WASHINGTON – US markets continued to flounder Thursday in light, uneven trading action. That’s courtesy of today’s oft-neglected Veterans Day holiday. But it also reflects a major inflationary influence on stocks, bonds, groceries and your price at the pump. Natural forces? Nope. It’s all Bidenomics 101. This time, courtesy of President Brandon’s Biden’s middle-class destroying “energy policy.” As in pipeline shutdowns, etc.

Hate what’s going on in your family budget and your 401(k) portfolio? Just remember before listening to and believing MSNBC’s latest anti-Trump blatherings. Want to know who’s behind today’s budget and stock market woes? Biden did it. So the investment pendulum might be swinging — the wrong way — yet again.

Bidenomics 101: The pipeline shutdowns and fracking bans part…

Apparently dictated by the ignorant blatherings of the likes of AOC and Saint Greta Thunberg, two of Slow Joe’s earliest and nastiest anti-US maneuvers upon assuming office (under dubious circumstances) was to halt or roll back President Trump’s wildly successful oil exploration and production initiatives.

Biden quickly halted all previously approved oil and gas drilling and exploration activities in the US, including the off-again, on-again activities in northern Alaska, which both that state and the US in general desperately needs. Worse, he unilaterally eliminated the Trump Era agreement with Canada to proceed with finishing the equally ill-fated Keystone XL pipeline.

Now Biden, aided and abetted by Michigan’s evil Democrat Governator and Wicked Witch of the MidWest, Gretchen Whitmer, is attempting to shut down Michigan’s only direct access to Canadian energy: A long-existing pipeline that tunnels under the Straits of Mackinac. The company that owns and operates this long-existing pipeline long ago agreed it needed updating years ago, and it reading to re-do this vital energy connection better and safer. But both Whitmer and Biden would rather just close this down and increase oil and gas prices by an estimated ten-fold for already economically beleaguered Michganders. Particularly in the state’s more densely populated Lower Peninsula. How bright is that?

Bidenomics 101: The real reason behind fossil fuel hatred. And hatred of the middle and working classes

The object, of course, is – like Barack Obama’s instant destruction of coal and coal-fired power generation – to price much cheaper and more manageable fossil fuel power generation so ruinously high that middle and lower class consumers would begin to clamor for wind and solar power energy that they could not afford without, of course, generous taxpayer subsidies to those essentially money-losing operations. The profits of which, of course, would go to politicians already heavily and personally invested in these businesses along with the oligarchs who own the businesses and who pay for re-electing their wholly owned politicians. It’s all part of the global warming climate change hoax threat, wouldn’t you know. Help save our planet. Choose poverty and oblivion.

This, the greatest piece of economic asininity in human history would (and already is) behind the greatest ongoing transfer of middle-class and working-class wealth to the wealthy in human history. But never mind, this inconvenient truth doesn’t track with the Democrats’, the globalists’ or the media propagandists’ utterly false narrative. To bad for the rest of us.

We’re already seeing the results of this genuinely nefarious gangland-style extortion racket in our rapidly declining standard of living. Consumers see this every time they head off to the grocery store. Or fill their gas tanks.

The inflation part of Bidenomics 101

This, in turn, is causing the massive inflation in US prices in nearly everything. And this is what caused yesterday’s nasty decline in the prices of your average stock holding Wednesday. Markets are attempting to gain some equilibrium Thursday in unconvincing trading activity. But much more of this, particularly any cut-off of that Michigan pipeline, and you can kiss a warm and generous family Christmas celebration goodbye for 2021. And perhaps for many years to come.

Personally, I wouldn’t be surprised to see those always-devious Michigan and Washington-based Democrat political operatives hold off that pipeline “ruling” until after the holidays. Just to limit the howling and screaming from a growing constituency of voters already aware of this administration’s many, many scams. But we’ll wait and see.

In the meantime, the relentless price increases, Covid “vax mandate” and other predations on the American way of life continue.

The price of crude – a simple measure of supply and demand – continues to creep upward. Anyone miss President Trump’s energy policies yet?

Technical analysis backs up our worries over current stock market action

California-based Carl Swenlin, technical analyst extraordinaire and longtime owner-operator of DecisionPoint (which now divides its time between its own site and Stockcharts.com in an arrangement I can’t quite figure out) has some purely chart-driven observations on the likely price of crude in the months ahead. And it’s not an encouraging one.

“Earlier this week I filled my gas tank at a cost of $4.65 per gallon, up $0.25 from the last fill-up. That’s the way it is in Redlands, California, and it got me to wondering how high prices might go. That, of course, depends mostly upon crude oil prices. Let’s look at WTIC (West Texas Intermediate Crude). From the pandemic low of 6.50/bbl it has advanced to 85.00/bbl, so it is certainly moving higher at a rapid pace; however, this time frame is too short to project future upside potential…

“As the Biden administration considers closing a second pipeline, price has already broken through the resistance line drawn across the 2018 top, and has reached a new high of 85/bbl. The next clear line of resistance is at 110/bbl, and I think that level is well within reach after a period of consolidation. In more normal times I might see 110 as the probable top of the range, but now I’m not so sure. Whether or not a run to 147 is possible remains to be seen, but with no reasonable actions being taken to curb raging inflation, it is not out of the question. [See chart directly below, via Stockcharts.com. – Ed.]

The tale of West Texas Crude. Oil prices soar, courtesy of Bidenomics 101. Chart from Carl Swenlin and DecisionPoint, via Stockcharts.com. (See link in article.)

And the final pitch of today’s Bidenomics 101 lesson…

“CONCLUSION: The long range chart gives us an idea of where the price of crude oil might go, based upon where it has already been. Unfortunately, the extreme volatility of last 20 years is likely to be the model for the foreseeable future.”

For an additional useful historical chart and further explanation, click on the link above.

Investors and voters must strongly consider replacing all Democrats and Rinos they can target in 2022’s Congressional elections. And they need to do this regardless of their traditional political orientations. Otherwise, the ongoing attack on you and your family’s income and way of life could proceed too far. And it could entrench itself too thoroughly for us to turn it back. As for the alternative? You’re enjoying the early innings of it right now.

BTW, buy your Thanksgiving turkey and trimmings right now. There’s that Biden-Covid-induced supply chain disaster to worry about as well. But that’s the topic for another article.

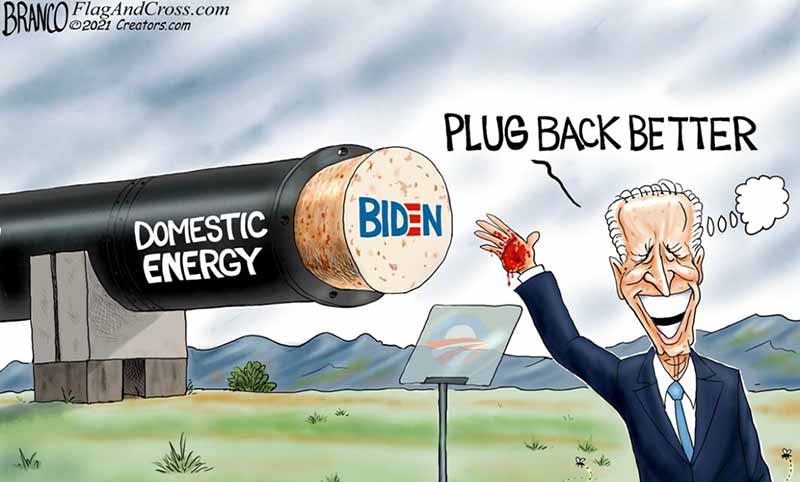

Headline image link: Cartoon by Branco. Reproduced with permission and by arrangement with Comically Incorrect. Resized to fit CDN format.