WASHINGTON – I’ve been attempting – for at least a week now – to write an article explaining exactly what is (or what may be) going on with the Elon Musk / Twitter brouhaha. On top of that, I’ve attempted to knit the story into the currently (?) sagging fortunes of Donald Trump’s recent serial TRUTH Social / DWAC faceplants. But these stories change again and again with the speed of light, even before the virtual ink is dry on my latest revisions. But as of right now – i.e., Monday, April 25, 2022 ~ @2 p.m. ET – it looks like the Musk deal for Twitter is on again (maybe). Or even more. (See below for details.)

So let me punch this in again before this story has me resorting to an Acme / Wile E. Coyote final cliff dive.

Background info on the Musk deal for Twitter

At the moment, the most accurate (but still interim) information continues to percolate over at ZeroHedge. The Twin Tylers posted their latest takes on the story this a.m., deriving info from Reuters and elsewhere.

To bring you up to this point, remember that Elon Musk made a detail-sparse offer to buy out and likely take private that far-left social media propaganda mill otherwise known as Twitter (NYSE: TWTR) for a squishy figure of roughly $43 billion. This occurred after he’d revealed he already owned somewhat less than 10% of existing TWTR shares, and turned down an offered position on Twitter’s BOD. Provided he agreed to cap his eventual share ownership just short of 14%.

Musk thought better of this and declared his offer for the whole shebang. This prompted the terrified BOD to swiftly impose what’s known on the Street as a “poison pill” defense. Grossly oversimplified, this is a legal device enabling a firm’s BOD to create and dispense a theoretically endless amount of “free” new shares to existing shareholders if a single shareholder exceeds a threshold of share ownership. The effect is to create a tidal wave of new shares that effectively prevent that shareholder from EVER acquiring a controlling majority of the company.

More on the Poison Pill Defense

The poison pill defense is not exactly novel on Wall Street. But the mind-boggling swiftness with which the board came up with its poison pill indicates that both they and the Marxist-fascists running this company were scared to death they’d all soon be frog-marched out of the building like the legion of overpaid journo-listic CNN+ hacks will be shortly. Ironically, on May Day 2022.

It’s ultimately what happens when your company or division never makes money for years and years and years. Proving that virtue signaling and censorship of viewpoints remains a losing proposition even our current troubled times.

At any rate, something started happening, apparently after COB Friday, April 22. The wires began to buzz over the weekend, indicating that Twitter’s BOD might be reconsidering its hasty poison pill. Rumor: as we just opined above, it’s a known fact that Twitter has never made any real money for its shareholders as an investment. Likely because, by banning most Twitterers whose politics are even slightly to the right of, say, Pol Pot or Mao, they’ve effectively banned 50% of the universe of potential customers. Which meant banning 50% of potential revenues as well. I.e., “Go Woke, Get Broke.” Shareholders tend not to like this.

In other words, Twitter’s BOD might have done some simple math and quickly figured out that dumping the whole steaming mess on Musk might give them all – along with disgruntled existing shareholders – a timely and rewarding excuse to bail on the disaster they’d caused. Before the usual legion of class action lawyers descended upon them all for the kill.

Now, let’s get to those ZH excerpts on the latest developments as of Monday morning.

“[7:50] Here comes Reuters with the latest on the Musk-Twitter deal. Their three-sentence scooplet includes two notable details.

“The first is that Musk and Twitter are indeed negotiating on the basis that his offer of $54.20/share (which would value the company at $43 billion).

“The second is that the deal would preclude a ‘go-shop’ provision (something we discussed below and for the first time earlier this month) allowing Twitter to solicit rival bids – although the company would still be allowed to take a rival offer if it pays the Musk group a break-up fee (agreements like these are pretty standard fare)…

“Elon Musk’ [T]witter takeover, which just one week ago seemed increasingly unlikely after the company rushed to adopt a poison pill, is suddenly looks rather possible and not because the world’s richest man decided to go all scorched over Twitter’s bread and butter, namely censorship and shadowbanning…

The Musk deal evolves

“… but because the WSJ reports that the social media company’s board is ‘more receptive to a deal’ and is re-examining Musk’s $43 billion takeover offer after the billionaire lined up financing for the bid.

“While Twitter had been expected to rebuff the offer, which Musk made earlier this month without saying how he would pay for it, and prompting Musk to threaten to launch a tender offer. But after Musk disclosed last week that he now has $46.5 billion in financing thanks to Morgan Stanley, ‘Twitter is taking a fresh look at the offer and is more likely than before to seek to negotiate’ although the situation is fast-moving and it is still far from guaranteed Twitter will do so.”

Musk, like Donald Trump, could not resist a snarky tweet on the topic…

)

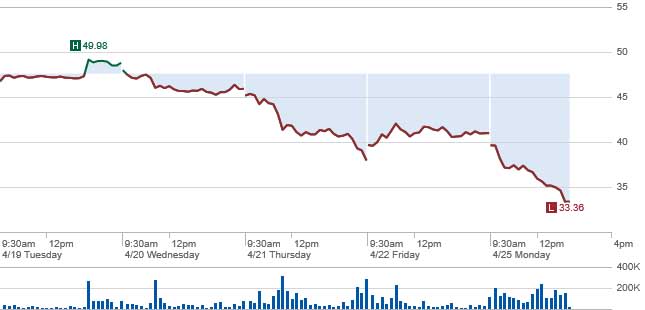

BTW, check out the early Monday morning action in Twitter shares.

Twitter shares soar on reported Musk takeover deal. (Chart courtesy ZeroHedge.)

More details on Trump’s DWAC faceplants: Permanently fatal or temporary inconvenient?

In a related-unrelated development, current TMTG and TRUTH Social CEO Devin Nunes also surfaced at the end of last week with thrilling news regarding that badly-limping pre-IPO Twitter alternative. TRUTH has been badly limping since its false start was announced nearly 2 months ago. Since then, only a small subset of excited potential users was able to actually log-in to the new app, initially downloadable only via Apple’s App Store. And only available on iPhones.

Everyone else was put on a “wait list.” And pretty much everyone on that list soon became resigned that they’d have to “wait” forever, as the site’s promise to get everyone up and running ASAP never came close to materializing.

Making matters worse, TRUTH’s two top tech weenies, well-respected in the business according to several articles, decided to bail. Not long thereafter, the iconoclastic Musk’s attempt to take over the Twitter disaster hit the wires, promptly tanking the shares of the previously high-flying Special Purpose Acquisition Company (SPAC) known as Digital World Acquisition Corporation (NASDAQ: DWAC) that has allegedly agreed to take Trump’s TMTG public. (Eventually.)

Is the worst yet to come for DWAC, TMTG and TRUTH Social?

Hovering around the $70 per share range at that time, DWAC quickly swooned, ending up in the low $50 per share range when the Musk-Twitter action surfaced.

With this morning’s allegedly positive developments that purport to move the Twitter board and Elon Musk toward a buyout-and-take-private deal, at least some investors and speculators in DWAC apparently decided to hit the ejector button. One look at the chart below, recapping Monday afternoon’s current action in these shares tells you the tale of the tape. At least DWAC style.

Shares of DWAC, likely TRUTH Social SPAC, begin a severe decline based on the Elon Musk Twitter take-under story. (Chart via Schwab web site.)

So what’s next with the Musk deal (or No Deal) and the latest related (or unrelated) news on Trump’s DWAC faceplants?

Preliminary answer? Who the heck knows? The complexities involving TWTR, DWAC and / or both could, at this time, require a modest-sized dissertation to sort out. There’s no guarantee that the Musk takeover of Twitter will actually pan out. If only because the nutcases employed by that woke, censorious Marxist might trash the place on their way out if the deal actually goes down.

Ditto the now even more uncertain fate of TRUTH Social. If Musk should actually succeed in his buyout gambit, with or without OPM (Other People’s Money), potential TRUTH supporters and fans could quickly switch alliances back to a newly liberated Twitter, give the far greater visibility of that platform.

On the other hand, some form of internal protest-sabotage of a Musk Twitter takeover could quickly eviscerate any real value that platform might still possess. Which could suddenly turn the advantage back to the still-not-yet-public Trump platform.

It’s a mess, and there’s plenty of blame to go around on all sides.

That said, a genuine ray of sunshine burst forth on the floundering TRUTH Social effort late last week. And just when all appeared lost. Nunes announced that the TRUTH platform had successfully migrated its operation and content over to the underpinnings of the already proven Rumble cloud and platform. As a result, TRUTH indicated that its long dormant “waiting list” users would quickly be able to become full members.

At #267,000 or thereabouts on the waiting list, I’ve tried and failed numerous times to complete whatever it was I needed to complete to get the full “membership” privileges I’d signed up for on TRUTH social. No followup, no updates, no nothing.

Until this morning. I gave it another shot and, mirabile dictu, after asking me for a bit more info, I managed to get in at long last – something that CDN’s head guru had somehow actually accomplished not long after TRUTH went live at the end of February. I haven’t had the chance to explore the new Trump site yet. But I’ll do so soon and report back on what I’ve found thus far.

But bottom line. TRUTH Social appears to be open for business to the general public as of now.

Personally, given all the Musk-Twitter excitement and speculation, I hope that Trump’s long- and unfortunately-delayed app can still get some traction at this point.

Starting a successful business first and foremost involves starting out with more than enough working capital. But is also involves a success-driven game plan. And, perhaps most importantly of all, given capital requirements and a success-oriented game plan, success can ultimately hinge on TIMING, whether intentional or serendipitous. TRUTH Social / TMTG / DWAC may have missed out on this crucial variable. But then again, who knows whether the ultimate fate of Twitter will help or hurt.

Stay tuned. Who says business is boring?

UPDATE: BREAKING:

Twitter accepts Musk’s buyout offer.

According to a 2:50 p.m. CNBC post dated April 25, 2022:

“Twitter’s board has accepted an offer from billionaire Elon Musk to buy the social media company and take it private, the company announced Monday.”

For the text of Twitter’s announcement, follow this link to the CNBC story. News will likely continue to break. Personally, this ongoing business drama could prove the most unpredictable business-stock market-political adventure any of us has ever witnessed. So again, stay tuned.