For weekend reading, the staff at Navellier & Associates offers the following commentary:

The stock market sent investors a crystal-clear message last week, and it wasn’t one to be taken lightly. Against the current chaos of a market landscape that is crushing every questionable growth company in its tracks and every pseudo-macro secular trend that pretends to be havoc-proof, it should be duly noted that all get-out-of-jail-free cards have expired. The S&P broke technical support, and it’s every stock for itself.

Q1 2022 hedge fund letters, conferences and more

That may sound bad on the surface, but it’s not so bad if you know where to rotate your capital – into the areas the market favors, and there are always sectors and stocks that provide safe-haven returns when the levels of market turmoil are elevated. This is not a time to try to be too clever, as there is little room for stocks exposed to anything other than those sectors that the market has placed a high level of trust in.

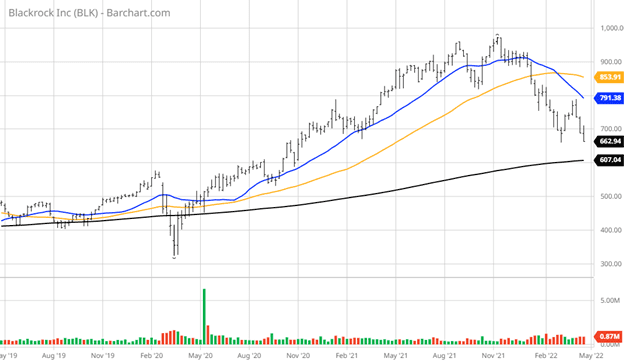

One indicator that gives me hope is the action of Blackrock Inc. (BLK) – the world’s largest manager of ETFs. This chart looks to be setting up a quintessential ‘double-bottom’ that historically results in a new and extended uptrend. We’ll see, but Blackrock is an excellent harbinger of fund flows in the market.

This past week’s hawkish Fed rhetoric was not very reassuring, but rather a full-blown admission that the Federal Reserve got it so wrong that the short end of the yield curve spiked to levels not seen since 1981, while the broader yield curve inverted, fueling talk of a “hard landing” in the second half of 2022.

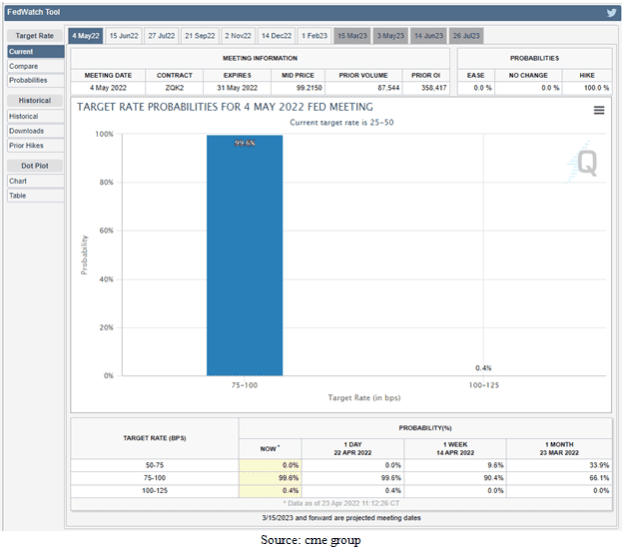

The war in Ukraine, lockdowns in China, soaring inflation, supply chain constraints, and the dereliction of leadership in Washington are at the heart of why the market staged this vote of low confidence. In light of that list, the widespread notion that the market finally “got religion” just because Fed Chairman Jerome Powell telegraphed a 50-basis point increase at the upcoming May 4 FOMC meeting is laughable.

Everyone in the global world of bond trading already knew full well that a half-point hike was a “done deal.” What fueled dragon-sized fear was the notion of a 75-basis point hike followed by further mega-hikes in June and July to attack inflation. That’s what sent the 3-, 5-, and 7-year Treasury yields to 3%.

The latest FedWatch Tool forecast reflects a 99.6% probability of a half-point hike coming next week (May 4), but investors should not be surprised if a three-quarter point increase crosses the tape, given how the bond market is trading. While the FOMC meets only eight times a year, the bond market votes every day, and the market sees inflation staying well above 5% and bond yields adjusting higher as a result.

Key Takeaway: Avoid Bonds – Stick with These Best Stock Sectors

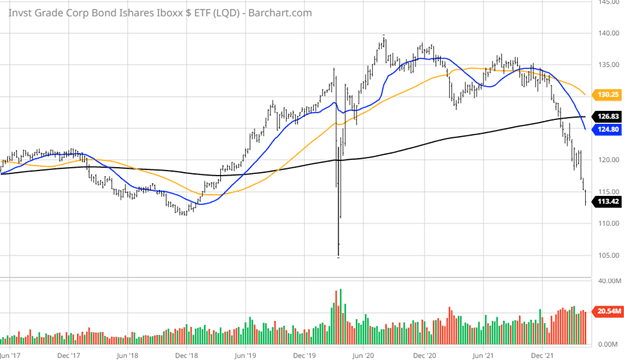

Forget for a minute what’s happening in the stock market. Take a look at the damage being inflicted in the investment-grade corporate bond market (chart, below). And this doesn’t take into account the hundreds of leveraged closed-end funds and bond mutual funds. Rate shock is hitting bond assets everywhere.

CNBC reported last week that there is roughly $55 trillion invested in the U.S. bond market, and $5 trillion has already been vanquished in the past two weeks alone. Imagine when investors get their April brokerage statements showing another 10% hit to their bond holdings’ principle. I believe money will likely fly out of the bond market and right into the very sectors noted below, for defensive safety and yield.

So, how should investors handle this treacherous market landscape? Very simply, I believe we should stay with what has been working. The major averages have been punished to where the selling pressure even got into the knickers of the six most favored sectors – energy, consumer staples, utilities, REITs, agri-business, and healthcare.

When the market finally takes down the most-favored sectors, the broad sell-off, I feel, is likely hitting a climax, or point of exhaustion. That does not mean it is time to pivot back into the stocks and sectors that got the most hammered. My experience is that a washout of the kind we just witnessed provides an attractive entry point for buying energy, staples, utilities, REITs, agri-business, and healthcare stocks on a pullback.

Trying to time peak inflation and the end of quantitative tightening (QT) for a time when the market will embrace its heavily-weighted index components is very uncertain, and all the current forecasts are based on fluid data – which means they aren’t reliable. What matters is where sovereign, endowment, pension, and institutional money flows are buying, so investors can ride the waves when the tides are coming in.

The hot sectors are finally consolidating, so don’t try to be too clever, cute, or try to outsmart the market. Just be in the places that the market wants to own. It’s not that hard, if you follow the big money.

Navellier & Associates owns Blackrock Inc. (BLK) in one account per client request only in managed accounts.

Updated on