WASHINGTON – Count on Washington to keep sticking it to Joe Sixpack during the Biden Interregnum. Fed Chair Jerome Powell, in a belated attempt to reign in Bidenflation said in a Thursday afternoon speech that the nation’s central bank would likely increase interest rates by another 0.5% next month. That’s on the heels of a 0.25% increase the Fed put in place in April. Powell’s 1 p.m. ET remarks essentially negated the nice stock market rally that began Thursday morning.

Stocks now appear set on reversing course entirely. Major averages find themselves heading back down to the basement. The declines range from – 0.41% (on the Dow) to almost – 1.5% on the tech-heavy NASDAQ as of 2:15 Thursday.

Interest rates up again in May. How Powell effectively canceled the Thursday stock market rally

CNBC provides further details on Powell’s remarks.

“Federal Reserve Chairman Jerome Powell affirmed the central bank’s determination to bring inflation down and said Thursday that aggressive rate hikes are possible as soon as next month.

“‘It is appropriate in my view to be moving a little more quickly’ to raise interest rates, Powell said while part of an International Monetary Fund panel. ‘I also think there is something to be said for front-end loading any accommodation one thinks is appropriate. … I would say 50 basis points will be on the table for the May meeting.’”

That’s great news for new homebuyers. Many of them now face 30-year mortgage rates in excess of 5% and climbing as May approaches. Such rates haven’t been seen since 2018 and they didn’t last for long. But given Powell’s remarks, we likely ain’t seen nothin’ yet before the current tightening cycle peaks.

CNBC essentially confirmed this unfortunate point of view.

Ditto the abrupt end of our Thursday stock market rally.

“Powell’s statements essentially meet market expectations that the Fed will depart from its usual 25-basis-point hikes and move more quickly to tame inflation running at its fastest pace in more than 40 years. A basis point equals 0.01 percentage points. [Bold text via CDN.]

“At its March meeting, the Fed approved a 25-basis-point move, but officials in recent days have said they see a need to move more quickly with consumer inflation running at an annual pace of 8.5%.

“Market pricing points to a succession of 50-basis-point increases that ultimately will take the Fed’s benchmark overnight borrowing rate to about 2.5% by the end of 2022.”

Obamanation, Obamanomics and Bidenomics: All the same thing…

The Biden Junta’s version of Obamanation, Term 3, seems intent on using various means geared toward full implementation of the notorious (yet little known to the public) Cloward-Piven strategy. That academic-Marxist construct promotes a series of crises created by a central government to destroy jobs and real income.

The goal: To drive the middle and lower classes to insist on some form of a guaranteed (minimum) income from the government. The goal: to effectively transform the average citizen an effective slave to the central government that caused the problem in the first place.

Add in the government’s massive overspending on energy destruction, massive debt overhangs and Covid Kabuki. And Washington seems well on its way to the ultimate implementation of Cloward-Piven.

(More on this in later articles. CDN writers have visited this topic before, here and here.)

Wrapping things up…

As for now, US markets are attempting to at least slow Thursday afternoon’s big decline.

But the bears may attempt yet again to crush any attempt by the bulls to regain ground. They’ll likely do that with the usual bout of heavy selling near today’s 4 p.m. closing bell. And with its current anti-inflationary mood — unfortunately the correct economic strategy here — the Federal Reserve seems determined to send interest rates up and up until the central bank triggers a nasty recession.

Caution advised as usual for home gamers. Stay tuned.

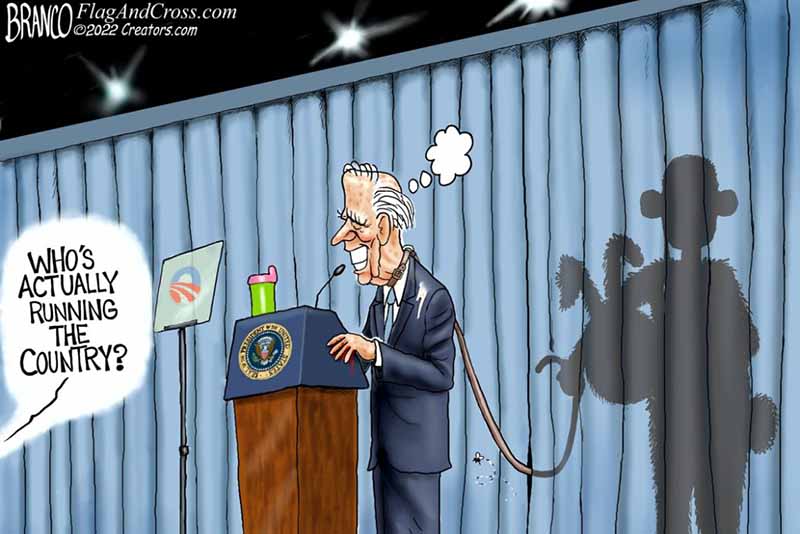

Headline image, artist link: Cartoon by Branco, via Comically Incorrect.

Follow CommDigiNews at

Truth ap @CommDigiNews