Arquitos Capital Management commentary for the third quarter ended September 2021, discussing their position in St Joe Co (NYSE:JOE).

Q3 2021 hedge fund letters, conferences and more

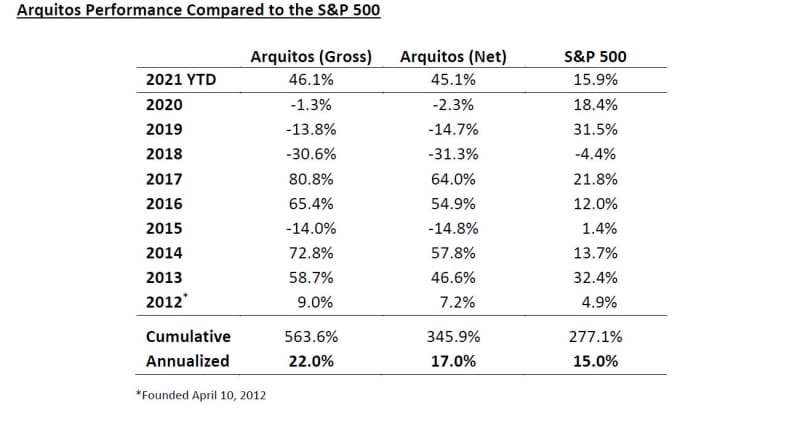

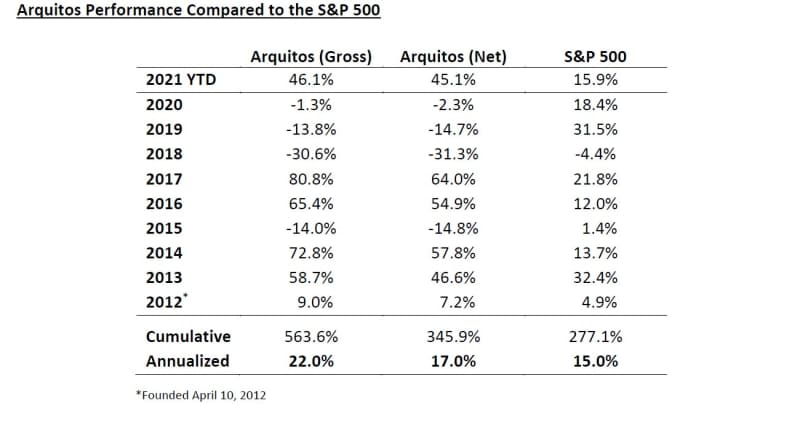

Arquitos Capital Management Perforamnce

Dear Partner:

Arquitos returned -4.1% net of fees in the third quarter of 2021, bringing the year-to-date return to 45.1%.

Making macro predictions is a difficult game to play. My view has always been to choose companies from a fundamental perspective, bottom-up, but look to the macro environment as a risk-control measure. There are times, however, when a macro view can be used to go on offense, as long as it is understood that there is a measurable chance that your view ends up being wrong.

Offense for me means investing in companies that are reasonably priced now, that have downside protection in any environment, and that have asymmetric upside if the macro forces align. Today, the issue to watch is inflation. On the one extreme, Jack Dorsey from Twitter recently said we were in store for hyperinflation. That term is overwrought. Hyperinflation does not happen without war, famine, etc. Hyperinflation is Venezuela and Zimbabwe, not the United States in the 1970s.

On the other extreme is the view that recent price increases are simply transitory in nature and will go away once the environment normalizes from COVID. This view does not seem realistic to me either but, again, any macro view requires a hedging of the bet.

Ironically, the best way to play inflation is to choose companies and industries that have pricing power, where revenues increase disproportionately to expenses, and where management is aligned with shareholders. That last point is key, because you need that excess cash generation to come to you as a shareholder and not be siphoned off by management.

A company with the three characteristics I just mentioned should do well in any environment. They will do especially well in an inflationary environment.

St Joe

So what does that mean for the portfolio? We have two real estate positions that fit this mold—one in the United Kingdom and one in the Florida Panhandle. I’d like to take a few minutes to discuss one of these positions, The St Joe Co (NYSE:JOE), which owns land in the Panama City area of Florida.

The foundation of my investment philosophy is seeking alignment of interests with the companies in which we are invested. What is the use of generating excess cash flow if that cash does not, at some point, make its way back to the owners of the company? In St. Joe, we have that alignment from their chairman (who is a major shareholder personally and through his fund) and from the CEO.

The company has also quietly been a cannibal over the last six years, reducing the number of shares outstanding by 36%. I expect those buybacks to increase as their cash flow generation continues to increase and we get a little further away from the uncertainty from COVID.

St. Joe owns 171,000 acres of land in Northwest Florida, the legal rights to develop more than 170,000 residential units, more than 22 million square feet of retail, commercial, and industrial space, and more than 3,000 hotel rooms as part of the Bay-Walton Sector Plan.

The primary driver of cash flows is their residential part of the business. They have a goal to sell 1,000 residential lots per year with some estimating that they can increase that number to 2,000 lots per year in the next five years. In 2020, the average revenue per homesite sold was $124,000. They get 60% gross margins on that. It has been even higher so far in 2021.

This is where a view on higher inflation can make the St. Joe case very interesting. They own 100 years’ worth of land, so expenses would remain somewhat constant while revenue would skyrocket. The other areas of their business—apartment and senior living units, commercial, hotel rooms, etc.—would also benefit from inflation.

Of course, we don’t want to overlook the migration patterns to Florida from states where taxes and living expenses are higher.

Our average entry price is $44 per share. We can see significant appreciation from that level if they continue to execute, inflation or no inflation. I view this holding as a multi-year position. Day-to-day stock movements should be ignored.

I have been impressed with St. Joe’s CEO, Jorge Gonzalez. In 2019, he and the company introduced a strategic plan presenting certain milestones for 2021. They are on track to handily beat each of the milestones in each of the five categories. He recently commented that, “We believe that we have only started to scratch the surface of our region’s potential as it is poised for multi-generational growth.”

St. Joe is in the early stages of dramatic cash generation growth. We have a long runway here and a significant multi-bagger opportunity. If elevated inflation ends up being more than transitory, this position could be a grand slam. And if inflation comes back down, the company will still do well.

Thank you for your continued commitment to Arquitos. I look forward to reporting back at the end of the year.

Best regards,

Steven L. Kiel

Updated on