In hisDaily Market Notes report to investors, while commenting on inflation, Louis Navellier wrote:

[soros]

Q3 2021 hedge fund letters, conferences and more

Hot PPI

PPI was hotter than expected, the market reaction is not.

The PPI numbers came in this morning and they were sky high as expected. While there is little doubt the Fed has all it needs to justify accelerating the tapering plans, and high valuation stocks have been selling off in anticipation of a higher interest rate environment.

We shall have to wait and see what happens when the largest buyer by far, the Fed, rapidly slows and then stops making open market purchases. It may be a case of having to walk instead of talk to move the needle.

Inflation Spins Out Of Control

One reason why the Biden Administration and the Fed are under fire is that it is now widely perceived that inflation has spun out of control because the Fed has “over-primed the pump.”

The Treasury Department was selling lots of securities last week and although some yields rose slightly, the 10-year and other long bond yields were relatively stable. Specifically, the Treasury Department sold $36 billion in 10-year bonds on Wednesday with foreign buyers accounting for about 69% of all bidders. The bid-to-cover ratio was a healthy 2.43, so the 10-year bond yield only rose slightly, to 1.518%.

Since there continues to be robust demand for Treasury securities, that should allow the Fed to taper a bit more rapidly and reduce its quantitative easing from $90 billion per month to $75 billion, or less, when they convene the Federal Open Market Committee (FOMC) today – with their decision due tomorrow.

As always, Wall Street loves to “climb a wall of worry,” but I expect that since the 10-year Treasury bond remains an oasis and fourth-quarter U.S. GDP growth is expected to be stunning, a strong U.S. dollar will continue to attract foreign capital and keep interest rates artificially low relative to inflation. This essentially means that growth stocks, as well as dividend growth stocks, will remain an oasis for investors.

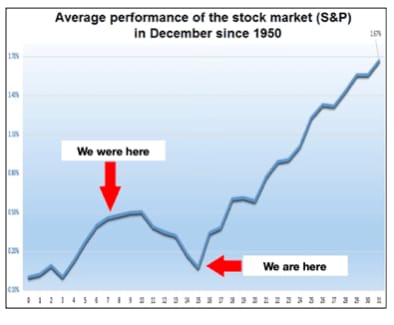

December Rally

Tomorrow’s FOMC statement as well as the November retail sales report (also due out tomorrow) are shaping up to be the catalysts that could push the stock market higher in the second half of December.

Updated on