Stocks and credit markets sent conflicting messages – weakness in the S&P 500 wasn‘t matched by bonds losing ground. Though elevated by recent standards, VIX doesn‘t look to be in the appetite for further sustained gains, which would speak for gradual stabilization in stocks before these decide to move again.

Q2 2021 hedge fund letters, conferences and more

CPI coming in neither too hot, nor too cold, would be in line with my recent expectations of inflation becoming entrenched and elevated. Still, the figures support the transitory notion to a degree – the markets are obviously afraid of high inflation forcing Fed‘s mistake, and any reading that won‘t light the immediate inflation fires, would be considered good for the risk-on assets. More so probably for real ones as opposed to stocks. Finally, more time for the Fed to act implies better possibilities for precious metals bulls.

As stated yesterday:

(…) tech behemoths – worthwhile to watch. Stagflation would be a powerful environment to facilitate stock market declines – who could forget the 1974-5 slump? Real assets stand positioned to reap the rewards as the cost push inflation that I‘ve been discussing since early this year, is very much intact. Throw in some serious supply chain disruptions that won‘t be resolved this year, and all you end up with, is waiting for precious metals to catch up in the commodities appreciation – bringing in very nice profits in oil and copper…

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

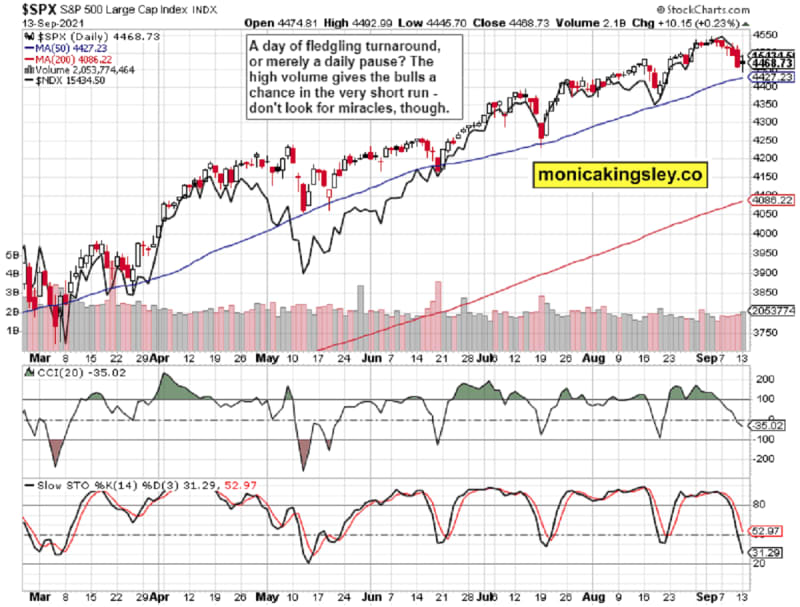

S&P 500 and Nasdaq Outlook

While the bears fumbled, the bulls didn‘t take the opportunity convincingly. The 50-day moving average looks to be holding for now still, especially when credit markets are considered.

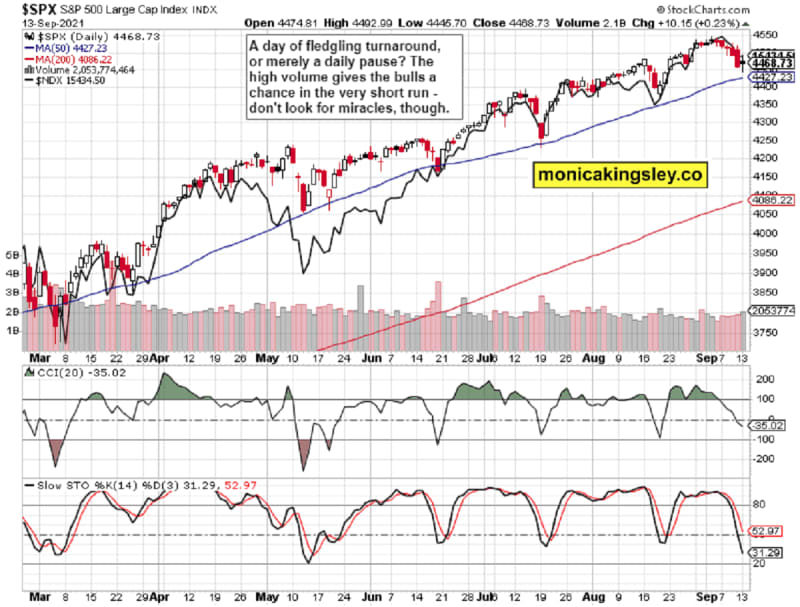

Credit Markets

Credit markets turned noticeably higher, and that‘s positive for the stock market bulls.

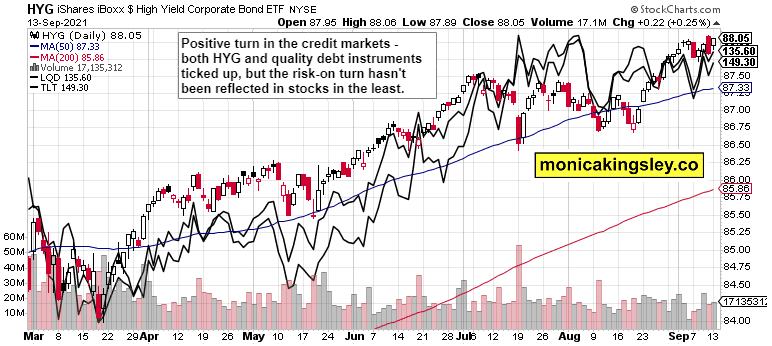

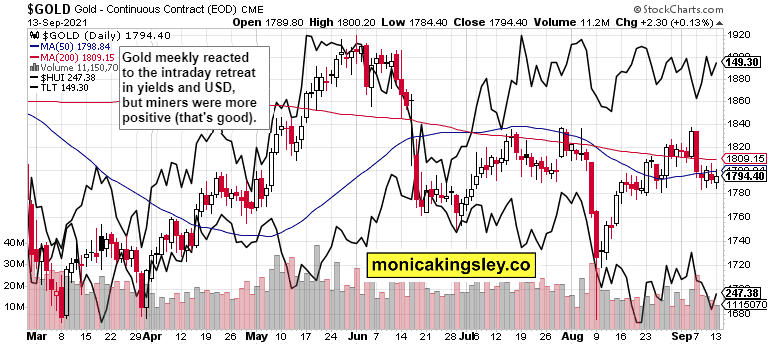

Gold, Silver and Miners

Gold and silver are rather stable in the very short run, and can still surprise on the upside – the miners to gold ratio is already turning up in preparation for the Sep FOMC disappointment as the Fed won‘t announce taper then. Meanwhile, inflation isn‘t disappearing, and real rates are going increasingly more negative.

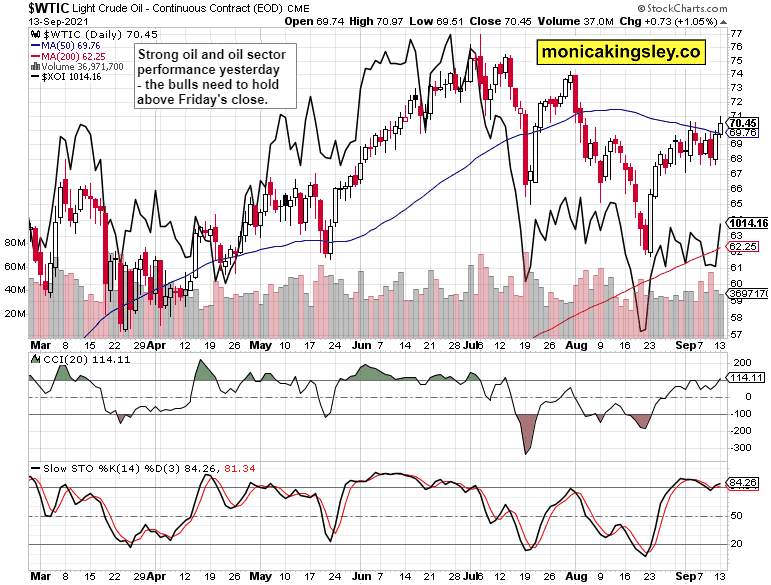

Crude Oil

Crude oil rise was associated with energy sector moving up as well, and the upswing outlook is slowly but surely improving. Black gold stands to benefit from the return of risk appetite and the dollar stalling – just as copper would.

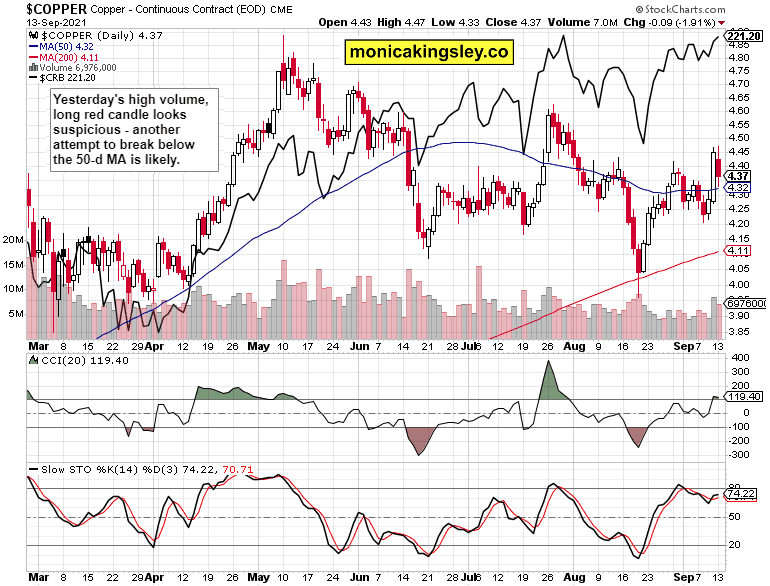

Copper

Copper reversal has the power to reach a bit further still, but I‘m not looking for the 50-day moving average to fold like a cheap suit.

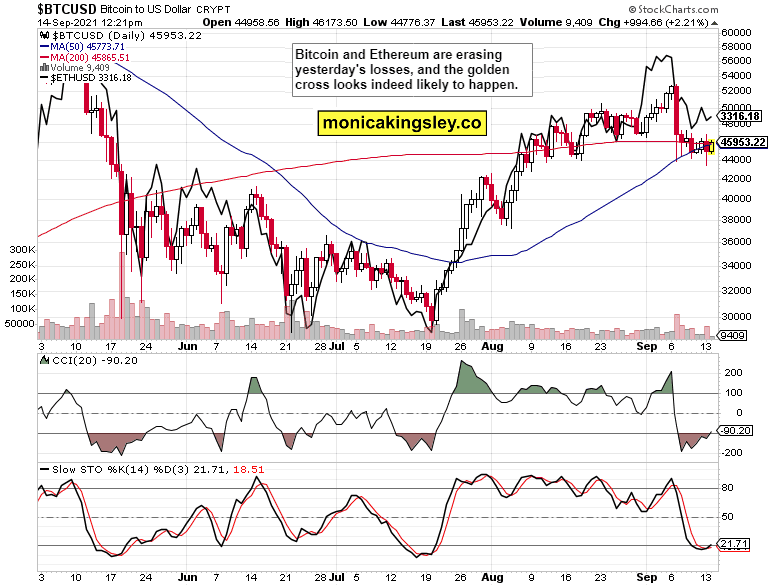

Bitcoin and Ethereum

Bitcoin keeps up the odds of golden cross happening, and Ethereum isn‘t at its weakest either. The crypto bulls can gather strength over the coming sessions.

Summary

Perceptions of cooling down inflation stand ready to support risk taking, and both real assets (including precious metals of course) and stocks, stand to benefit. The dollar would get under renewed pressure, and not even yields moving up, would help reverse its slow but steady decline.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

Updated on