What’s New in Activism – Daily Mail Takeover

Two large shareholders in Daily Mail and General Trust PLC (LON:DMGT) expressed their opposition to a take-private bid by Lord Rothermere.

Q3 2021 hedge fund letters, conferences and more

JO Hambro Capital Management said on November 26 that it was "underwhelmed and unconvinced" by the takeover proposal. A family investment vehicle controlled by Jonathan Harmsworth, Lord Rothermere, made an offer to buy out the Daily Mail for 2.9 billion pounds, including a special dividend and cash returns from the sale of the insurance business and the listing of Cazoo. The media group’s independent board recommended in favor of the offer.

Majedie Asset Management has also called on shareholders not to tender their shares. The offer "is substantially below what we believe is a fair and reasonable valuation," Majedie U.K. income fund manager Chris Field said in an emailed statement to Bloomberg.

To complete, the deal needs the support of 90% of Daily Mail Class A shareholders, excluding the 30.3% stake owned by Lord Rothermere. However, Lord Rothermere can lower this threshold to 50%, which would allow him to delist the company and give the opposing shareholders shares in the private firm.

To arrange an online demo of Activist Insight Online, send us an email.

Activism chart of the week

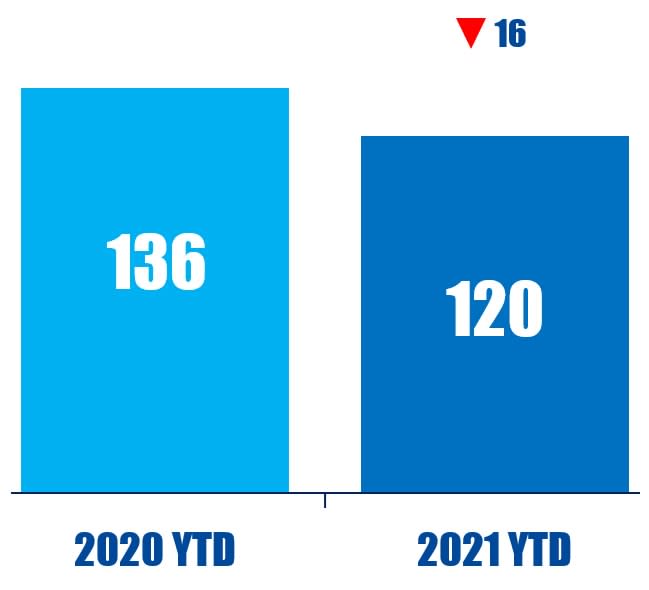

So far this year (as of November 25, 2021), globally, 120 investors who disclose activism as part of their investment strategy have publicly subjected at least one company to activist demands. That is compared to 136 in the same period last year.

Source: Activist Insight Online

What’s New in Proxy Voting - EE0-1 Survey Disclosures

More than 60 investors, representing $956 billion in assets under management and coordinated by Boston Trust Walden, sent a letter to Securities and Exchange Commission (SEC) Chair Gary Gensler on November 25, urging the U.S. regulator to make EE0-1 survey disclosure mandatory.

Investors argued that disclosure of EE0-1 surveys, corporate forms detailing the gender, racial, and ethnic composition of employees, are critical to providing investors with "consistent, comparable, and decision-useful data on U.S. workforce demographics."

Companies that have at least 100 employees currently file EE0-1 surveys to the U.S. Equal Employment Opportunity Commission. Making these surveys available to investors is easy and comes at "virtually no additional cost" to companies, according to the signatories, which included Friends Fiduciary, Majority Action, and the California Public Employees' Retirement System (CalPERS).

"The extraordinary context of the pandemic, together with the ongoing national debate over persistent, unequal treatment of people of color, have given rise to countless corporate statements and commitments to improve human capital management," the letter reads.

To arrange an online demo of Proxy Insight Online, send us an email.

Proxy chart of the week

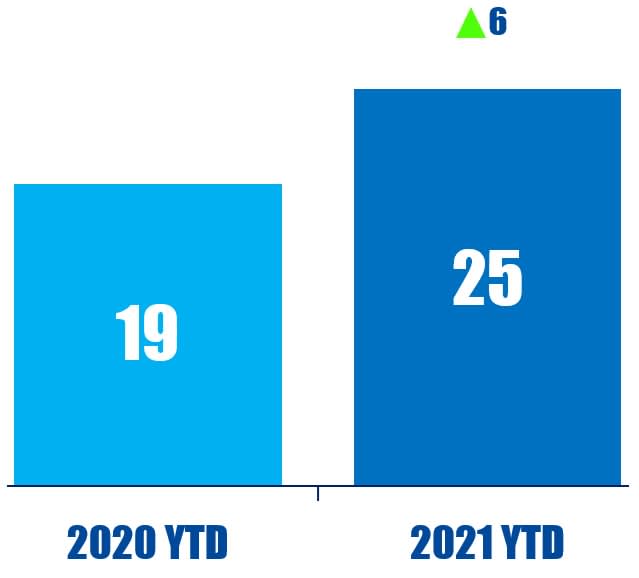

So far this year (as of November 24, 2021), globally, 25 shareholder proposals on environmental issues have gone to a vote at energy companies. That is up from 19 in the same period last year.

Source: Proxy Insight Online

What’s New in Activist Shorts - Standard Lithium Fights Back

Lithium development company Standard Lithium Ltd (NYMARKET:SLI) accused Blue Orca of publishing a "false and misleading" report that resulted in the company's share price falling 10% on November 22.

In a Friday statement, Standard Lithium said there were "numerous important inaccuracies and misunderstandings" in the short report.

In a Monday tweet, Blue Orca said Standard Lithium's response "does not address our investment thesis or the independent data in any meaningful way."

Last week, Blue Orca Capital alleged that Standard Lithium had inflated lithium extraction rate numbers, adding that the technology used by the company "is neither economically viable nor scalable."

The short seller called the company's valuation of $1.46 billion "absurd," noting it "rests solely on the viability on its demonstration plant" in Arkansas. Standard Lithium said the report misunderstands "the necessity and purpose" of its demonstration plant and stated that the company is "confident in its lithium extraction technology and [plant]."

To arrange an online demo of Activist Insight Shorts, send us an email.

Shorts Chart Of The Week

So far this year (as of November 26, 2021), 26 public activist short campaigns have alleged stock promotion against the company. That is down from 33 in the same period last year.

Source: Activist Insight Shorts

Quote Of The Week

This week's quote comes from a long-term shareholder in Toshiba, who declined to be named, as part of our in-depth article on the shareholders unhappy with the company's breakup plan.

“In their disclosure and subsequent investor Q&A, they confirmed that they never requested the private equity firms to indicate a price nor did they create any competitive dynamic. Why did they not do such a simple thing unless the strategic review precluded from day one the possibility of a privatization?” – Long-term shareholder in Toshiba

Updated on