In hisDaily Market Notes report to investors, while commenting on Ford entering the semiconductor chip business, Louis Navellier wrote:

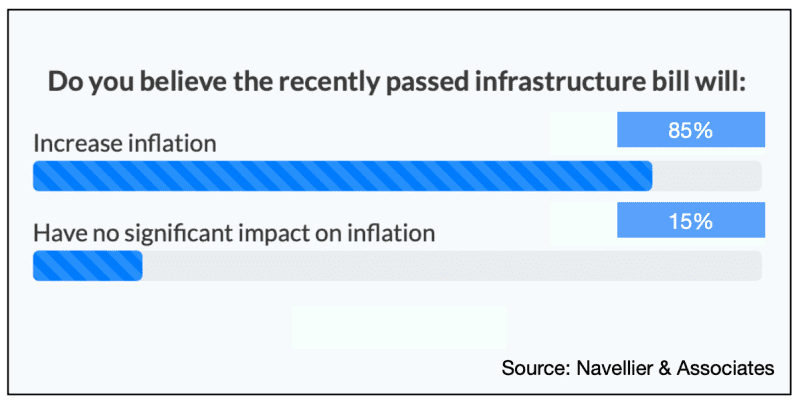

Infrastructure Bill Will Increase Inflation

Our survey this week revealed that 85% of retail investors believe that the recently passed infrastructure bill will increase inflation. One respondent called it “throwing gas on a fire.”

The poor and middle class are increasingly frustrated every time they go to the gas station or the grocery store. Due to a turkey shortage, many Americans are going to be eating chicken for Thanksgiving, but the price of chicken has risen as well. It will be interesting how long consumers will tolerate inflation eroding their wealth. If inflation is indeed “transitory,” it’s not transitory enough.

Ford is Getting Into The Semiconductor Chip Business

Ford Motor Company (NYSE:F)’s CEO, Jim Farley, on Thursday tweeted that he expects Ford will be producing EVs at an annual rate of 600,000 by the end of 2023. Farley also said that Ford aims ‘to become the second bigger EV producer within the next couple years.” Finally, Farley concluded by saying “Then as the huge investments we’re making in EV and battery manufacturing come onstream and we rapidly expand our EV lineup, our ambition is for Ford to become the biggest EV maker in the world.”

I should add that Ford is following Apple Inc (NASDAQ:AAPL) and getting into the semiconductor chip business. Specifically, Ford entered into a strategic agreement with GlobalFoundries to develop semiconductor chips. This pact may also lead to Ford producing semiconductor chips. Vehicles are increasingly computerized, especially electric vehicles, so other auto manufacturers may follow Ford into the semiconductor chip business to better design their vehicles as well as to alleviate current semiconductor chip shortages.

Coal Reactivated

Natural gas prices surged again this week with the German regulatory delays of Russia’s Nord Stream 2 pipeline, so electricity producers in Europe are now operating coal plants at near-record capacity. Poland’s electricity is largely coal-fired and Poland exports electricity to other countries in central and eastern Europe. Furthermore, idle coal plants in Portugal and Spain have been ”reactivated” due to high natural gas prices. Politicians do not want to raise electric prices too quickly, so the resurgence of coal in Europe is a bit ironic and obviously counter to everything politicians were saying at COP26.

The Climate & Freedom Symposium, which was going on at the same time as COP26, concluded that “markets will solve the climate crisis.” This is a very true and profound statement. Governments can provide carbon incentives, but the private sector and free markets usually provide the best, most cost-effective solutions.

Companies we recommend, like Enphase Energy Inc (NASDAQ:ENPH) and Generac Holdings Inc. (NYSE:GNRC) are already helping to provide backup electricity solutions and decentralize the electric grids. We believe that entrepreneurs and innovative companies like Enphase Energy and Generac hold the key to fulfilling climate change goals.

Navellier & Associates owns Enphase Energy, Inc. (ENPH), and Generac Holdings (GNRC), in managed accounts. Louis Navellier and his family personally own Enphase Energy, Inc. (ENPH) and Generac Holdings (GNRC), via a Navellier managed account.

Heard & Notable

Volcano scientists issued an alert Wednesday, warning that a layer of ash from the powerful 1912 eruption of volcano Novarupta, is being whipped up by winds and is headed toward Kodiak Island. An aviation alert to aircraft was issued. Source: AP News

Updated on