WASHINGTON – Stock market traders and investors continue to experience a bizarre “on again, off again” week. Wall Street traders and investors seem determined to keep US stocks veering precariously between euphoria and panic. Thursday’s trading action once again had US markets attempting a comeback. But during the predictable Friday fizzle, the obsession was always Covid, as it has been all week. So traders decided to resume this past week’s generalized dump-a-thon.

That said, the Dow moved close to breakeven at the 4 p.m. ET closing bell. But it didn’t quite make it into the green.

Whatever we may think, it’s always Covid

At least partly at fault for getting a miserable start to December instead of a Santa Claus Rally? The media-chosen meme this week is, of course: Covid. Rinse, repeat. This time, the government bureaucracy and the Biden Interregnum have tag-teamed with the media to obsess on the dreaded Omicron variant. The game has become exceedingly tiresome at this point, but it’s all the government-media-oligarch combine has left to keep the masses at bay. It sure managed to clobber stocks nonetheless, though many investors were already looking for an excuse to sell.

It’s telling that the media, in particular, has already forgotten about the dreaded Delta variant. Pin that at least in part to Mr Science, aka Dr Fauci. America’s co-president apparent decided that in Delta’s stead, we can now obsess about an exciting new variant without skipping a beat. The Omicron flavor-of-the-month boasts 57 tasty ways to mess with your cells’ DNA strands. (Or something like that.) Scary Movie! Mask up, folks!

Unfortunately for the oleaginous Fauci and his non-mask wearing, panic-stricken cohorts, every reported Omicron case thus far proved a major headline bust. At least two of those afflicted were already vaxxed individuals. Oops. More reported “cases” (not deaths) seem to indicated that the Omicron variant is about as scary as its cousin, the common cold. In other words, this variant allegedly can spread like hell. To everyone, including the already vaxxed populace, wouldn’t you know? Which once again, BTW, proves that the so-called mostly work to prevent serious cases of Covid but not mild ones. Which also seems to mean that the vaxxed populace can still carry (and presumably spread) the virus. Weird, eh?

The real reason behind this week’s instant “always Covid” narrative and the Friday fizzle

Bottom line, this “scary” variant actually doesn’t seem to do much. Even better, it clears rather quickly. The Deep State and its allies will have to work hard to ruin Americans’ second Christmas in a row. But they’re trying very hard to do just that, having already extended “mask mandates” on commercial travelers to March 2022. That’ll work.

Nonetheless, the media instantly decided to begin resolutely ramping up its next Covid terror campaign. The Rittenhouse “outrage” has already left the front pages, and the media isn’t much interested in the Waukesha massacre either. Probably because its alleged perp doesn’t help “the Narrative.” Only continuing Covid terrorism has a chance of getting many state legislators to re-up and amp up the ruinous mail-in voting fraud regimes that destroyed Election 2020. .

The near-instantaneous Omicron panic narrative clearly marks the latest media-Deep State attempt to scare Amerikkka into allowing extensions of the mail-in ballot fraud that “fortified” 2020’s election results, according to Time magazine. That worked so well in 2020 that many on the left see it as the only way at this point that the Democrats can have even an iceberg’s chance of keeping control of Congress next fall.

Always Covid and this week’s unpleasant Friday fizzle

So what does this Covid rant have to do with stocks? Or this week’s depressing Friday fizzle? Everything. Look at the McClellan Oscillator chart below, as of COB Wednesday, December 1. Wednesday’s nasty market crash (blue circle) came close to equaling this spring’s 2021 low, viewed toward the left of this chart, circa July 19. The Thursday bounce (seen in our second chart) that followed this spectacular market nosedive made almost inevitable. (Lower right on the chart.) The Oscillator remains our favorite way of predicting market bounces from extreme overbought or extreme oversold situations. (This week, we got the “extreme oversold” flavor.)

McClellan Oscillator, COB Wednesday, December 1, 2021. Second crash this week. Courtesy Stockcharts.com.

The chart above also illustrates the hit stocks took at the beginning of the week. Aside from oil price weakness, the big Monday hit on US stocks largely resulted from the new Omicron terror attack. This crapped up the start of even a modest December Santa Claus Rally. It pancaked market averages, IRAs and individual portfolios alike. And it terminally confused any number of businesses. Again. (New Congressional legislation can only make things worse.) A bit more of this, and a 2021 Santa Claus Rally could become yet another bullish mirage. Our second McClellan Oscillator chart, below, shows Friday’s renewed selling panic. It followed Thursday’s rally, knocking out the past week’s second rally attempt in a row.

McClellan Oscillator, COB Friday, December 3, 2021. Third market crash this week. Techs devastated Friday, but Dow almost recovered. Courtesy Stockcharts.com.

The only saving grace here? The Dow, at least, almost recovered near the closing bell. That may indicate the chance for another recovery attempt on Monday. Depending, of course, on how headlines go this weekend.

Never any good news these days

The constant Covid terror attacks orchestrated by the media, its government overlords, and the government’s wealthy international overlords continue to batter small businesses in particular. It’s all part of the wider international plan to knock down the remaining pillars supporting the crumbling edifice of capitalism. Namely, the middle class and small, independent businesses. And the fallout from this false narrative could seriously depress US stocks unless wiser heads prevail. And soon. Otherwise, this week’s final Friday fizzle could prove just the beginning of something worse.

Trashing capitalism, US stocks, the middle class, and small, independently owned businesses: A feature, not a bug

For the oligarchs and globalists, this kind of relentless fiscal destruction remains a primary goal of their faux socialist plan for world domination. A feature, not a bug. Because socialism, like progressivism, is Marxism in disguise.

This murky but increasingly obvious trend worries traders and investors alike. This week, the reappearance of Covid, along with weak business confidence and wobbly employment numbers inspired them to dump perfectly good stocks left and right. (Pun intended.) Add to this some measure of end-of-year tax-loss selling, and you get one hell of a confusing mess on Wall Street. And in your portfolio as well.

All this, in a macro sense, is why most of our portfolios continue to suffer their own depression in a season that’s usually responsible for a big tick upward in annual portfolio profits.

Need some details on Friday’s weird action?

Fox Business offers a pretty good scorecard, accurate as of 3 p.m. Friday. It explains a positive pair of relevant influences responsible for guiding the averages earlier in the day. Before the week’s panic motifs took over once again.

“Oil, which entered a bear market, also rose 1.5% to the $66 per barrel level as OPEC decided to maintain the amount of oil they pump to the world even as the new omicron variant casts a shadow of uncertainty over the global economic recovery from the coronavirus pandemic.

“In economic news, the second labor-related report of the week showed an uptick in unemployment benefits for last week rising by 220,000, up from the previous week’s total of 199,000, which marked a 52-year low. Continuing claims, which track the total number of unemployed workers collecting benefits, dropped to 1.95 million from 2 million the prior week.

“On Friday, the November jobs report is expected to show the U.S. economy added 550,000 new nonfarm jobs last month, slightly above October’s stronger-than-expected tally of 531,000. The unemployment rate is anticipated to fall 0.1 percentage point to 4.5%.”

A mixed bag like this, plus Covid, plus news that insiders were dumping stocks faster than Soros & Co. can subvert free elections took averages down hard Friday afternoon. Particularly hard hit were the techs, oddly enough. They’d attempted to recover not once but twice this week. But Friday’s tech massacre put them back solidly in the red.

Omicron lockdowns, or lack thereof, may determine the direction of December market action. Again, these day’s, it’s always Covid…

Apparently, some Covid optimists opined that we wouldn’t have lockdowns this time around, at least in red states. Which meant that a host of remote school and business companies and apps might not get a second boost from the current variant. Down they went. And, given Mr Market’s bad mood this week, so did every other tech that even remotely benefited from this phenomenon.

As we continue trying to figure out the whys and wherefores of this week’s Friday fizzle, we leave you to contemplate this weekend’s market carnage and reach your own conclusions. While we think that many stocks remain overvalued here, the kind of selling panics we saw this week seem irrational, although some of the dumping could be simple profit-taking and / or year-end tax loss selling.

We’ll do a bit more R&D this weekend and let you know where we think our completely irrational markets may go next.

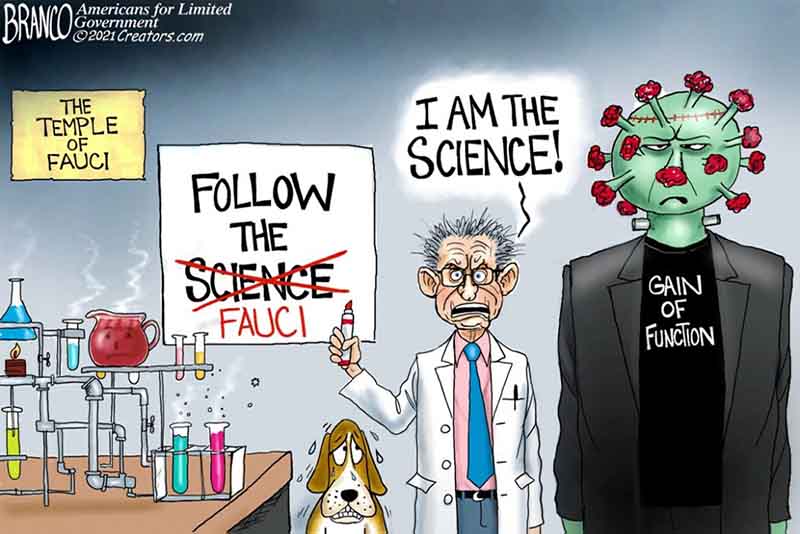

Link for headline cartoon: Cartoon by Branco. Reproduced with permission and by arrangement with Comically Incorrect.