WASHINGTON – Is the Biden Recession now revealing its ugly visage on Wall Street? For two days in a row (Wednesday and Thursday), US stocks attempted to rally, only to get clobbered back into the Red Ink Zone in the final hour of trading. Today, Friday, we’re white-knuckling the Wall Street roller-coaster once more as Dow, NASDAQ and S&P stocks plummet again.

Perhaps not surprisingly, today is also the first triple witching day of 2022. Thursday’s nasty downturn was likely attributable, at least in part, to the typical strange triple witching antics that tend to go on prior to options expiration Fridays. Markets continue to bleed out on Friday, as if to emphasize the point. With puts and shorts apparently set to profit handsomely from this month’s ongoing market debacle, it looks like we’ll end up down badly again at the 4 p.m. closing bell.

Can even the Dow Dogs save us in this market? Read: 2022 Dow Dogs and SDOG: Annual dividend based stock strategies

More on that likely-imminent Biden Recession

But maybe something else is driving stocks down. We refer to the now obvious (even to partisan Democrats) total incapacity of White House Resident Joe Biden to function even marginally as this nation’s “duly elected” chief executive. His ability to do so in any capacity became painfully obvious early in his unearned first term. But the obvious and relentless build-up of amyloid plaques in his withering brain became stunningly clear in recent weeks, even to the Democrats’ dutiful shills in the so-called news media. Is a looming Biden Recession dead ahead?

Could be.

Or maybe it’s already here.

Multiply the Biden Recession by the Zweig Rule

Add the late Marty Zweig’s memorable dictates – “Don’t fight the [investing] tape” and “Don’t fight the Fed.” And voilà! we may have a hat trick of reasons for a nasty FY 2022. And perhaps Mr Market finally decided to reflect this in January’s relentlessly plummeting stock market averages.

Losses extend throughout all asset classes, leaving few investors with any useful places to hide until the worst is over. Except perhaps for short-to-medium CDs. Oh, wait. Even most of these offer pitiful returns –as they have for years. Returns that amount to negative interest rates.

In other words, the mathematically nonexistent returns on such CDs, along with equally bad returns provided by brokerage houses’ “high-yield” money market funds, only mean we get to lose our hard earned savings and retirement accounts more slowly in these investments than in our withering stock market accounts.

McClellan Oscillator shows why US stocks plummet again in January 2022

A look at our favorite pair of market indicator charts paints an ugly portrait of Mr Market’s recent serial face plants.

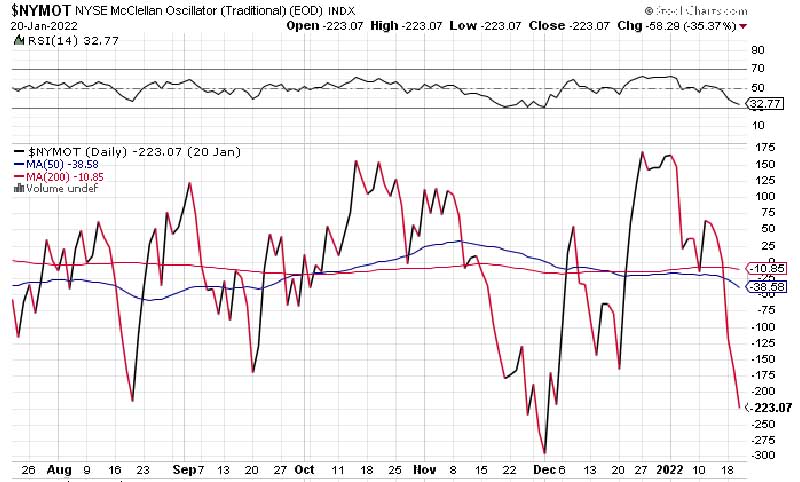

In our headline illustration above, take a quick look at the recent, extended swan dive of US stocks via the McClellan Oscillator. As we’ve noted in these columns before, this market indicator gives us a pretty good idea as to whether the market of stocks is overbought (when it trends considerably above the 0 [zero] line) of the chart’s x-axis; or whether the market is getting oversold (when it trends considerably below the 0 line).

You can see why the McClellan Oscillator had us more than a bit confused in December as it attempted to stage a real Santa Claus Rally from mid-to-late month. However, investors could see that this rally, which finally did occur, was a bit unconvincing. It also proved less robust than we would have liked. Even as Santa’s spike up occurred, bullish investors still found themselves quickly thwarted by more selling.

Something wrong was happening here. But we had to wait until January to see what it was.

And what it was was a continuing relentless selling and shorting, but not only by big hedge funds. Corporate CEOs almost across the boards busily unloaded thousands of their own company shares as we eventually learned. The selling volume crescendoed into January 2022. The VIX volatility chart began a slow, then a sharp spike upward upward. It continues today. Such spikes are fun and profitable for computer-driven options traders. But they’re not so good for every day investors who seek market stability and respectable returns.

Today’s midafternoon VIX chart. Continuing upward spike not good news for bullish small investors. Chart courtesy Stockcharts.com.

This worrisome background noise hardly augured confidence going into 2022. Which is why we keep watching a majority of US stocks plummet again and again as 2022 gets off to a genuinely bad investing start.

Biden Recession + Fed interest rate moves + angry Democrats and RINOs = Serious investing danger for home gamers

In Q$ 2021, the Fed clearly stated intention to cut off the free money feedbag by slowing and then halting its latest QE (Quantitative Easing) bond buying bonanza. They said it would be their first move to slow the growth of our money supply and the increasing inflation this caused. The Fed also vowed to jack up interest rates not one, not two but three times in 2022. The nation’s central bankers clearly indicated their desire to rein in America’s nearly out-of-control inflation rate, likely by initiating the usual “mild” recession. This despite the fact that “mild” recessions rarely are. At least for Mr and Ms Joe the Plumber.

Add to this hideous witches’ brew the utter incompetence of the Biden Junta – an underground leftist coup against this country run through this obvious figurehead “president” who was elected from his basement via a well-planned and ruthlessly executed electoral coup – and you have the perfect recipe for disaster. And the perfect recipe for an ugly Biden Recession.

Can we hope for a solution to our current socio-economic issues?

Can we save any part of the twice-revived Trump economy in 2022? Even if the GOP (or some variant of the GOP) succeeds in blowing out both Congressional Democrat majorities in this fall’s elections? Perhaps not. Changing America’s course yet again assumes one crucial prerequisite. Namely, that America’s Communist Party of Bernie Bros. doesn’t game the elections once again (without evidence). In any event, we’ll still have to endure a bitterly divided and dysfuncional Washington for two more years.

At any rate, bitter clinger Dems would still have a full 11 months to talk just one, two or three incorrigible RINOs into coming across the aisle to pass some terrible, budget busting pieces of the Biden Junta’s recently terminated “Build Back Worser” legislation. This would keep the wrecking ball swinging through January 2025 and perhaps beyond.

And all the while, a World War Z horde of unvaxxed, Covid-carrying illegals will continue pouring over the Southwester border of the US unabated, ready to be flown or bused (at taxpayer expense) to every GOP-led Congressional district in the country.

What to do as stocks plummet

Bottom line: This looks like a political column. But this, along with many of the columns I write, is really about investing in a bad, to uncertain, to very bad US business environment. It’s more treacherous than ever, particularly for home gamers like you. And me.

To fight the likely incoming Biden Recession in 2022, the only weapon investors have is common sense. And common sense right now tells us to sell quite a lot of our holdings. That holds true even if we still believe that our holdings can still make us some serious money. At least until we get a bottom signal, confirmed by both the McClellan Oscillator and a declining VIX. Meanwhile, it’s best to hide out wherever we can.

We might get a sharp rally soon as the McClellan Oscillator seems poised to hit a tradable bottom shortly. But with all the other things I’ve rattled off in this column still hiding behind a curtain, a huge, bull-market style rally is likely a long way off at this point. So let’s circle the wagons for now. And lose as few $$ as we can, until Mr Market blows the all-clear signal.