Whitney Tilson’s email to investors discussing Charlie Munger’s speech on Friday; Doug Kass on cryptocurrencies; his take on cryptos.

Q3 2021 hedge fund letters, conferences and more

Charlie Munger's Speech On Friday

1) At age 97, investing legend Charlie Munger doesn't do much public speaking anymore. When he does, I always pay attention because I think he's not only one of the world's greatest investors but also thinkers/philosophers. One of the highest honors of my life was being a contributor to the definitive book about him, Poor Charlie's Almanack: The Wit and Wisdom of Charles T. Munger.

He did a wide-ranging interview on Friday for the Sohn Hearts & Minds Investment Conference in Australia, and he didn't disappoint. The video isn't available, but here are some of the highlights of what he said, courtesy of The Australian Financial Review:

- On the current investing environment: "The dot-com boom was crazier on the valuations even than we have now, but overall I consider this era even crazier than the dot-com era."

- On cryptocurrencies: "I wish they'd never been invented. And again, I admire the Chinese – I think they made the correct decision, which is to simply ban them. In my country, English-speaking civilization has made the wrong decision. I just can't stand participating in these insane booms, one way or another... Believe me, the people who are getting in cryptocurrencies are not thinking about the customer, they're thinking about themselves. Just look at them. I wouldn't want any one of them to marry into my family."

- On owning good companies: "You want companies that have high earnings on capital and have a durable competitive advantage, and if you can add to that they've got a good management instead of a bad one, that's a big plus too. But what you'll find is that the great companies of the world have been discovered, so they're very expensive to buy. That is particularly hard for me because... you have to pay a great deal for good companies, and that reduces your future returns."

- Risks facing good companies: The high valuations of good companies meant the cost of making mistakes had increased and cited the slide into oblivion of Kodak (KODK)... "Kodak was a very admirable company and led the world for a long time. Basically, that your shareholders' claims went to zero. They got blindsided by technological change."

- On the right way to make money: "I want to make my money by selling people things that are good for them, not things that are bad for them."

- On Tesla Inc (NASDAQ:TSLA) CEO Elon Musk: "He thinks he's even more able than he is, and that's helped him. Never underestimate the man who overestimates himself."

- On Amazon.com, Inc. (NASDAQ:AMZNN) and Costco Wholesale Corporation (NASDAQ:COST) [Munger is a long-time board member of the latter]: "Amazon may have more to fear from Costco in terms of retailing than the reverse. Costco will eventually be a huge Internet player. People trust it, and they have enormous purchasing power."

- On venture capital investing: Munger admitted he was not well suited to venture capital investing and could never have emulated the likes of Sequoia Capital, which he said has one of the best investing track records in the world. "I don't know how to do what they do. I regard it as a minor miracle."

- On inflation: "So over 100 years, I don't trust any currency issued in the whole world. It's natural to reduce the purchasing power of currency. If you're a government, the best you can hope for is the inflation will be slow."

- On clean energy: "I love the fact that we're rapidly reducing the burning of coal and the burning of gasoline and diesel. I think that's a smart thing for the world to be doing, and it would be smart even if there were no global warming."

- On China's crackdown on speculation and corruption: "They're right to step out, step hard on booms and to not let them go too far. The extent that my country doesn't do that, we're inferior to China. They're acting in a more adult fashion. They were right to step down so hard on corruption."

- On millennials: "I don't know what they're like in Australia, but here they're very peculiar: very self-centered and very leftist."

I generally agree with Munger's comments, though I don't think the speculative frenzy today equals that of the Internet bubble at its peak in March 2000. I think it's more like mid-1999 today, which is why I think the market still has room to run.

Doug Kass On Cryptocurrencies

2) My friend Doug Kass of Seabreeze Partners shares Munger's skepticism of cryptocurrencies. He outlines the reasons why in this recent missive:

I still don't see the value proposition in digital currency.

- Over the weekend, the price of bitcoin and other digital currencies plummeted

- To me, digital currencies remain just another risk asset and not a bona fide medium of exchange/trade

Over the weekend, the price of many cryptocurrencies fell by almost 20%.

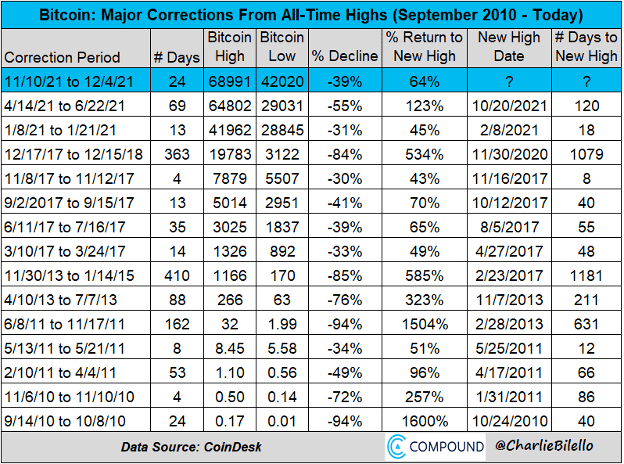

Bitcoin has now dropped by 38% from its recent high – that's the third correction of greater than 30% in the last 12 months.

Here is a history of the major corrections in bitcoin over the last 11 years:

Mark Twain taught us that history doesn't repeat itself, but it often rhymes.

The same applies to market history.

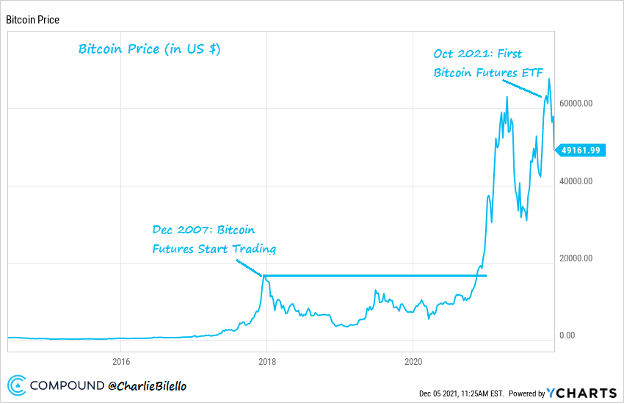

Four years ago, bitcoin futures started trading – the euphoria was short-lived, and the price of bitcoin eventually dropped by over 80%. Since the start of the first bitcoin futures ETF in October 2021, the price of bitcoin is down 38%:

What are digital currencies, if they can be created ad hoc – like monetary presses – and produce an endless supply?

Why are digital currencies better than fiat currency if their supply is really not fixed?

What value do digital currencies have if:

- They provide no protection from the rising inflation we've seen in the last few months.

- They have provided no protection from deflation in the past.

- They have provided no protection from geopolitical events.

- Most cannot be seamlessly used as a currency or as a medium of exchange of trade.

- The lack of price stability and consequences of price volatility make digital currencies unsuitable as a medium of exchange for trade.

- They are tax-inefficient.

- They are vulnerable to regulation.

- They are vulnerable to the competitive threat of sovereigns creating their own digital currencies.

- They have no intrinsic value, nor do they provide any cash flow.

I recognize that many very intelligent investors that I respect (like Paul Tudor Jones, Elon Musk, Anthony Scaramucci) and even some countries have confidently made large commitments to digital currencies.

I am not a luddite, but, sorry, I just don't "get" digital currencies, and I don't see the value proposition.

There... I have said it.

For several years cryptocurrencies have taken the oxygen out of the gold room – and many long-term and strongly committed investors in precious metals have begun to lose confidence in gold and silver.

Gold has been around, through thick and thin, for thousands of years.

Bitcoin is only 13 years old, and other digital currencies are still infants.

But we don't know what bitcoin and other digital currencies will look like when they grow up.

There... I have said that also.

Take On Cryptos

3) My take: My view hasn't changed from what I wrote in my April 22 e-mail:

Given how bearish I've been about cryptocurrencies – calling them "a techno-libertarian pump-and-dump scheme" and nailing the December 2017 bitcoin top to the hour – I wanted to share with all of my readers an excerpt of what I wrote in last month's edition of our flagship Empire Stock Investor newsletter entitled "The Most Unexpected Recommendation in Empire Financial Research History":

I think [my colleague] Enrique [Abeyta] is right that at least some forms of digital assets will have real – and growing – value. In particular, you may be surprised to learn that my views on certain cryptocurrencies ("cryptos") have evolved since I called the previous top of bitcoin in late 2017.

It comes back to the Rembrandt analogy. While one of these works of art can't be valued based on any known valuation formula and is therefore definitionally a speculation (evaluated solely as an investment), it clearly has value because, over time, many people have been willing to pay ever-increasing prices for these artistic masterpieces.

In other words, if a large number of people believe something has value – and are willing to pay cold, hard cash for it – then it has value, regardless of whether it produces cash flow.

The question, therefore, is whether something is likely to have sustained, growing value over time, relative to today's price. In the case of a Rembrandt, the answer is likely yes. In the case of Dutch tulip bulbs, the answer was no.

So where do cryptos fall on this spectrum?

I don't know for sure... Most, no doubt, will end up worthless. But it's also become clear to me that some – bitcoin and a few others – have reached a critical mass in which enough people believe in them that their values are more likely to go up than down.

As I often say, here at Empire Financial Research, we aren't value investors or growth investors. We're make-money investors.

That's why – despite my previous skepticism – we're recommending our favorite cryptocurrency in this month's issue of Empire Stock Investor. Yes, it's a speculation (so size it accordingly!), but we think it's a good speculation...

For more on this, see the e-mail I sent out on May 12: A Major Change to My Investing Philosophy.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.

Updated on