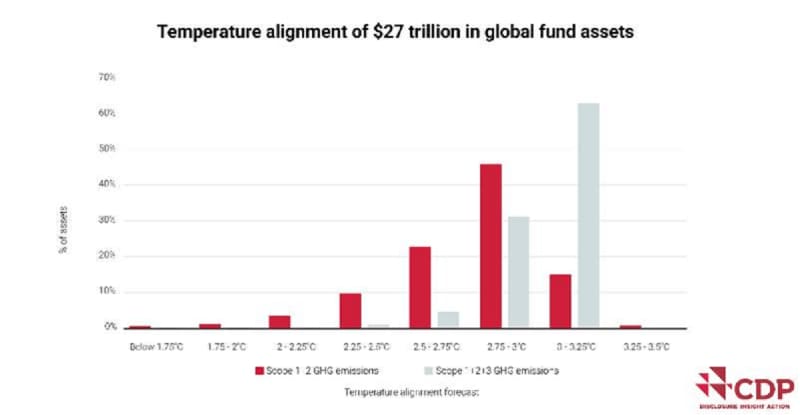

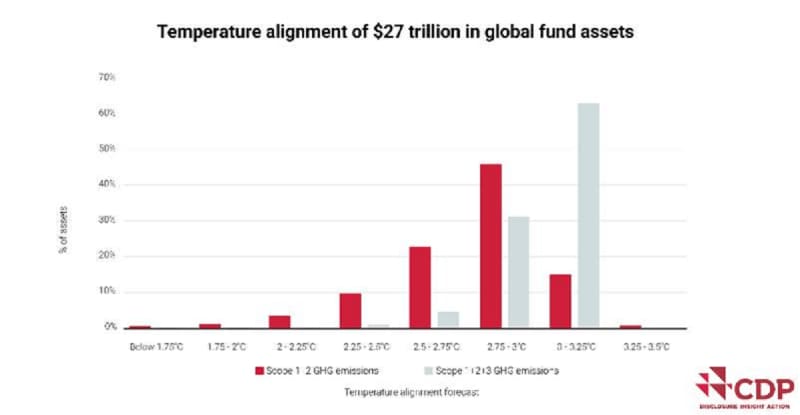

- Analysis of a third of the total global fund industry reveals just 158 funds worth 0.5% of the total assets have a temperature pathway in line with the Paris agreement[1];

Q3 2021 hedge fund letters, conferences and more

- Over 60% of all fund assets exposed as aligned with over 2.75°C of global warming;

- Analysis comes from non-profit charity CDP, which runs the environmental disclosure system and gives temperature scores for companies, funds and stock indices.

Under 0.5% Of The Global Fund Assets Are Aligned With The Paris Agreement

October 27, 2021 (Berlin/London): Analysis of over 16,500 investment funds worth USD $27 trillion has revealed that under 0.5% of the assets are currently aligned with the Paris agreement’s temperature target of ‘well-below 2°C’.

The sobering data from non-profit CDP, which runs the global environmental disclosure system, shows that the vast majority of global funds assessed – worth over $27 trillion – are currently invested in assets with an expected temperature path of over 2.75°C of global warming.

Overall, just 158 individual funds were assessed at ‘well-below 2°C’, while over 8,000 (62% of assets) were temperature scored at above 2.75°C.[2]

102 funds were temperature rated at 1.5°C, the more ambitious goal of the Paris agreement. Climate scientists and the IPCC are clear that this must be the upper limit of global warming if the most catastrophic impacts of climate change are to be mitigated.

The research is based on CDP temperature ratings, which give a science-based temperature pathway for thousands of global companies. Ratings are based on emissions reduction targets and companies’ past performance at reducing emissions.

The 16,500 funds in the analysis have total assets of $27 trillion – over a third of the total global fund industry.[3]

Scope 3 Emissions

When considering Scope 3 emissions – most commonly the use of a company’s products or emissions in the supply chain – the percentage of funds aligned to the Paris agreement drops from 0.5% to just 0.2%, or just 65 individual funds.

The difference in the Scope 3 temperatures reflects the current pace of corporate reporting of their full value chain emissions. Only 15% of companies disclosing to CDP currently disclose any target for these emissions, and targets often exclude the most relevant source – such as use of sold products[4].

The research follows continued strong growth for ESG funds, particularly climate-themed, with over half of all European fund flows in Q1 marked as sustainable, and a strong rise in the number of Paris-aligned funds being launched.[5]

The analysis comes as the world’s attention looks to global leaders at both the G20 in Italy and COP26 in Glasgow to increase the ambition and pace of climate action. The IPCC earlier this year issued a ‘code red’ for humanity, should emissions not urgently reduce.

An Urgent Reality Check

Laurent Babikian, Global Director Capital Markets at CDP, commented:

“Global leaders land this week in Rome for the G20 and in Glasgow for COP26, where ensuring 1.5°C is achievable and global climate finance mobilized are two key objectives. But this data is catastrophic. Despite mounting net-zero commitments from the financial sector, and an apparent ESG ‘boom’, the truth is that not even 1% of fund assets are currently Paris-aligned. This is like an x-ray on the industry, exposing almost all assets on the planet to be out of step with climate objectives. It’s an urgent reality check for real, credible actions now from the financial community to step up engagement with their portfolios and take decisive action to transition their portfolios onto a 1.5°C path.

The fund market reflects the real economy. Though growing fast, science-based emissions targets still cover only a tiny fraction of the investable market. Vast volumes of global capital now need to move to be 1.5° C -aligned, but can’t because the corporate sector ambition is too low. We must see that COP26 drives much faster adoption of 2030 targets in line with 1.5°C, and many more financial products which are actually Paris-aligned. Collaboration and engagement are key: investors and lenders must engage all companies in their portfolios to set science-based targets now.”

Last month, over 220 financial institutions with $29 trillion in assets publicly called on 1600+ high-impact companies worldwide to set 1.5°C emissions targets. The group of financial institutions taking part in CDP’s Science-Based Targets campaign included some of the world’s biggest, like Allianz, Amundi, Credit Agricole, Legal & General Investment Management, Insight Investment Management and Manulife.

Following last year's campaign, 8.1% of the high-impact companies targeted joined the Science Based Targets initiative, highlighting the power of investor engagement to drive corporate ambition and increase the universe of Paris-aligned companies.[6]

Methodology & data sources

The public CDP-WWF Temperature Ratings methodology was used to assess all corporate GHG reduction targets disclosed to CDP in 2020 for their temperature alignment. In addition, the temperature alignment of science-based targets (SBTs) and, where applicable, companies’ past emissions performance were considered. For all companies without CDP disclosed targets or insufficient disclosures of past GHG emissions, a default temperature score of 3.2°C was applied.

The company temperature scores were aggregated at the fund portfolio level using a financed emissions weighting approach, meaning that each portfolio constituent’s individual temperature score was weighted by its portfolio share of financed emissions.

GHG inventory and target data reported by companies to CDP as well as modelled GHG emissions data was used in this calculation. The source of fund holdings and asset information was FE fund info. The latest available full portfolio constituents of each fund were analysed, provided they were not older than 12 months and at least 60% of the portfolio value had a temperature score (the average portfolio coverage ratio was 86%)

About CDP

CDP is a global non-profit that runs the world’s environmental disclosure system for companies, cities, states and regions. Founded in 2000 and working with more than 590 investors with over $110 trillion in assets, CDP pioneered using capital markets and corporate procurement to motivate companies to disclose their environmental impacts, and to reduce greenhouse gas emissions, safeguard water resources and protect forests. Over 14,000 organizations around the world disclosed data through CDP in 2021, including more than 13,000 companies worth over 64% of global market capitalization, and over 1,100 cities, states and regions. Fully TCFD aligned, CDP holds the largest environmental database in the world, and CDP scores are widely used to drive investment and procurement decisions towards a zero carbon, sustainable and resilient economy. CDP is a founding member of the Science Based Targets initiative, We Mean Business Coalition, The Investor Agenda and the Net Zero Asset Managers initiative. Visit cdp.net or follow us @CDP to find out more.

[1] Based on Scope 1 + 2 emissions.

[2] Temperature ratings as of October 2021

[3] Source: EFAMA, sample covers 38% of the total net assets of regulated open-ended funds. The fund sample is comprised of open-end funds (incl. ETFs) domiciled in Europe, US and Asia investing in public equities and corporate bonds globally. Data as of April/May 2021.

[4]Source: CDP / AbsolutImpact 03/2021.

[5] Source: MorningStar