When discussing wealth preservation or any form of a conservative hedge, the word gold comes easily to the forefront. The shiny metal has a substantial history of having saved a civilization or two. The lesser obvious choice is silver, but this precious metal is in a unique situation right now that any speculator that seeks out a hedge against inflation should be aware of. Silver, the edge over gold.

Q3 2021 hedge fund letters, conferences and more

It isn’t just a good bet to hedge exuberant market risk right now. It is massively undervalued and, as such, a pristine play in itself.

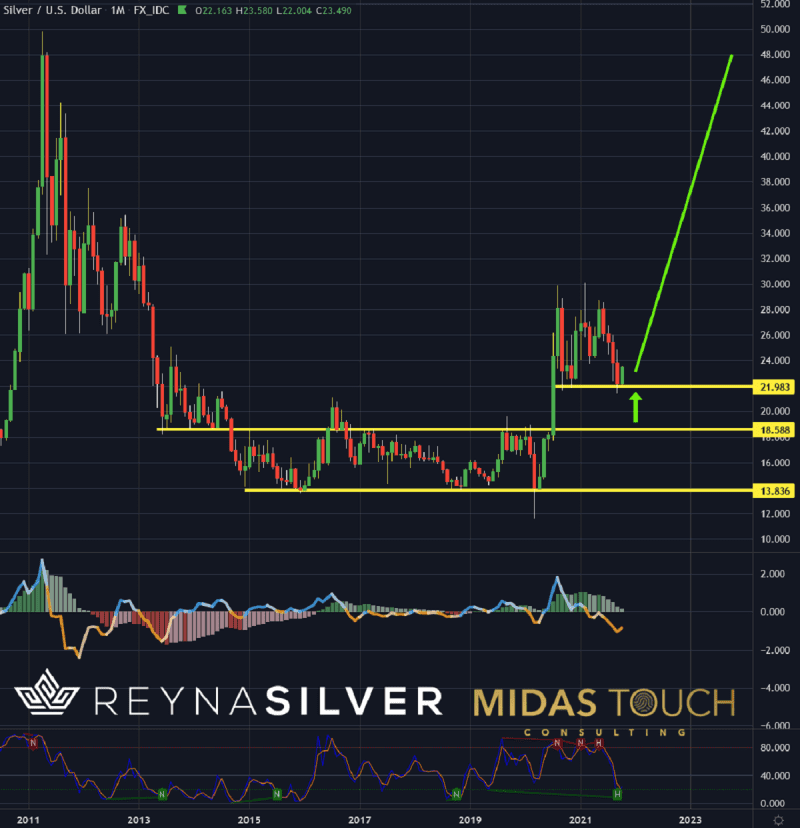

Silver In US-Dollar, Monthly Chart, Still At Average Prices:

Silver in US-Dollar, monthly chart as of October 15th, 2021.

A look at the monthly chart over the last forty years, back to 1980 when the US also was confronted with a crisis, silver prices skyrocketed. Overall, though, prices right now reflect averages like averages of that time.

Gold In US-Dollar, Monthly Chart, Trending Up:

Gold in US-Dollar, monthly chart as of October 15th, 2021.

In comparison to the monthly gold chart, we can see what’s out of whack. Gold since then from its averages at the time has appreciated nearly 300%. We see no fundamental reasons that substantiate such a divergence between the two. With silver being that grossly undervalued, it has tremendous additional potential once it is forced to catch up. This is partially reflected in the stretch between the spot price and the actual value of physical silver that can be acquired. A nearly 20% spread can be seen now for almost two years. It would come as no surprise that a supply shortage might bring fuel to an up move.

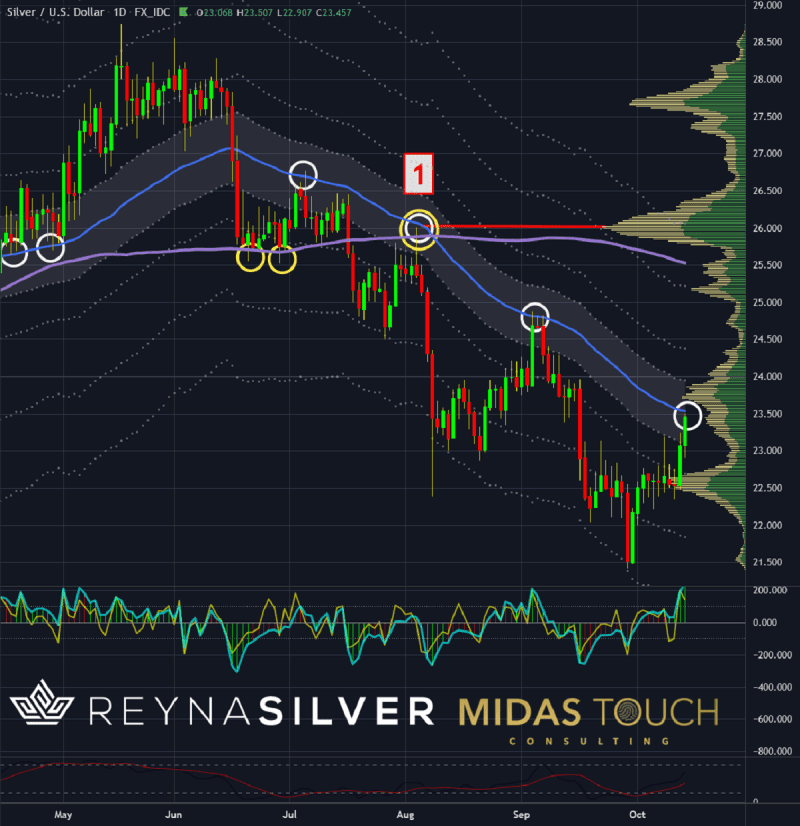

Silver In US-Dollar, Daily Chart, Minimizing Entry Risk:

Silver in US-Dollar, daily chart as of October 15th, 2021.

It isn’t only the long-term profit probability that makes silver attractive. Silver also has an edge from the perspective of execution. Low-risk entries and exits are fundamental elements for high probability win ratios.

We want to share some edges with the reader on how to engage with silver from an execution standpoint.

We picked the daily time frame since daily charts do have a significant position for most market speculators. Daily time frame charts are typically used for smaller time frame position traders as setup time frames. Larger time frame players who have their setups either on weekly or monthly charts still use daily time frames to time their entries to mitigate execution risk.

We circled in the daily chart above two sets of supportive methods on how to find low-risk entries that provide not only higher likely turning points, but a way to set tighter stops than usual.

White circles show how meaningful the “mean” (blue line) is to silver traders. Yellow circles show when the price meets the 200 simple moving average (purple line), another point of interest to traders.

A low-risk entry point marks when multiple edges appear simultaneously like in scenario “one,” a low-risk entry point is located. In our example, a short entry with support from a two-hundred simple moving average, the mean, and a distribution zone defined by a fractal volume analysis (histogram to the right of the chart.)

Silver In US-Dollar, Monthly Chart, Getting Ready:

Silver in US-Dollar, monthly chart as of October 14th, 2021.

From a long-term investment perspective, we would be interested in looking for a daily low-risk entry point once October (very right bar on monthly chart above) closes in the green. In addition, we would like the price to be lower than the October’s candle closing price after the first four trading days of November.

Silver, The Edge Over Gold:

We do not believe in extremes, quite the contrary. While typically diversification means more like throwing stuff against the wall and hoping something sticks, when it comes to wealth preservation, diversification is a good thing. We aren’t living in times to aim to make a killing. Right now, risk control supersedes exuberant market play for profits. We find gold and bitcoin very much suitable to protect your wealth. The steep percentage factor of inflation also warrants for a more aggressive wealth preservation play. That is where silver comes in. Silver with the potential to see triple-digit prices in the near future allows for keeping inflation risk in check.

Feel free to join us in our free Telegram channel for daily real time data and a great community. If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can also subscribe to our free newsletter.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. The views, thoughts and opinions expressed here are the author’s alone. They do not necessarily reflect or represent the views and opinions of Midas Touch Consulting.

Article By Korbinian Koller, Midas Touch

About the Author: Korbinian Koller

Outstanding abstract reasoning ability and ability to think creatively and originally has led over the last 25 years to extract new principles and a unique way to view the markets resulting in a multitude of various time frame systems, generating high hit rates and outstanding risk reward ratios. Over 20 years of coaching traders with heart & passion, assessing complex situations, troubleshoot and solve problems principle based has led to experience and a professional history of success. Skilled natural teacher and exceptional developer of talent.Avid learner guided by a plan with ability to suppress ego and empower students to share ideas and best practices and to apply principle-based technical/conceptual knowledge to maximize efficiency. 25+ year execution experience (50.000+ trades executed) Trading multiple personal accounts (long and short-and combinations of the two). Amazing market feel complementing mechanical systems discipline for precise and extreme low risk entries while objectively seeing the whole picture. Ability to notice and separate emotional responses from the decision-making process and to stand outside oneself and one’s concerns about images in order to function in terms of larger objectives. Developed exit strategies that compensate both for maximizing profits and psychological ease to allow for continuous flow throughout the whole trading day. In depth knowledge of money management strategies with the experience of multiple 6 sigma events in various markets (futures, stocks, commodities, currencies, bonds) embedded in extreme low risk statistical probability models with smooth equity curves and extensive risk management as well as extensive disaster risk allow for my natural capacity for risk-taking.

Updated on