Hey Big Spenders: Americans Run Out Of Money 8.89 Days After Payday, According To New Research

Q3 2021 hedge fund letters, conferences and more

- New research by comparethemarket.com.au uncovers the truth behind America’s spending (and saving) habits

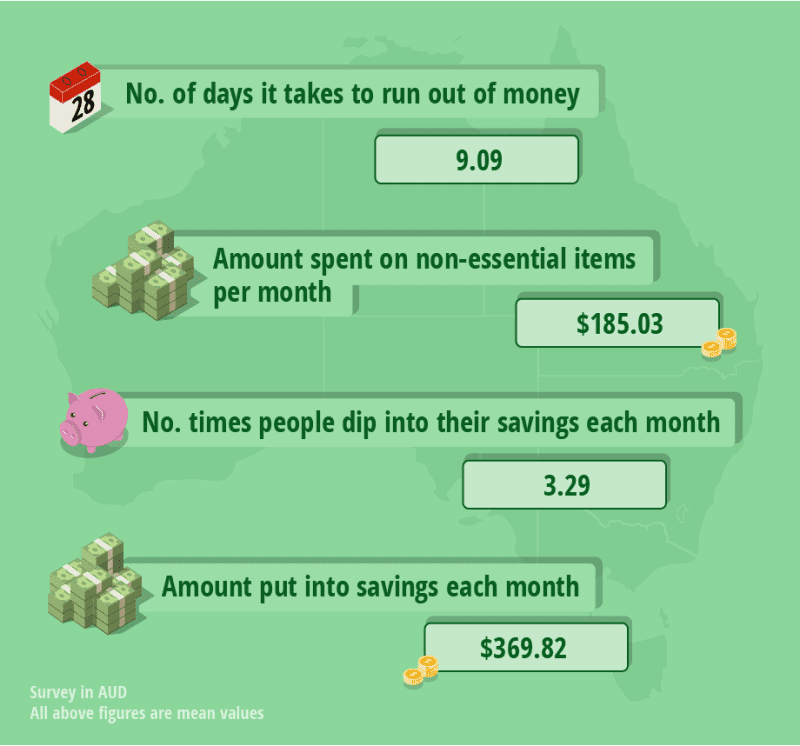

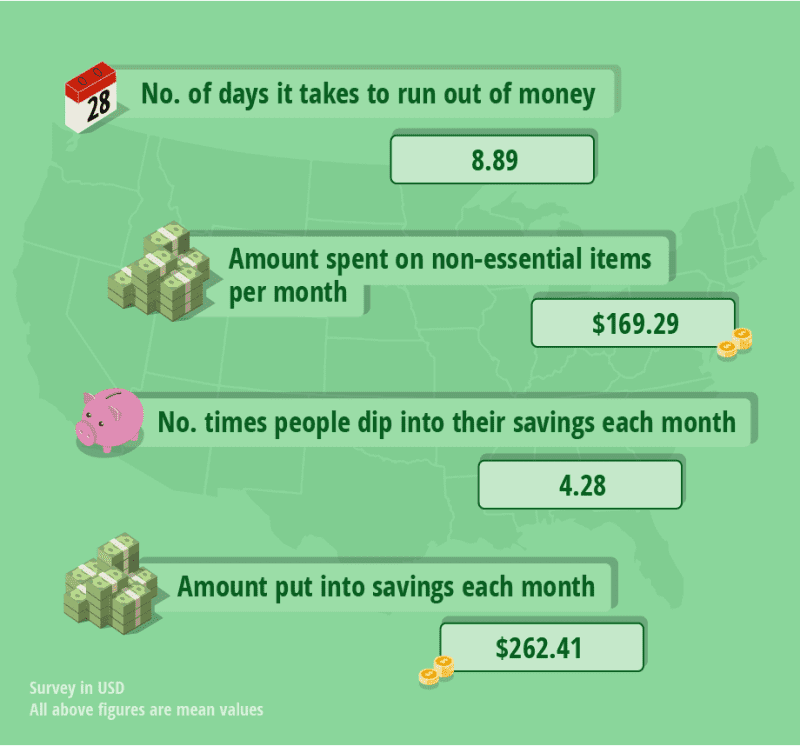

- Surprisingly, it takes 8.89 days for the average American to run out of money after receiving their monthly paycheck, with almost a third (29%) spending their income by day six

- Despite putting an average of US$262.41 into savings each month, residents admit to dipping into their rainy-day fund or relying on credit 4.28 times per month

How Long It Takes Americans To Run Out Of Money

If you find yourself eagerly anticipating payday each month, you’re not alone, as new research by Compare the Market reveals the truth behind Americans’ spending habits, including how long it takes residents to run out of money, how much is spent on non-essential items, the amount set aside for savings, and how often they have to dip into their rainy-day fund or rely on credit.

According to the study, it takes Americans 8.89 days to splurge their monthly wage, with almost a third (29%) spending their income by day six, and over one in six (16%) running out of funds by day three.

When asked about their spending habits in relation to non-essential items, the average spent across the states is reported as US$169.29, although 67% will spend up to US$250. Eating out and takeout is America’s biggest vice for non-essential spending (52%), followed by clothing, shoes, and accessories (35%) and cigarettes, tobacco, or alcohol (23%).

Although Americans put an average of US$262.41 into savings each month, they also admit to dipping into their savings account or relying on credit, 4.28 times per month.

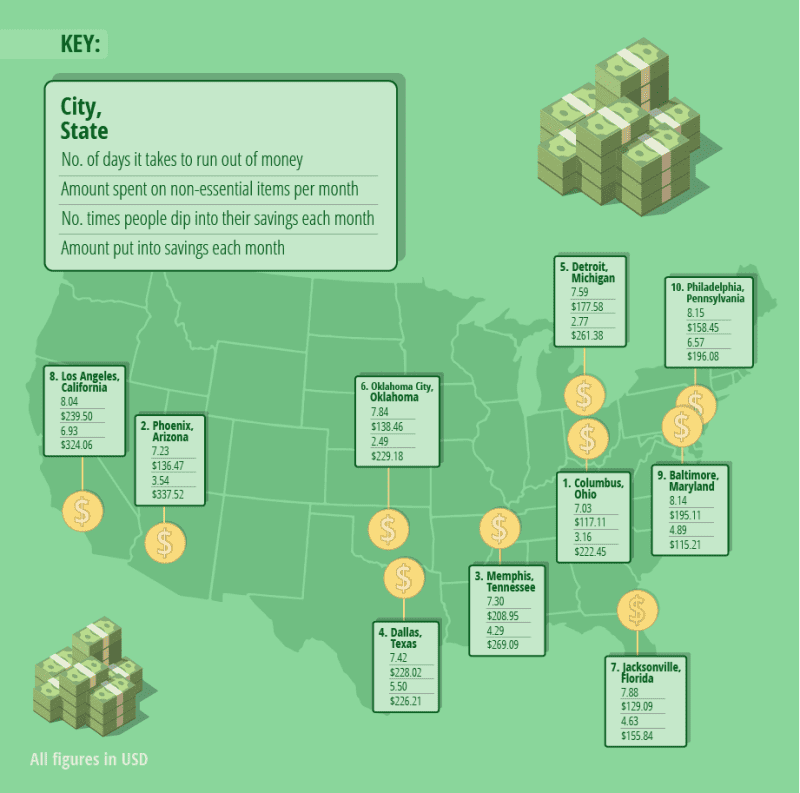

Biggest-Spending Cities

Following the research, America’s biggest-spending cities* are revealed:

Those in Columbus have been ranked as America’s biggest spenders, with residents running out of money 7.03 days after getting their paycheck. Residents spend US$117.11 on non-essential items each month, with one in ten (10%) spending between US$201 - $300.

Phoenix and Memphis make up the top three cities for spending, with residents running out of money 7.23 and 7.30 days after getting paid at the end of the month.

Those in Philadelphia sit just outside of the national average, with residents getting to day 8.15 before running out of funds. With this said, they will dip into their savings 6.57 times, the second highest out of all in the top ten, behind Los Angeles.

Hannah Norton, spokesperson for comparethemarket.com.au concludes: “If it’s within your means, it is important to enjoy spending on non-essential items, however, it’s also wise to save money so you have a fund to rely on should the worst happen. For those that struggle with saving, keeping a record of your incomings vs your outgoings or separating your wants from your needs can be a great place to start.

“Having an income protection policy will also help you pay your mortgage and bills – depending on your policy – if you find yourself unable to work due to illness or injury.”

To find out more about the research, please visit: https://www.comparethemarket.com.au/

About comparethemarket.com.au

comparethemarket.com.au is an online comparison service that takes the hard work out of shopping around. We help Australians to quickly and easily compare and buy insurance, banking, and energy deals from a wide range of providers. Our easy-to-use comparison tool enables consumers to find a product that suits their particular needs. We’re also in the business of helping you find the lowest fuel prices in your area. Our service is entirely free to the consumer, empowering Australians to make informed decisions. We’ve got your back, Simples!

Updated on