Hayden Capital commentary for the first quarter ended March 31, 2022.

Dear Partners and Friends,

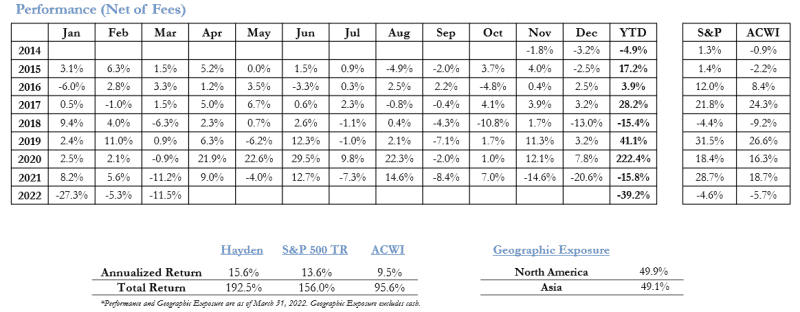

Please see the following table and link for our quarterly performance update.

Hayden Capital’s Performance

The last few months have been our most painful period of performance since I started Hayden seven years ago. In the last quarter, our portfolio has declined -39.2%. Since inception, we have generated +15.6% annualized returns for our partners, versus +13.6% for the S&P 500 and +9.5% for the MSCI World indices.

Q4 2021 hedge fund letters, conferences and more

Starting last fall, most of our company valuation multiples have retraced back to below when we first purchased what ultimately became our core positions, the majority approximately 4 years ago. Back then, these businesses were mainly call options with a very wide range of outcomes (and as a result, were sized smaller back then with this in mind). However, I believed the expected path of these businesses’ fundamentals would be a high sloped one (i.e. high IRR), which would more than compensated for the potential downside.

Not only did I think the fundamentals would compound at a high rate, but we were also getting paid for taking the business model risk. At the time, the market was pricing the shares at half the multiple of what a “proven” business model with visible margins would trade at. Our upside underwriting was based on a combination of fundamental business growth, along with a valuation re-rating as the business model developed and the company’s dominance and viability became more “obvious” to the market.

This is why the degree of valuation compression these last few months has been surprising. Over the last few years, our core investments have gone from double-digit operating margin losses (in the case of one, its operating margins were negative -120% in 2018!), to profitability or on the cusp of profitability today. Theoretically, with business viability no longer a question (therefore resulting in a narrower range of outcomes) this should justify a higher valuation on a much larger earnings base. At the same time, interest rates were already at in 2018 where the Fed only is hoping to get to (it’s “neutral rate”) over the next year. (For the CAPM aficionados, it's the other components of the cost of equity that have widened due to macro uncertainty, but should structurally revert when this subsides).

A Highly Uncertain Macro Environment

In the short-term, this makes sense. We’re facing a highly uncertain macro environment, the highest inflation rates in decades, a US central bank that’s aggressively raising interest rates, and even talk of a nuclear war. When the financials or profit potential isn’t obvious yet, this segment of the market is the hardest for other investors to stomach since there’s no obvious profitability “anchor” for prices. Within our internal company watch list, share prices have generally declined anywhere from 30 – 80% (just wow...). Future profits aren’t worth very much, if we aren’t around to enjoy them in a nuclear war (but luckily that last fear seems to have subsided in recent weeks…).

The mistake I made (one I take full responsibility for, and am still thinking through how to prevent this in the future), is that I initially underestimated the pace that valuations would compress. I anticipated a compression would happen over a year or two, rather than just 3 months! When valuation multiples compress by 50% or more in a matter of months, it’s practically impossible for the fundamental growth of the underlying business to offset this in such a short period of time (see our Q4 2021 letter from February for more details; LINK). In this case, the valuations took the hit first, and our companies will need to pull themselves out over time via their own fundamental execution. Our company fundamentals remain on track, and some have even strengthened their competitive positions over the last few months. We’ll discuss this in more detail, in our quarterly letter in a few weeks.

On a positive note, our portfolio seems to have stabilized since late January. Since then, the portfolio has been trading within a volatile range during February and most of March (except for the couple weeks after the Russian invasion of Ukraine), but not nearly to the degree we saw in the prior months.

While I believe valuations have greatly over-shot to the downside, and our companies should re-rate higher in a more normalized environment, there’s no guarantee of this or that it will happen quickly if it does. But at the very least, I do suspect that valuations may have found a bottom recently, and as mentioned before, are trading even below where they were when expected interest rates were higher, and when these business models were much more speculative / unproven years ago at the time of our initiation.

If valuations stay where they are currently, based upon our expectations for our companies’ fundamental growth, it’s possible for our companies to trade at their previous values within the next 2 - 3 years. If we get the benefit of a valuation expansion in a less volatile macro environment, this may happen sooner.

**

I understand that this is not the result our partners expected when they placed their capital and more importantly, their trust, with us. While our early partners are still realizing a compound annual return of ~16% annualized, this doesn’t help partners who decided to join the Hayden family in the last year. Trust me when I say that ensuring all our partners realize a satisfactory return on their investments over the long-run is my top priority (my family, parents, and close friends are all substantially invested alongside our partners as well – in my family’s case, at near 100% of our liquid assets).

I’ve historically talked a lot about our journey, the process, and how we’re going to achieve this in our prior letters. But in the investment business, there needs to be sufficient tangible rewards if we’re going to ask our partners to undergo such a long and volatile (and at times, painful) investment journey with us. This isn’t lost on me – earning the trust of our partners and getting us to these ultimate rewards has been, and always will be our primary focus.

Operational & Travel Updates

A few updates on the business side this quarter. First, Philip is transitioning into a Senior Adviser role at Hayden, in order to spend more time within the crypto space and perhaps start an entrepreneurial venture within it. He had expressed this desire to me late last year, and after discussing it more over a few weeks together in Singapore, he has decided that the entrepreneurial bug was too strong to pass up.

We plan to keep in touch just as frequently and he will remain our "eyes and ears" for the Southeast Asia tech ecosystem, while continuing to build relationships for us on the ground. Additionally with him now deeply immersed in the crypto space, perhaps we’ll have some even greater insights as it relates to our Coinbase investment.

As a result, we’re also going to restart our internship program this summer / fall. If you know of any undergraduate or MBA candidates who might be a good fit (particularly those with experience / backgrounds / relationships in Asia), please have them send their resumes along with a prior investment write-up to Alyssa at alyssa.mccarthy@haydencapital.com. While we can’t promise that we’ll have a chance to respond to each candidate individually, we promise that we’ll carefully consider every submission.

Lastly, I just returned from Asia a few weeks ago, and am now back in NYC. I’m heading to Omaha for Berkshire’s annual meeting at the end of this month, but plan to be in NYC for this summer and early fall. If any of our partners are planning to be in New York or Omaha, please do reach out. It would be great to have the opportunity to discuss these topics in person.

While we can’t control the markets, global events, or the actions of other investors, one aspect I can control is our communication with our partners – to always ensure they’re informed of what’s going on with their hard-earned capital. I promise that at Hayden, we will always remain transparent and accessible to our partners, in both good times and bad.

Best,

Fred Liu, CFA

Managing Partner

Hayden Capital

Updated on