Praetorian Capital’s commentary for the third quarter ended September 31, 2021.

Q3 2021 hedge fund letters, conferences and more

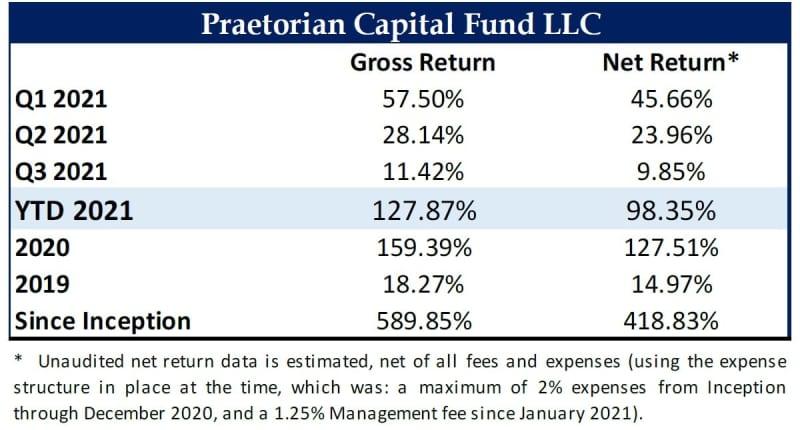

Praetorian Capital's Performance

During the third quarter of 2021, the Praetorian Capital Fund appreciated by 9.85% net of fees. Given the fund’s concentrated portfolio structure and focus on asymmetric opportunities, I anticipate that the fund will be rather volatile from quarter to quarter. During the third quarter, our core portfolio appreciated moderately. Meanwhile, our Event-Driven Book produced a negligibly positive return, which is mostly a reflection of a slow summer in terms of events and reduced overall market volatility.

I would like to caution you that our portfolio has become somewhat lopsided in terms of being exposed to inflation assets, particularly with a focus on energy assets. Partly, this is due to disproportionate appreciation of those assets as a percentage of the portfolio and partly this is a result of what I see as the most attractive opportunity set in the current market. As commodities tend to be more volatile than the overall market, it bears mentioning that this increased exposure is likely to increase the overall volatility of our fund.

In the Q2/2021 letter, I wrote about how ESG along with government misunderstanding of the situation, will create inflation and increased commodity prices. At the same time, there will almost certainly be scary moments along the way for this thesis. These moments will test any investor’s resolve. When in doubt, I will constantly ask myself if these carbon jihadists are focused on accelerating or curing the energy crisis that they are creating—that will be my polar star.

Normally, I’d write a more detailed letter, but most investment topics are rather dull and inconsequential these days. The only two questions in my mind are how badly society will have to suffer from global governments fighting germs and how badly humanity will have to suffer through the coming inflationary crisis. I don’t think anyone can have much visibility into the first issue and I’ve already spoken quite a lot about the second issue. Interestingly, the two themes are somewhat tied together. The key is to be on point in terms of changes in the second derivatives on both narratives. However, given my understanding of human nature, I believe these trends need to dramatically overshoot before logical people push back—at which point I can re-evaluate the situation.

Position Review (Top 5 Position Weightings At Quarter End From Largest To Smallest)

Uranium Basket (Entities Holding Physical Uranium Along With Production And Exploration Companies)

It may take some time still, but I believe that society will eventually settle on nuclear power as a compromise solution for baseload power generation. This will come at a time when there is a deficit of uranium production, compared with growing demand. As aboveground stocks are consumed, uranium prices should appreciate towards the marginal cost of production. Additionally, there is currently an entity named Sprott Physical Uranium Trust (TSE:U.UN) that is aggressively issuing shares through an At-The-Market offering or ATM to purchase uranium (we are long this entity). I believe that these uranium purchases will accelerate the price realization function, by sequestering much of the available above-ground stockpile at a time when utilities have run down their inventories and need substantial purchases to re-stock. The combination of these factors ought to lead to a dramatic increase in the price of uranium as it will take roughly two years for any incremental supply to come online—even if the re-start decision were made today.

We previously owned this entity when it was named Uranium Participation but sold in early 2020 to fund the purchase of equities that had seen their share prices decline due to Covid. Since our sale, I have remained fixated on the uranium market, waiting for a catalyst that would change the price of uranium. I believe that when Sprott launched their ATM, it was such a catalyst, and we purchased the majority of our shares in the first few days after the ATM went live.

As we learned when we owned the Grayscale Bitcoin Trust (OTCMKTS:GBTC), if an entity constantly issues shares to acquire an asset, eventually the free float of that asset becomes restricted and the price responds—often violently. Given the much smaller size of the available supply of uranium and the needs of utilities to maintain a reliable stockpile, I suspect that uranium may overshoot the marginal cost of production—potentially by a wide margin. Or at least, that has been the history of the price of uranium over the past few decades.

While most of our exposure is to physical uranium within the Sprott trust, as it allows us to express this view with reduced risk, we also own a basket of producers along with a few select junior miners. I am well aware that mining is one of the riskiest businesses out there, but the lowest-cost producers have unique advantages, in what is a highly consolidated industry. Thus, despite the obvious risks of owning these businesses, they’re interesting speculations and we own a few of them, while the majority of our investment is in physical uranium.

Energy Services Basket (Positions Not Currently Disclosed)

In 2020 when oil traded below zero, drilling activity ground to a halt and many energy service providers declared bankruptcy. Many of these businesses had teetered on the verge of bankruptcy for years due to reduced demand and over-leveraged balance sheets. The bankruptcies led to consolidation and reduced future industry capacity, removing future competition in the recovery.

With oil prices near multi-year highs, I believe that demand for drilling and other services will recover. While I believe this recovery will be somewhat anemic, we purchased many of these positions at fractions of the equipment’s replacement cost, despite restored balance sheets and positive operating cash flow. As the sector recovers, I believe that this cash flow will become more apparent, and this equipment will trade up to valuations closer to replacement cost.

St. Joe (JOE – USA)

St Joe Co (NYSE:JOE) owns approximately 175,000 acres in the Florida Panhandle. It has been widely known that JOE traded for a tiny fraction of its liquidation value for years, but without a catalyst, it was always perceived to be “dead money.”

Over the past few years, the population of the Panhandle has hit a critical mass where the Panhandle now has a center of gravity that is attracting people who want to live in one of the prettiest places in the country, with zero state income taxes and few of the problems of large cities. This is more than evidenced by the 100% year-over-year growth in Q2/2021 revenue reported by the company.

The oddity of the current disdain for so-called “value investments” is that many of them are growing quite fast. I believe that JOE will grow revenue at 30% to 50% each year for the foreseeable future, with earnings growing at a much faster clip. Meanwhile, I believe the shares trade at a single-digit multiple on Adjusted Funds from Operations (AFFO) looking out to 2024, while substantial asset value is tossed in for free.

Besides the valuation, growth, and high Return on Invested Capital (ROIC) of the business, why else do I like JOE? For starters, land tends to appreciate rapidly during periods of high inflation—particularly an inflationary period where interest rates are suppressed by the Federal Reserve. More importantly, I believe we are about to witness a massive population migration as people with means choose to flee big cities for somewhere peaceful.

I suspect that every convulsion of urban chaos and/or tax-the-rich scheming will launch JOE shares higher and it will ultimately be seen as the way to “play” the stream of very wealthy refugees fleeing for somewhere better.

Newspaper Securities Basket (Positions Not Currently Disclosed)

Most global print newspapers have seen their readership decline for decades as subscribers seek out alternative digital sources of information. In response to this, newspapers have tried to build up their digital presence. Historically, this digital revenue stream was always rather negligible as it was coming from a small base, especially when compared to steep declines from the print side.

Over the past few years, digital revenue growth has accelerated to the point where I expect that the newspaper companies in our basket are within a few years of their digital revenue overtaking their print revenue—assuming recent trends hold. Digital revenue represents a higher margin and higher return on capital business when compared to the capital and manpower intensity of printing and distributing physical newspapers. My belief is that, as these digital businesses come to dominate the revenue stream, newspaper company valuations will re-rate—particularly as many of them trade as if they are dying businesses, when in reality, the digital side of their businesses are growing quite rapidly.

While many well-known global newspapers have successfully made this digital transition and seen earnings growth for a number of years, many smaller papers have continued to see earnings decline. I believe that these smaller papers are now on the cusp of an inflection to earnings growth as digital growth overtakes print declines. Should this happen, I anticipate it will dramatically change the narratives for these companies, along with their valuations, much like what occurred at more well-known papers. The fund owns a global basket of these smaller newspaper companies.

Cornerstone Building Brands (CNR – USA)

Cornerstone Building Brands Inc (NYSE:CNR) is a producer of components for the construction of residential and commercial properties. They make critical components for entry level homes along with multi-family properties. As people continue to leave chaotic cities and high-tax states, they need to go somewhere, and a lot of that new supply must be built from scratch. Cornerstone is a primary beneficiary of this as they supply everything from vinyl windows and aluminum siding to stone façade and gutters. While none of these components are particularly sexy, the company has had strong returns on capital over the past few years—which was also a period when housing demand was somewhat slack. Now that demand is elevated, I suspect that returns on capital will improve from here. We purchased our shares for a low single-digit multiple on free cash flow. While the company is a bit more leveraged than I’d normally prefer, that leverage could dramatically increase our returns should this housing cycle continue for an extended period of time. As cash flow increases and debt gets paid down, I suspect that Cornerstone will look dramatically less leveraged in a few more quarters—which likely leads to a dramatic re-rating of the cash flow multiple.

Conclusion

In summary, during the third quarter of 2021, the fund experienced a positive net return on our capital, despite a rather subdued return from our Event-Driven book. Our exposure is a bit more concentrated in inflation, particularly in energy, than I’d normally expect it to be, but those are also my favorite themes. I also believe we’ve expressed this view through instruments like physical uranium, long dated oil futures and futures options, energy equipment services companies and land plays, which should have a reduced risk of permanent impairment.

Given our moderate overall leverage, I’m actively looking for additional themes to add to our stable of positions, while cognizant that accelerating inflation may create additional volatility.

Sincerely,

Harris Kupperman

Updated on