WASHINGTON – In a recent column via Stockcharts.com’s public page, respected stock market guru Joe Duarte opined at some length on the possibility that stocks could resume their long-delayed march back to bullish mode. Or not. A bit more clarity, vis-à-vis those Russian-Ukraine war drums, plus a bit more of the same on US interest rate trajectory could turn the trick. Maybe. Are we on the “Edge of Chaos” here?

Joe Duarte poses an investing theory and potential conclusions

Duarte first notes that one of the drivers of 2022’s lousy, bearish Wall Street trajectory thus far was attributable to massive put buys that came due over the past 3 months. Puts are essentially “bets” that a stock will fall, perhaps dramatically, before these options expire. (They’re the opposite of calls, which bet on stocks likely to take the opposite direction.)

Massive put buying can influence the VIX volatility index, which is perhaps the best predictor of wild and / or (mostly) negative action in stocks over the intermediate or short term period. And volatility is certainly what we’ve had thus far in 2022.

But note the recent reversal in VIX volatility as per the chart below. In this VIX chart, you can see the dramatic upswing in volatility at the beginning of 2022 as opposed to the recent dramatic drop we can see in recent days. Check out the chart below, measured as of Wednesday afternoon.

VIX volatility index, mid-afternoon, March 30, 2022. Image via Stockcharts.com

Joe Duarte noticed this drop as well. He explains his ideas in “VIX Crashes Says Few Put Buyers Left.”

On stock market volatility

“For the past few weeks, we’ve seen the CBOE Volatility Index (VIX) fall significantly. It’s no accident that the stock market has recovered during that time. Moreover, if this trend in VIX keeps going, then it makes sense to expect that the general trend in the stock market will keep its upward bias. That’s because rise in VIX signals that put option volume (bets that the market is going to fall) are on the rise. What follows when put volume rises is that rising put volumes cause market makers to sell puts and, simultaneously, hedge their bets by selling stocks and stock index futures. So, if VIX continues to fall and NYAD [New York stock exchange Advance-Decline index] continues to rise, we could see higher stock prices in the short term.

“…[G]iven the amount of bearish sentiment and doubt that is in the air, coupled with very constructive price charts, it makes sense to prepare for a potential bullish surprise, while certainly being aware of the fact that any such breakout could just as easily fail. In other words, cautious bullishness is the correct stance at the moment. On the other hand, if a liquidity crisis develops then all bets are off.”

Checking out a recent VIX volatility index chart

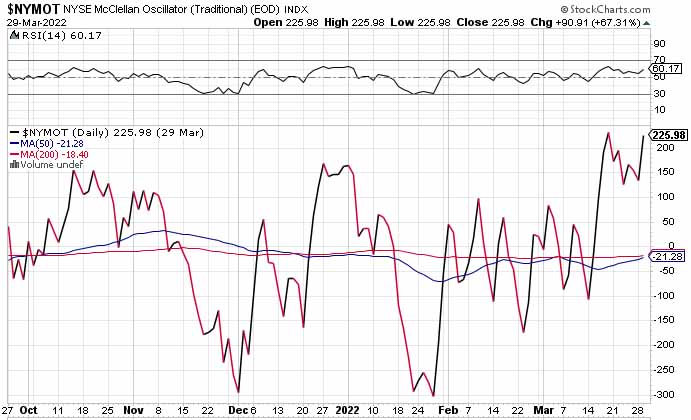

To see this change in sentiment, we have no further to look than the most recent available McClellan Oscillator chart (COB March 29, 2022). After an extremely bearish recent trip, encompassing early 2022, we can see a dramatic shift in bullishness as the chart rises dramatically above the zero line.

In fact, the recent rise was so sharp that stocks could be in the “overbought” zone, at least temporarily. You can see this at the far right of the current chart as the recent short, vertical zig-zag lines indicate some investor indecision as to where the average investor should proceed next.

McClellan Oscillator chart, traditional version, as of COB March 29, 2022. Courtesy Stockcharts.com.

Duarte obviously sees this nervousness as well. This led him to summarize a pair of opposing views as to where stocks may go next.

“Mainstream View of Current Situation in the Economy”

“The mainstream view of the economy can be summed up as follows:

Runaway inflation is the central influence

The Federal Reserve will raise interest rates aggressively until 2024

The Economy will tank

The stock market will crash

“The Stock Market’s View

Inflation is a thing to consider, but not the only thing

The Fed won’t be able to raise rates too many times

The Fed will be lowering rates in a hurry before too long

The market moves the economy and lower rates lead to higher stock price.”

This leads him to offer the following useful – if paradoxical – maxim. One that’s useful when investing in the current chaotic and essentially rudderless market environment.

“Welcome to the Edge of Chaos:

“he edge of chaos is a transition space between order and disorder that is hypothesized to exist within a wide variety of systems.This transition zone is a region of bounded instability that engenders a constant dynamic interplay between order and disorder.” – Complexity Labs”

Is this an answer? Of course it isn’t.

But could considering ourselves on the Edge of Chaos help provide us with an excellent basis for establishing a cautious investing stance moving forward? The current Russia-Ukraine conflict has, at the very least, massively upset the globalist economic “Great Reset” for one thing.

Worse yet, there’s that increasingly alien, Marxist-oriented, pro-totalitarian Junta currently running Washington. It’s nominally run by a likely illegally “elected” White House Resident. One who increasingly displays clear signs of catastrophic mental and moral decline.

That’s a bad place for a weakening world power to be. Particularly when all of our post WWII certain certainties verge on complete collapse.

And it’s a bad place for investors in US stocks and bonds as well.

The Edge of Chaos.

Be careful out there.

Headline image, Pixabay artist link: Mohamed Hassan.