While last week’s geopolitical tensions have eased a bit, the OPEC+ members’ meeting knocks at the door. How will it affect crude inventories?

Q4 2021 hedge fund letters, conferences and more

Crude Oil Prices Pause

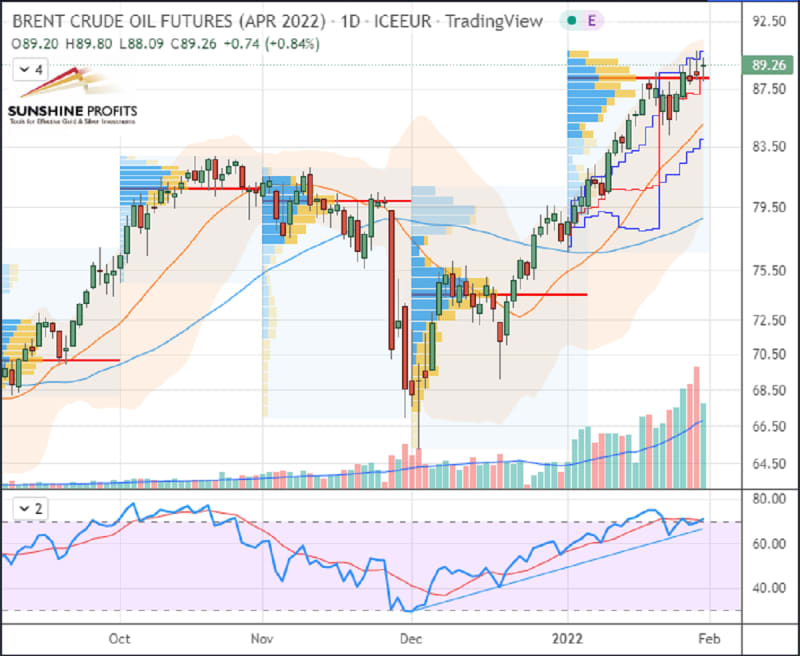

Crude oil prices paused this morning in the European trading session, the day after a new technical increase linked to the expiration of futures contracts. OPEC+ members, including Russia, are due to hold a meeting tomorrow in which speculative talks suggest that OPEC+ could announce a quicker increase in supply. On the other hand, US crude inventories should be scrutinized this week, with the first figure to be released later today by the American Petroleum Institute (API) at 2130 GMT / 1530 Chicago Time.

Therefore, we could see a new rise in crude stockpiles of 2 million barrels. As a result, the oil market could be set to start a pullback down to previous support – $ 85.80 could represent a level that would attract more bulls, eventually.

Regarding OPEC+ output, Saudi Arabia could decide to add barrels on top of its quota, as the kingdom is one of the only members of the cartel able to ramp up production, if necessary.

On the US dollar side, the recent rally of the greenback has propelled the dollar index (DXY) towards higher levels, even though it has not had a huge impact on crude oil. The overall inverted/negative correlation between the USD and black gold could catch up now as we have a greenback sliding after less hawkish comments from the Fed than expected and a barrel located in overbought territory.

On the geopolitical scene, the slight ease of tensions from the past week – or, at least, the diminution of anxiety inducing news in the mainstream media headlines – is characterized by decreasing volatility. The latter is thus marked by a volatility index (VIX) – aka “Fear Index” sliding just below 25 today.

WTI Crude Oil (CLH22) Futures (March contract, daily chart)

Brent Crude Oil (BRNJ22) Futures (April contract, daily chart)

RBOB Gasoline (RBH22) Futures (March contract, daily chart)

In summary, after such a rally in January 2022 on crude oil prices, we may start to see a weakening of the momentum, which could result in correcting oil prices, if such a scenario of supply and demand dynamics is followed on both sides (input rise / stockpiles accumulation) of the market.

Like what you’ve read? Subscribe for our daily newsletter today, and you'll get 7 days of FREE access to our premium daily Oil Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist

The information above represents analyses and opinions of Sebastien Bischeri, & Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. At the time of writing, we base our opinions and analyses on facts and data sourced from respective essays and their authors. Although formed on top of careful research and reputably accurate sources, Sebastien Bischeri and his associates cannot guarantee the reported data's accuracy and thoroughness. The opinions published above neither recommend nor offer any securities transaction. Mr. Bischeri is not a Registered Securities Advisor. By reading Sebastien Bischeri’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Sebastien Bischeri, Sunshine Profits' employees, affiliates as well as their family members may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Updated on