Qualivian Investment Partners commentary for the second quarter ended June 30, 2021.

[soros]

Q2 2021 hedge fund letters, conferences and more

“You don’t have to invest like a big bureaucratic institution. If you choose to invest like one, then you’re doomed to perform like one.” – Peter Lynch

Overview

Qualivian Investment Partners is an investment partnership focused on long-only public equities. We own a concentrated portfolio of 15–25 understandable companies with wide moats, long reinvestment runways, and outstanding capital allocation. Since we expect them to compound capital at a mid-teens rate, we hold them for an extended period. We are seeking investors who are aligned with our long-term investment time horizon. We do not short securities. We do not use leverage. We do not use derivatives. We are not macro investors. We believe that only a relatively small number of exceptional companies are worth investing in over the long term.

Our Formula:

Long-Term Orientation + Long-Term Investors + Focused Portfolio + Quality Compounders = Maximizing Chance for Outperformance

Our investors should understand how we invest so they make the right decision. We encourage investors who agree with our long-term horizon and philosophy to contact Aamer Khan (aamer.khan@qualivian.com) at 617-970-9583 or Cyril Malak (cyril.malak@qualivian.com) at 617-977-6101.

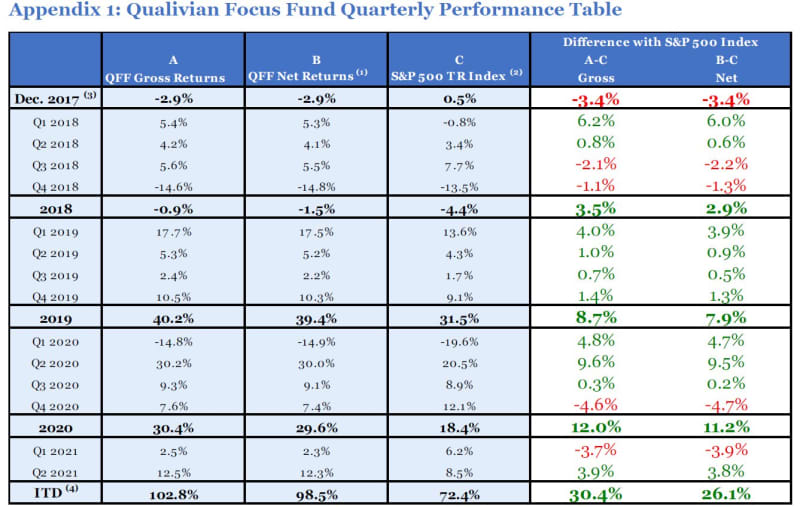

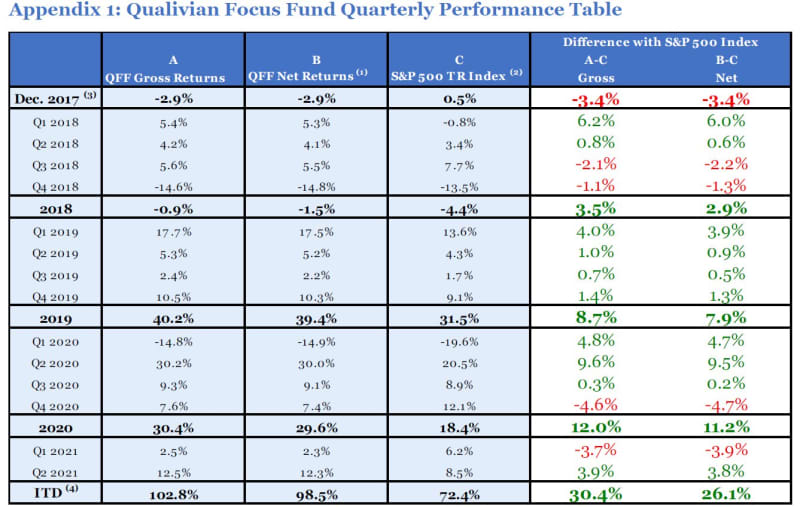

Qualivian Performance in Q2 2021

Since inception (December 14, 2017) to end of Q2 2021, we have returned 102.8% and 98.5% on a gross and net basis respectively, outperforming the S&P 500 Total Return index by 30.4% and 26.1%, respectively.

In Q2 2021, we outperformed the S&P 500 by 3.9% and 3.8% on a gross and net basis, respectively. We were positively impacted by the rotation to higher quality and growth-oriented sectors in Q2 2021, like the Consumer Discretionary and Technology sectors.

Portfolio Changes

The only change we made to the portfolio this quarter was that we trimmed Apple (AAPL) to fund a new position in Evolution Gaming (EVVTY). Evolution is the dominant online live casino gaming competitor in Europe with a growing presence in the US and Asia (see our Q1 2021 investor letter for an in-depth discussion of Evolution Gaming).

Top and Bottom Contributors

Our top three contributors in Q2 2021 were Alphabet (GOOGL), PayPal (PYPL), and Moody’s (MCO). Our bottom three contributors were Evolution Gaming (EVVTY), TJX Companies (TJX), and Mastercard (MA), with Evolution Gaming being the only stock that underperformed the S&P 500 in that period.

Top 3 Contributors:

Alphabet

The opportunity in online advertising remains very attractive for Alphabet’s subsidiary Google. In the recent June quarter, Google’s ad sales grew 69%. Alphabet Inc (NASDAQ:GOOGL)’s subsidiary YouTube’s ad revenue soared 84%, to $7 billion, in the second quarter, putting the business on par with Netflix, which reported quarterly revenue of $7.3 billion. Netflix is expected to grow sales by 19%, to $29.7 billion this year, while YouTube’s ad revenue is forecast to rise 45%, to $28.7 billion.

Alphabet slashed operating losses for the Google Cloud by more than half, as the business continues to scale, growing at 50%+ clips. Furthermore, the company continues to have potentially new growth options via its investments in autonomous driving (Waymo) and various healthcare businesses such as Verily and Calico.

PayPal

The company reported a slightly disappointing quarter with revenues growing 19%, missing on the average revenue per transaction due to the accelerated decline in eBay transactions, the higher mix of Braintree transactions, and other impacts from hedging and F/X translations. Given the stock’s significant outperformance in 2020 and heightened expectations coming into the quarter, the stock has been consolidating since the earnings report. Long term we remain bullish on Paypal Holdings Inc (NASDAQ:PYPL), given the company’s continued growth in eCommerce end markets, as well as the continued share gains of digital payments/wallets over paper payments.

Moody’s

Revenue, operating profit margins, and EPS all exceeded expectations, and annual guidance for these items (and for free cash flow) was raised. In MIS (Moody’s Investors Service) which houses the traditional ratings business, the outlook for debt issuance was raised for the remainder of the year, while MA (Moody’s Analytics) also came in ahead of expectations. The company leveraged strong revenue growth with strong operating profit margin improvement of 200 bps, with EPS coming in $0.22 ahead of consensus estimates. Management alluded to having interesting opportunities in their M&A pipeline, which we will have to assess when the time comes, but Moody’s Corporation (NYSE:MCO) management team has been very effective at allocating capital in the past toward value-creating bolt-on acquisitions, especially in their Moody’s Analytics business, a key growth driver for the company.

Bottom 3 Contributors:

Evolution Gaming

Evolution ADR (OTCMKTS:EVVTY) was the only position that underperformed the S&P 500 in the quarter. While the company reported another strong quarter with revenues, operating profit, and EPS growing by 100%, 110%, and 75% respectively in the quarter, these represented slight beats to elevated investor expectations. The stock’s subsequent decline reflected these very high expectations. We recognize that the valuation on Evolution was challenging, which is why we initiated and have added to positions on pull backs in the stock. Of course, our position is predicated on a multi-year view that online gambling, and specifically the live casino format, will continue to gain traction in the US and Asia as more jurisdictions approve online gambling, and that Evolution will be the primary winner going forward.

TJX Companies

While it still outperformed the S&P 500, TJX Companies Inc (NYSE:TJX) landed in the bottom three as its stock’s tepid performance reflected the broader underperformance of stocks levered to post-COVID reopening. These were muted in the quarter given the resurgence of COVID cases due to the Delta variant. Its actual results, which it reported on August 18th, were outstanding, beating across the board on both top and bottom lines and showing strong operating leverage in the operating profit line. Same store sales were up an impressive 20% overall. We remain very confident in TJX’s moat in that its treasure hunt format is hard to replicate for the likes of Amazon and Walmart.

Mastercard

Q2 revenue and EPS beat consensus estimates by 3.7% and 12% respectively. Operating margins also beat consensus by +240 bps. Gross domestic volume growth of +38.3% (+32.8% in constant currency) was buttressed by continued e-commerce strength and better in-store performance, while purchase volumes grew 41.8% (35.5% in constant currency). Cross border performance was strong, but durability remains uncertain given uncertainty arising from the Delta variant and its impact on travel and tourism. We believe Mastercard Inc (NYSE:MA) has a robust runway for growth given further travel recovery, new/existing partnerships, traction in digital payments, and ongoing economic recovery.

Thinking About the Mega Caps

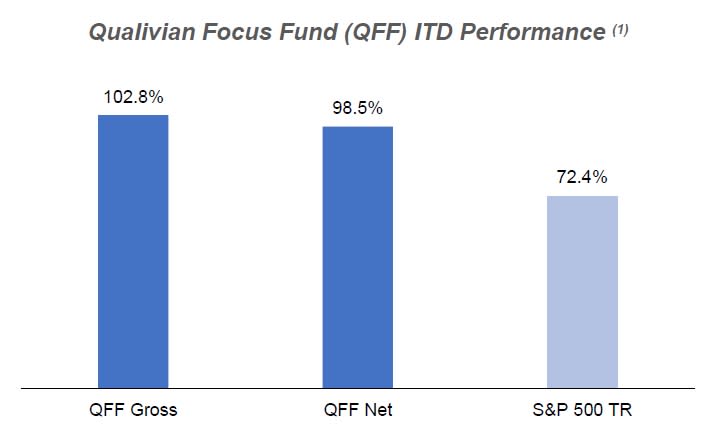

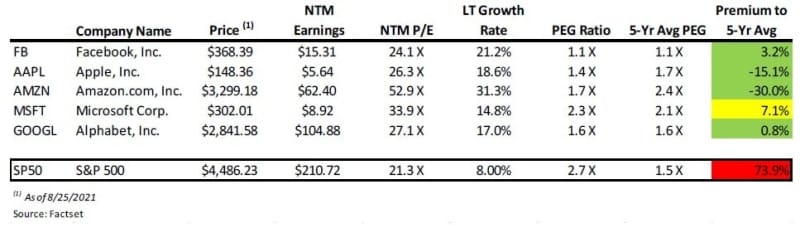

We own some of the mega cap stocks. They have had a great run. Are they overvalued? We have discussed some of them before in previous letters (see our Q3 2020 investor letter).

Here are the valuation ratios for the top five stocks vs the S&P 500.

Considering their potential earnings growth, the stocks seem undervalued vs the index, which itself seems overvalued relative to its past long-term earnings growth rate. Earnings may also be understated due to generally accepted accounting principles’ (GAAP) requirement of expensing investment rather than capitalizing it. The stocks continue to have some of the best business models in the world. Their future earnings should easily outpace that of the S&P 500 while their valuation is at a modest premium on next year’s earnings and at a discount on earnings five years out.

Many investors suffer from ennui— these stocks have done so well for so long that investor excitement about them has dissipated. “Show me something else, I am sick of hearing about them” is a refrain. The investor desire for new, exciting stocks makes investing more complicated than necessary. We like to keep things simple. Sometimes it takes great effort to see what is at the tip of our nose.

Investing: Then … and Now

“This time it’s different” is perceived as a facile and dangerous remark, loose thinking that disrespects investment history. However, the investing landscape has changed over time, and our investment frameworks need to adjust accordingly. Let’s outline some changes.

Quality Trumps Quantity – Now More Than Ever

There was a time when quantitative measures (price/earnings, dividend yield, price/book, etc.) could signal which stocks were likely to outperform. In the 1950s, Buffett made a killing by applying these techniques in a straightforward fashion. Much of his success was due to the difficulty in obtaining and sorting through data then. He had to plough through Moody’s and Value Line publications, examine hundreds of stocks, and do calculations manually. Opening the most oysters led to the most pearls.

Things are different today. First, because of the widespread use of databases and computers, quantitative measures of undervaluation are easily observed by virtually all professional (and many retail) investors. They are arbitraged away and are less predictive of outperformance. Second, because GAAP is increasingly outmoded, many components of equity value cannot be measured. So quantitative screening alone is unlikely to produce a durable edge. Qualitative factors have to be considered.

Business Has Qualitatively Changed

In addition to observable quantitative characteristics being less signal rich, the underlying characteristics of dominant businesses, especially quality compounders, are also considerably different from several decades ago:

Dominant Businesses Have Increased Their Dominance

The returns on invested capital for the top decile-performing firms have increased over the last quarter century. Some factors leading to the growth:

- Wider moats due to the prevalence of double-sided platforms, network effects, superior brands that can be migrated internationally, and corporate cultures that lead to product/service innovations.

- Greater prevalence of intangible assets that can be scaled and dominant businesses that benefit from increasing returns that result from a greater worldwide market.

- Increased use of software models, and business models requiring less capital.

Firms with high returns continue to maintain those high returns. This means that mean reversion of returns on invested capital is less applicable to competitively advantaged/dominant companies.

Legacy Businesses Are More Vulnerable Than in the Past

These companies face greater competition because it is easier to form new businesses. Startups can now leverage the greater availability of venture and other forms of capital. Outsourcing key non-core functions is much easier. Technology (like the cloud) enables businesses to launch new enterprises much quicker and with less hassle than before.

Much of the talent that would have gone into academia, medicine, law, or scientific research in the past is now going into business. In addition, the US can tap the human talent pool from Europe, China, India, and other parts of the world. Indeed, 55% of America’s billion-dollar startups have an immigrant founder. The US is attractive to entrepreneurs from across the globe.1

As a result, legacy businesses struggle with this increased competition.

The Net Result…

The difference between the best and worst performing businesses is wider than before. Dominant businesses are more likely to have long growth runways, better returns on capital, and deservedly high valuation ratios. Legacy businesses, on the other hand, are more likely to be disrupted and have their economics deteriorated. Characteristics that could be quantified in the past are no longer useful; the old valuation frameworks are less relevant. New thinking and insights are required.

What does Lobster Fishing have to do with the Institutionalization of Asset Management?

The fundamental character of asset management changed when it transitioned from a profession to a business that was increasingly dominated by large firms.

What changed? First, consider a well-known case: the Prelude Corporation.2 Prelude was a lobster fishing company that tried to bring “modern management techniques” to the lobster fishing industry. This is what its then president, Joseph Graziano, said:

The fishing industry is now just like the automobile industry was 60 years ago: 100 companies are going to come and go, but we’ll be the General Motors…. The technology and money required to fish offshore are so great that the little guy can’t make out.3

However, the Prelude Corporation soon failed in the lobster fishing business. The little guy won. Why? And how is this relevant for asset management?

Lobster fishermen know that lobsters are best caught from small boats whose crews “hunt” lobsters rather than by techniques that automate lobster fishing and seek to “manufacture” them. The distinction is important. Hunting takes local knowledge, idiosyncratic skill, intuitive understanding, and flair. It cannot be “managed” by set procedures, like a manufacturing operation. Those who practice the “craft” of lobster fishing easily outperform those in the “industry” of lobster fishing.

Now apply this insight to asset management. Investing is a craft, not an industrial operation. Good investing ideas are hunted, not manufactured. However, large asset managers shoehorn what is inherently a craft into a manufacturing operation. They break up the investment value chain into discrete procedures with standardized, repeatable protocols that can be measured, monitored, and incentivized. They use the latest technology and have access to legions of analysts, expert networks, etc… This may be more cost efficient in dollars, but at the cost of lowered curiosity, more conformity, diminished creativity, and less intelligent risk taking. For this reason, small, focused teams outperform much larger firms.

Reading Creates an Edge … but It Is Not Always Fashionable

You can get an edge just by doing your homework: reading all the company disclosures—SEC filings, earnings calls transcripts, investor presentations, and press releases. Even though the documents are easily accessible, many investors do not take the time to read, digest, and assimilate them.

A surprisingly large number of investors base their investments on qualitative top-down theses or themes. Other investors rely on a purely quantitative approach without familiarizing themselves with an investment’s business model, quality of the management team, or understanding the competitive, technological, or regulatory backdrops of these businesses. They think that all the signposts are embedded in the quantitative signals their models are generating.

Some of them, especially hedge funds, believe they can generate an investment edge spending time and effort to obtain non-public information. This often distracts from the time, patience, and effort required to read all the public documents. This is even more true if a fund does not run a concentrated portfolio. It is very difficult to read all the relevant documents if you have more than thirty or so stocks in a portfolio. You are more likely to outsource your reading … and your thinking.

A hedge fund is more likely to raise funds by saying it engages in complex research like satellite image analysis of retail parking lots and the airfield where a CEO’s corporate jet may be spotted. Telling institutional investors that it studies public information is not a successful marketing strategy for many funds.

Our take is that generating an investment edge based on uncovering a piece of data outside of the public domain via “proprietary” research may, at best, generate occasional investment success, but it is very hard to do systematically and repeatedly.

Investing Advances One Retirement at a Time

Has the investing profession properly assimilated these changes into its beliefs and processes?

Many senior investors have not incorporated these changes into their investment frameworks. Many of these individuals entered the investing profession in the 1990s. Their views were formed then. They invested through the Internet bubble and its subsequent collapse. They were not exposed to the changes that we discussed above. Their early successes may not serve them well in today’s market.

It is hard to modify an investing framework you’ve used for years. To illustrate how slowly minds are changed, remember that after the equity wipeout in the Great Depression, many investment committees considered equities speculative until the mid-1950s, due to recency bias. Only high-quality fixed-income funds were considered suitable for large pensions and endowments. This caused them to miss out on the attractive equity returns attained in the 1940s and 1950s. Many “cigar butt” investors held on to their beliefs long past the date when this style was no longer relevant due to the ease of quantitative screening. And momentum investors in the go-go years of the 1960s often held on too long and suffered poor returns in the ’70s. Buffett and a small handful of investors over the decades were flexible enough to change their investment styles, but they were the exception to the rule.

The same phenomenon was seen in the history of science. Darwin’s theory of evolution was not accepted until well after its proposal, with numerous prominent biologists who never accepted the theory.

Max Planck, one of the founders of quantum mechanics, stated, “Science advances one funeral at a time.” We may reformulate this to say that “investing advances one retirement at a time.” Many investors will hold on to their old frameworks until they retire … or their managed assets shrink due to poor performance.

We would now like to discuss Intuit, a company that fits our investment strategy and illustrates how we think about stocks. Intuit epitomizes the high returns on capital, shareholder focus, predictability, and long-term growth we seek in high-quality businesses. It is on our shopping list, and we would consider purchasing it at the right price. We thought it would be interesting to review the stock here.

Intuit (INTU)

The Thesis in a Nutshell

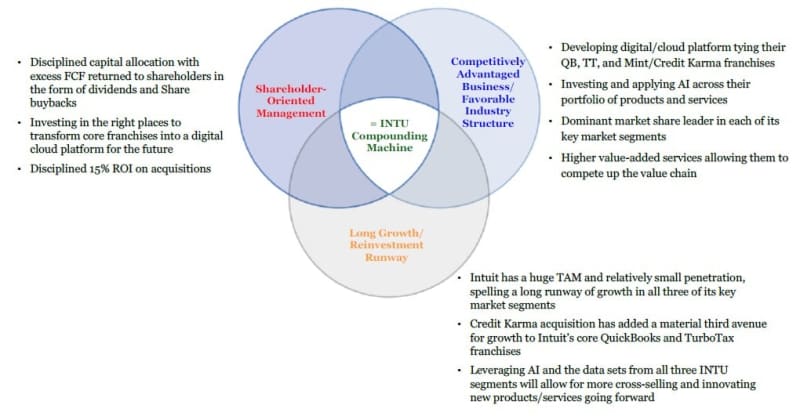

Intuit Inc. (NASDAQ:INTU) is an attractive combination of:

- attractive economics,

- a wide moat, especially via the development of a connected ecosystem/digital platform that locks stakeholders in, and

- strong growth in core markets supplemented by geographic global expansion, as well as,

- a shareholder-oriented management team.

It is a quality compounder. At the right price it is a clear buy.

What Intuit Does

Intuit dominates the small and medium business (SMB) accounting software category as well as the do-it-yourself (DIY) tax preparation software market. Intuit has three key businesses:

- Software for financial and business management (QuickBooks) as well as integrated payroll solutions, merchant payment processing solutions, and financing for small businesses in the US and key global markets;

- Do‑it‑yourself and assisted income tax preparation software products (TurboTax) and services sold in the US and Canada; and

- FinTech Apps (Mint and now Credit Karma) that provide users the ability to integrate and monitor their financial lives in one platform, while allowing them to shop for financial service products (credit cards, mortgages, auto loans, and insurance products).

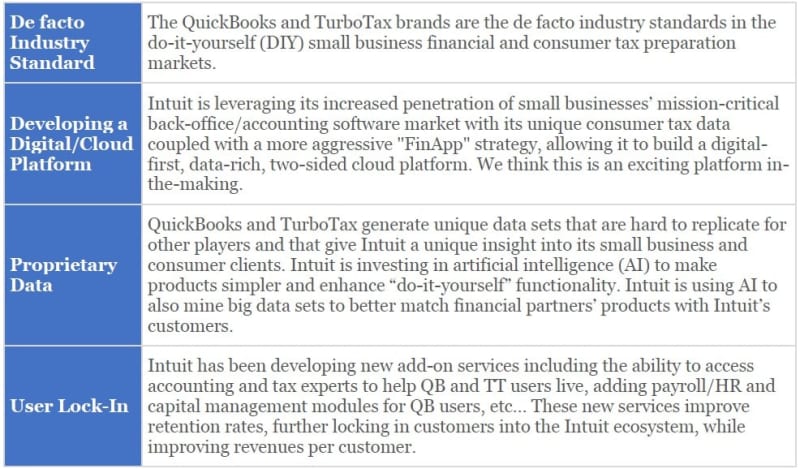

Intuit’s Competitive Advantage

Intuit has a strong moat derived from these key characteristics:

Intuit Has a Long Growth Runway

We believe that Intuit can continue to generate mid-teens revenue and high-teens EPS growth over the foreseeable future, given low penetration rates and new add-on services in its core markets.

QuickBooks

QuickBooks is the #1 market share leader in the United States with 4.6 million customers (out of 48 million small businesses in those markets) and 1.2 million customers in the United Kingdom, Canada, and Australia (out of 10 million small businesses in those markets).

Management has guided QuickBooks revenue growth in the range of 10—15% over the medium term, while aiming to grow QuickBooks ecosystem (associated services like Payroll/Human Capital Management, payment processing) revenue by 30% per year. QuickBooks ecosystem accounted for 6% of Intuit’s group revenue in FY2012, 28% in FY2020, and in our estimation will account for around 50% of QuickBooks total revenue by FY2025.

TurboTax

TurboTax already supports the filing of 30% of all tax returns in the United States, yet only accounts for around 13% of revenue spent on filing tax returns. We expect TurboTax’s share of total filing and dollars spent on tax returns to continue to increase. Over the past 6 years TurboTax’s revenue has increased at a 10% average annual growth rate.

Through the development of TurboTax Live and other products, Intuit will be able to gain further share from tax preparation services like H&R Block, while generating increased revenue per average filing, supporting its medium‑term target of 8–12% revenue growth for this division.

FinApp (Mint and Credit Karma)

The addition of Credit Karma to Intuit’s Mint platform is opening a third leg to growth that will enable third-party arrangements with financial service providers and new revenue streams in credit card, auto loan, and mortgage loans as well as the sale of various insurance products.

Intuit Has Excellent Shareholder Orientation

Management has been steadily redeploying Intuit’s excess cash toward opportunistic share repurchases, as well as supporting a growing dividend in-line with earnings growth.

Management has traditionally deployed capital toward smaller tuck-in acquisitions, requiring a strict 15% ROI from its acquisition targets. However, management acquired Credit Karma for $7.1 billion last year (50% cash funded with rest via equity), which we believe, in combination with Mint, will add a substantial third leg to Intuit’s growth stool.

Attractive Economics

Intuit’s advantaged business exhibits the following attractive financial characteristics:

- Consistent, sustainable revenue growth. Intuit has grown revenue at 15% compounded annually over the past 5 years, and we expect it to continue generating mid- double-digit revenue growth over the medium term.

- High margins. Operating margins of 26–28% and free cash flow margins in the 30–33% range in the last 5 years are likely to improve as management leverages continued strong topline growth.

- Very high cash conversion. Consistent free cash flow/net income of > 120% reflects Intuit’s focus on working capital management.

- Limited capital requirements to support organic growth. Growth has been achieved without Intuit raising equity capital over the past 20 years. Capital expenditure is less than 2% of revenue.

- High returns on invested capital (ROIC). Mid-40%+ ROICs have been the norm for Intuit given its attractive return and capital light model. With the Credit Karma acquisition, Intuit’s ROIC dipped into the low 30% range last year but should rebound nicely as it integrates the new business.

Intuit’s Valuation

Admittedly, when one looks at Intuit’s valuation on one-year out revenues and earnings, trading at 13.6X NTM Sales and 49.0X NTM EPS, the stock looks expensive. But we expect the company to grow its top and bottom lines at 15% and 20%+ over the next 3–5 years. When you normalize for that growth, the stock is still trading at 2.5X PEG ratio which is still somewhat high in our view. We have placed INTU on our watch list. It has all the characteristics we look for in a quality compounder, but we await a more attractive entry point. We are constantly evaluating our forecasts and if Intuit can leverage the Credit Karma acquisition and ramp up new profitable revenue streams or ramp up its ancillary services in QuickBooks and TurboTax more quickly than we anticipated, then we will revisit buying the stock at that point.

Ending Thoughts

We look forward to continuing to share our thoughts on our investment approach, and to keep you abreast of our performance and changes to the portfolio. If you would like additional information about Qualivian, please refer to Appendix 2 for links to prior Investor letters, our investor presentation, and an interview Aamer did with Insider Monkey. In the meantime, if you have any questions, please feel free to reach out to us at the links below.

With best wishes,

Aamer Khan

Co-founder

aamer.khan@qualivian.com

www.qualivian.com

Cyril Malak

Co-founder

cyril.malak@qualivian.com

www.qualivian.com

Updated on