What’s New In Activism: Starboard Value & Box Fight Intensifies

Q2 2021 hedge fund letters, conferences and more

Starboard Value and Box Inc (NYSE:BOX) have shared dueling interpretations of the company's performance as their proxy contest intensifies.

Starboard put forward measures to boost performance at Box in support of its campaign for three board seats at the enterprise software company. The activist said Box failed to meet all of management's long-term revenue growth targets since going public in 2015, has "consistently suffered" from decelerating revenue growth since its initial public offering, and offers "poorly designed" compensation programs.

Starboard holds Box's board responsible for this, saying directors "seemed complacent" with management's "continued underperformance and inconsistent execution."

In response, Box issued a statement saying its "board and management team have taken meaningful actions to accelerate the company's growth strategy, improve its operational and financial results, and enhance its governance." Then, last week, Box said in a letter to shareholders that it outperformed a set of peers by 29% in total shareholder returns since the start of the year.

Activism chart of the week

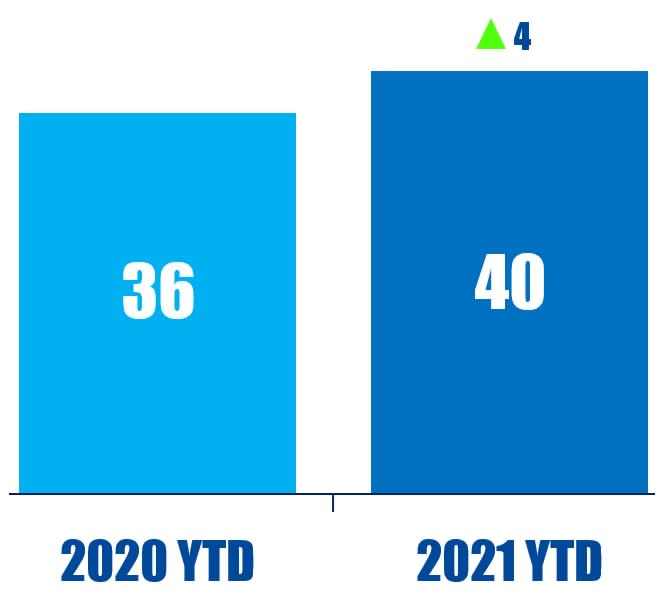

So far this year (as of August 12, 2021), 40 investors who disclose activism as part of their investment strategy have publicly subjected at least two companies to activist demands. That is compared to 36 in the same period last year.

Source: Insightia (Activist Insight Online)

What’s New In Proxy Voting: SOC Investment Group's Letter To Activision Blizzard

SOC Investment Group (formerly known as CtW) issued an August 5 letter to Activision Blizzard, Inc. (NASDAQ:ATVI)'s lead independent director, Robert Morgado, urging the S&P 500 multimedia company to boost board diversity and claw back executive bonuses to address ongoing diversity, equity, and inclusion (DEI) concerns.

SOC suggested that CEO Bobby Kotick's July 27 letter to employees, customers, and shareholders, announcing changes to the company's structure and employee support capabilities, did "not go nearly far enough to address the deep and widespread issues with equity, inclusion, and human capital management at the company."

Activision was urged to add a third female director to its board by the end of 2021, to reserve at least one board seat for a nominee selected by current employees, and to undertake a company-wide equity review.

SOC's letter came in response to California's Department of Fair Employment and Housing filing a lawsuit with Activision over its alleged culture of "constant sexual harassment" and gender-based discrimination.

Proxy chart of the week

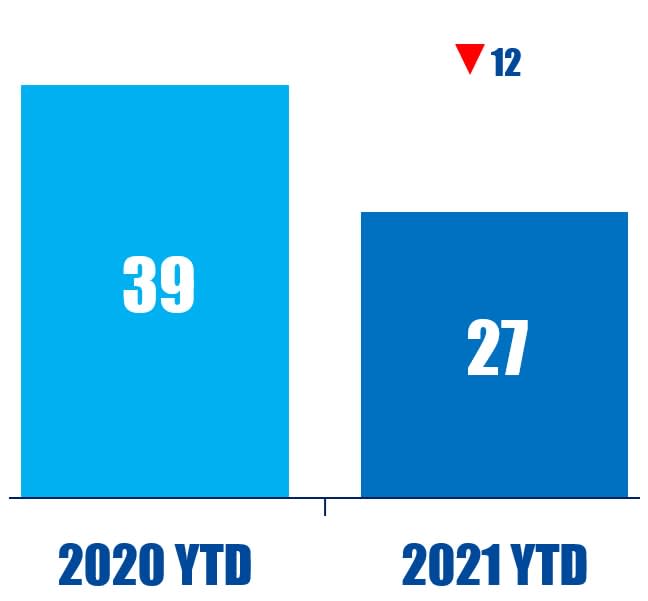

So far this year (as of August 11, 2021), there have been 27 shareholder proposals calling for an independent board chair at S&P 500 companies. This is down from 39 over the same period in 2020.

Source: Insightia (Proxy Insight Online)

What’s New In Activist Shorts: Argo Blockchain Shorted

The Boatman Capital Research disclosed a short bet on Argo Blockchain PLC (LON:ARB)'s stock, in the belief that the company recently purchased land in Texas for seemingly up to 100 times more than the acreage is worth.

In a Monday report, Boatman Capital highlighted that Argo agreed in February to buy 320 acres of land in Texas, initially for $5 million in shares, rising to $17.5 million. The short seller pointed out that, in June, the company admitted that the agreement was actually for 160 acres with the option to buy a further 160 acres.

Boatman Capital claimed that a formal valuation of the land by a certified real estate appraiser came to $168,000. The valuation has been corroborated by local tax records and recent property sales in the area, the short seller added.

The short seller also explained that the seller of the land, DPN, is registered in Delaware but has no website, no physical location, and no obvious track record. Nine of DPN's owners are also shareholders of Argo, Boatman Capital claimed. "The fact that Argo shareholder profited from the DPN deal represents a potential conflict of interest and/or related-party transaction that a more transparent company might have wanted to disclose to investors at the time of the deal," said the short seller.

Shorts chart of the week

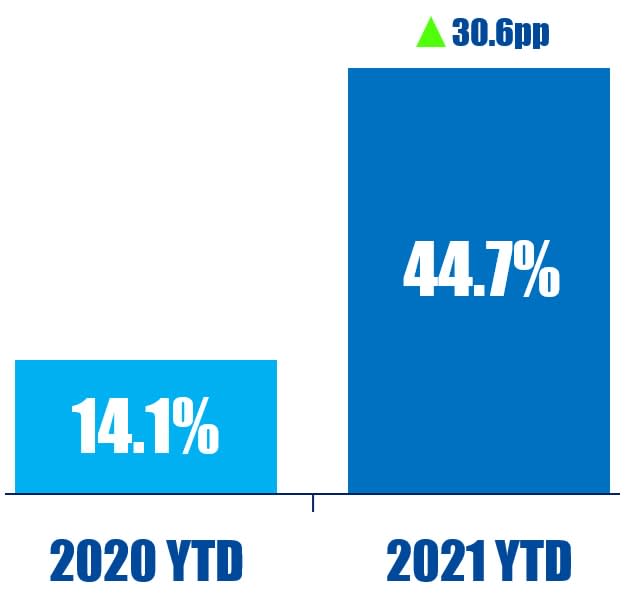

So far this year (as of August 12, 2021), White Diamond Research's one-week campaign return for public activist short campaigns is 44.7%. That is up from 14.1% in the same period last year.

Source: Insightia (Activist Insight Shorts)

Quote Of The Week

“The fights that are going to a vote are the ones where the dissident perhaps does not have the track record, doesn’t have a history, and the company is willing to take a bet they can prevail.” - Tom Ball

Updated on