Brandywine Asset Management commentary for the month ended October 2021, titled, “Glory Days with 60/40.”

Q3 2021 hedge fund letters, conferences and more

A “Smarter 60/40”

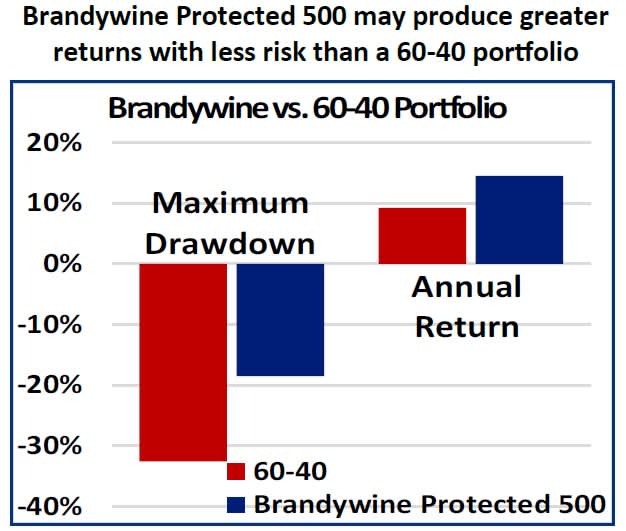

For the past 40 years the 60% stocks/40% bonds portfolio produced impressive performance, with returns over 9% and a maximum loss that was 1/3 less than that of the S&P 500.

But during those 40 years, the cyclically-adjusted price/earnings ratio (“CAPE”) for the S&P 500 swelled from 7.8 to more than 38 today. Similarly, the 10-year U.S. treasury note yield collapsed from its peak at over 15% in 1981 to just 1.6% today.

So it’s clear that the opportunity for a 60/40 portfolio to produce those same historical returns is now long gone. In fact, adding bonds to a portfolio today is the epitome of risk. Doing so locks in a real loss of more than 3% per year (the interest paid on the bonds minus the rate of inflation). Furthermore, one recent study by Blackrock projects future returns from 60/40 at just 3.5%. We at Brandywine have prepared a white paper that shows a return expectation of less than 2% throughout the remainder of the 2020s. Fortunately, there is a smarter way to 60/40.

The Innovation of “Risk Replacement”

Let’s start by laying out the original purpose of the 60/40 portfolio – to reduce risk and improve risk-adjusted returns by:

- Reducing the exposure to high-risk equities and

- Adding exposure to a lower-risk, non-correlated asset – bonds

There is a new way to accomplish this today while improving on the old 60/40. It is comprised of three components:

- Maintain 100% equity exposure

- Offset risk, not by reducing stock exposure and allocating to bonds, but instead by purchasing put options.

- Pay for the puts with a less risky “Return Driver Diversifier”.

This describes Brandywine’s innovation of “Risk Replacement.” Its not only better than what 60/40 is expected to do today, but even improves on the historically strong performance of the “old” 60/40. This is illustrated in the chart to the upper right.

We encourage you to contact us to learn how we can apply this innovation to benefit you and your clients.

- Watch our 3-minute video to learn how Brandywine Protected 500 provides you with a “smarter 60-40”

- Book a meeting to get started . . .

We look forward to talking with you soon.

Mike Dever, CFP & Rob Proctor, CFA

Updated on