, even as consumers flee their respective currencies, central banks say that inflation is nothing to be concerned with. Meanwhile, all you need to do is look at the price of gas or shop for groceries to see inflation in action. But the real question is, is inflation transitory or structural?

Q2 2021 hedge fund letters, conferences and more

Basically, is it permanent or temporary? More importantly, what can you do about it?

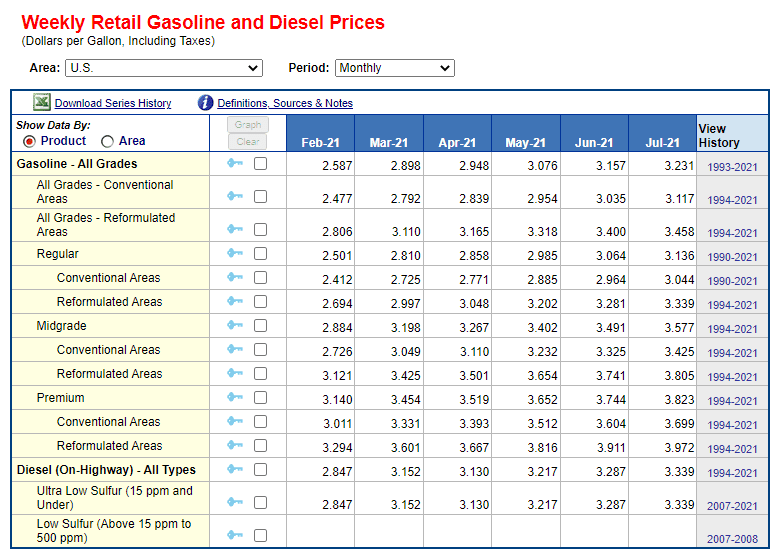

Source: US Energy Information Administration

Inflation: Is it Here to Stay?

Right now, the narrative is that central bankers view inflation as temporary, meanwhile, the individual consumer sees it as structural. According to recorded data, inflation was already rising at the start of the recession.

Source: Trading Economics

Normally, there is more deflationary pressure and decreasing CPI. Then there would be aggressive monetary and fiscal policies to counteract that. But because the recession has already begun and these policies were not implemented, economists are concerned that it may be here to stay. In response, many are turning to gold and crypto.

Fiscal vs Monetary Policy, What’s the Difference?

Now, because of Janet Yellen, the US is using fiscal policy to offset monetary policy.

To clarify, the difference between monetary and fiscal policies is monetary policy is set by all the world’s central banks. In short, these banks decide how much currency there is and how much it will cost, which is the interest rate. Meanwhile, fiscal policy is the government with spending and debt, passing bills for bridges, roads, schools, stimulus checks, etc.

Fiscal policy works in the short term. The effects kick in quickly but fade off quickly as well. Monetary policy, through quantitative easing, tries to stimulate the economy through the banking system. This mostly winds up with asset price inflation.

Now it appears the biggest tool, negative real rates, is gone because this strategy is not working. At this point, people are worried that rising rates can clog the economy. So, the other option is for fiscal policy to bring forth new change.

What is the Fed Doing?

The Fed sees its job and micromanaging the economy, but they have yet to go hawkish on anything. There is speculation that the Fed will discuss tapering at the Jackson Hole meeting, including rising interest rates at the end of 2022. However, as soon as equity markets begin to experience volatility, (5-10% down), Austrian Fund Manager Ronald-Peter Stӧferle of Incrememtum thinks the Fed will become more dovish again. He also believes the stock market holds a lot of power over the Federal Reserve.

Stӧferle stated that Powell showed promise originally, but now he thinks the Federal Reserve is “enslaved” to the bubbles they blow and “there’s no way out.” Additionally, everyone once thought that Powell was different because he is neither an economist nor an academic. Now, it appears that he is much more similar to his predecessors.

Powell’s solution, like his predecessor Ben Bernanke, is basically to create more currency. He also recently indicated that the government needs to spend all it can and the Federal Reserve will support it. And with that, comes inflation.

So Where Does That Leave Gold and Crypto?

At this moment, cryptocurrencies are strongly rebounding after this weekend. Several factors helped buoy bitcoin. Last week, Cathie Wood, Jack Dorsey, and Elon Musk attended and promoted the opportunities with bitcoin at the B-Word event. Additionally, over the weekend, media reports alleged that Amazon was planning to accept bitcoin by the end of 2021. However, Amazon has since issued a statement saying that was untrue, although they see great benefits to bitcoin and other cryptocurrencies.

Additionally, the gold spot price remains mostly stable throughout the month, keeping above $1,800 per oz.

Source: Bullion Exchanges

What this all means for individual investors is that buying real assets like gold and crypto can be an important move right now. Unfortunately, inflation negatively affects the stock market as it increases the cost of materials as well as labor. This is why betting all your investments in the stock market is not always a strong option. Furthermore, this is also why there is strong support for buying gold and crypto as well as silver right now. Many are afraid of losing the buying power of their dollar and turn to real, liquid assets to help bolster their personal savings.

Seeing as the Fed is not responding to rising inflation with interest rates, now could be an opportune time to diversify holdings. Cryptocurrency can be volatile and you can either win big or lose it all. Others turn to precious metals, which are historically more stable and grow or fall over an extended period instead of fast episodes. A helpful method that appeals to many is to buy cryptocurrency, then sell some of their profits and convert it to gold and silver.

Gold and Crypto Meet as Digital Gold PAXG

It can be a difficult decision to choose between gold and crypto. So, another option is to buy PAXG, a stablecoin that represents real physical gold ownership. The New York State Department of Financial Services and the DFS both approve of and regulate PAXG. You can even sell it for the physical gold property anytime through a licensed dealer, like AlphaBullion.

These options can benefit individual investors as well as businesses. Over time you can grow your savings with real assets safely, especially in the face of inflation. Right now, it is uncertain how the federal government will correct the economic trajectory of inflation. Investing in options such as gold and Bitcoin as well as silver can potentially help protect your wallet as liquid assets.

The post How Gold and Crypto Can Help Against Today’s Rising Inflation appeared first on ValueWalk.