The last time I talked to entrepreneur, venture capitalist, and Shark Tank investor Kevin O’Leary, digital assets made up 7% of his investment portfolio. Eight months later and he’s up at 20% percent. Dressed in a bespoke gray suit paired with a collectors’ watch with a red Rubber B sport band, Canada-born visionary investor was seated on a brown leather sofa in Washington DC, ready for our wide-ranging interview on everything from crypto to politics to free speech.

—Are you working on NFTs for luxury watches? I recalled our previous conversation on NFT space and the watch world.

“I am, actually!” he quipped. “I’m interested in authentication, and the aspect of insurance. If I have an NFT of a watch, I can use it to insure just the watches that are not in the vault.”

O’Leary is a timepiece connoisseur with a very large watch collection that comes with a “very expensive” cost of insurance. “I am insuring watches that are on the streets of Zurich. That makes no sense,” he shared his frustration. “I want to self-insure those watches, but I want to insure the 12 or 15 I am traveling with. The only way to do that is with an NFT, with authentication,” he explained. “I can just tell the insurer from the app, these are the ones I have, and they can monitor what countries I’m in. They can price the insurance by the day. There’s so much productivity available with this digitization. So that’s what I’m doing in the watch space.”

White House Correspondent Ksenija Pavlovic Mcateer and Kevin O’Leary

O’Leary has swag and exquisite aesthetic taste, but the amount of business he invested in the domain of digital assets best encapsulates his high-velocity mindset.

“I started buying equity positions in companies like FTX and Circle and using their products as well because I consider them sort of infrastructure plays on crypto, and they’re very advanced in terms of market capitalization,” O’Leary began. “I don’t mind taking risks and new blockchain projects,” he revealed, “but I also want to get some scale in the portfolio. So the larger investments are in the large-cap companies [i.e., a company with a market capitalization value of more than $10 billion]. So all of a sudden, we went up to 20%, which is our maximum in any sector, and we treat it now as if it’s going to be — and I believe that it will be — the 12th sector of the S&P in about ten years.”

Mr. Wonderful does not see anything wrong with “getting some exposure” with his crypto investments. Taught by decades of business experience, he knows that “Not all of it is going to work” but, he explained, “I don’t need all of it to work, I just need four or five of them to work out of the thirty two that I have.”

Kevin O’Leary

Since the first US Congressional hearing on digital assets in December last year, legislators have been starting to pay more attention to this evolving field of financial innovation. O’Leary is watching closely the policy space and has his finger on the pulse of the issue. He believes that regulators in order to be successful should “pick specific projects” instead of trying to regulate all the crypto at once.

“I would really like to see some policy on stablecoins first. The industry can decide if they want to be approved or not. I don’t care. But the whole idea that Senator Pat Toomey (R-Pa.) and Senator Bill Hagerty (R-TN) both contemplated — a 30 day audit, and that underlying assets don’t have a duration of more than 12 months—that would be a good outcome,” O’Leary said, referring to the the Stablecoin Transparency Act and the Stablecoin Trust Act.

The legislation Senator Hagerty introduced in March 2022, the Stablecoin Transparency Act, requires stablecoins to be backed by government securities with maturities of less than 12 months and requires stablecoin issuers to publicly release audited reports of their reserves that are executed by third-party auditors.

In April 2022, Senator Pat Toomey (R-Pa.) released a discussion draft of the Stablecoin TRUST Act that looks to establish a new regulatory framework for stablecoins.

While O’Leary does not own any Luna or Tether he does own Circle Yield stablecoin USD Coin (USDC). “It’s a pretty big position,” he revealed.

O’Leary slams Elizabeth Warren

Kevin O’Leary

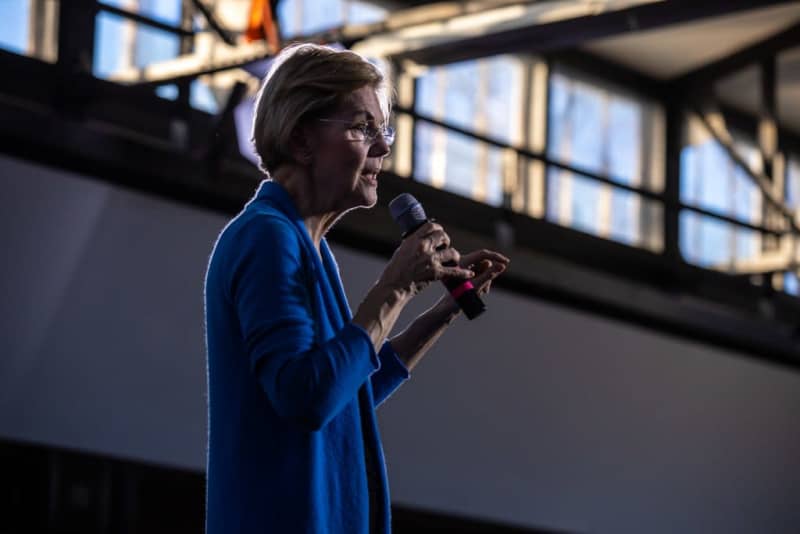

As the legislators on the Hill are getting an education on digital assets and looking into ways to shape the future of financial innovation, Senator Elizabeth Warren has emerged as one of the loudest crypto critics in the US Senate.

Recently, with Minnesota Senator Tina Smith she sent a letter%20Bitcoin%20investments.pdf) to Fidelity attacking the company’s decision to add Bitcoin to its 401(k) investment plan options.

Senator Elizabeth Warren has emerged as one of the loudest crypto critics in the US Senate. (Photo: Elizabeth Warrent/Flickr)

—Why do you think Senator Warren does not understand crypto? I asked.

Senator Warren is a genius in terms of how she commands the press: The more outrageous stuff she says, the more fundraising she can do with the outlandish

Kevin O’Leary

“Senator Warren is a genius in terms of how she commands the press: The more outrageous stuff she says, the more fundraising she can do with the outlandish,” said O’Leary. “I mean, I get it. Will she ever get an opportunity to actually develop policy? Probably not,” she shared his thinking.

“I am not saying she’s a bad person,” O’Leary continued. “She’s not a bad person. It’s just when you take a tact of extremism, you never get to develop policy. You get to get great social media and can raise a bunch of money, but in the back of most people’s minds, they don’t want her running the show. They like her out there, making noise. And that’s what she’s doing.”

Zero carbon crypto mining

As he navigates the field of digital assets, the Canadian powerhouse is venturing into hydro-powered crypto mining, with his latest strategic investment into BitZERO company that harnesses renewable energy within an ESG-driven Zero Carbon Displacement ecosystem aimed at harmonizing relationships between data processing, crypto-mining and the environment.

“We’re doing mining around, because what’s happened is the ESG [Environmental, Social, and Governance] has destroyed the mining industry. Whether that’s good or bad is open for debate. But when I’m investing in mining facilities and data centers now, it’s based on hydro electricity, and nuclear power,” he revealed.

Everybody knows that carbon offsets are bullshit.

Kevin O’Leary

“I have no interest in doing carbon based audits. The reason all these stocks have basically been crushed is that they rely on carbon offsets. And everybody knows that carbon offsets are bullshit, there’s no way you can audit it. You can say I bought an acre of sea bed with grass on it, and I’m offsetting my carbon in my power plant that burns coal. That’s bullshit. And the SEC is calling the industry out on that and saying we’re going to audit it [how they affect the climate]. And of course, no one’s going to survive. So that’s not going to work. As a result, all those stocks got killed.”

BitZero

—What is the solution? I asked.

“So, now the only way to do it is to go to a state like Montana, North Dakota, Tennessee Valley, Florida,” he said adding that “upstate New York is off right now” because of the bill in the NY State Senate that establishes a moratorium on cryptocurrency mining operations that use proof-of-work authentication methods to validate blockchain transactions.

“Our biggest crypto mining facility is in Northern Norway, which has an abundance of hydropower. We’re doing a lot of work there. The company’s called BitZERO, it’s private, but everything they do is 100% zero carbon. So it’s primarily hydro primarily nuclear power,” he shared.

With his business ventures, O’Leary is forward looking.The UK’s new energy strategy is looking at expansion of nuclear energy to assure energy independence. “So is the US. The Turkey Point in Florida just got recommissioned,” said O’Leary. “Nuclear power plants are not being shut down because the administration has figured out, ‘Okay, we made a mistake on oil policy, let’s keep the nuclear power plant store.’”

— Are you open to investing in the UK?

“Yes, absolutely,” affirmed O’Leary. “ If I can get a connection to power at around four cents or less per kilowatt hour, I’m happy to do it.”

Kevin O’Leary offers message for President Biden

The flight of intellectual capital from the US is giving Kevin O’Leary a pause. He does not want to see the smartest Stanford and MIT graduates like Sam Bankman-Fried taking their businesses to the Caribbean. What, I asked him, needs to happen for the governing class to understand that intellectual capital and financial innovation should be kept in the United States?

“Well, right now it’s chaos,” said Kevin O’Leary. “There’s no policy. So these island countries are saying, ‘Well, we’ll give you policy. We’ll give you some rules. And you can build your business here.’ And they’re getting all this capital.They’re building markets from scratch. Meanwhile, we’re sitting around here, trying to figure out what to do. And this is just moving away from us. There’s a lot of intellectual capital going into those places.”

In a recent exclusive interview for the Pavlovic Today, former UK Health Secretary Matt Hancock, said that he wants for the UK to become the European headquarters for exchanges and crypto innovation.

The reason the US should give policy to stablecoins is that a US dollar backed stablecoin would become the reserve currency of the world.

Kevin O’Leary

“There’ll be a lot of competition for this. Because it will become a global, regulated form of currency and form of payment,” said O’Leary.

“The reason the US should give policy to stablecoins is that a US dollar backed stablecoin would become the reserve currency of the world. Everybody would use it, backed by the US dollar, of course. Right now, the world could use something like that.”

O’Leary sees a great potential for the US policy on stablecoins to be prioritized on President Biden’s agenda and even maybe to have different stablecoins, “all with different attributes” that could be licensed.

Algorithmic stablecoins clearly don’t work.

Kevin O’Leary

“Maybe I would use five of them and get a diversification portfolio,” he suggested. “But right now the only one I’m willing to buy is Circle USDC. It’s the one I’ve started with, because I don’t like experimental stablecoins,” he said.

”Algorithmic stablecoins clearly don’t work. Losing 90% of your capital is not stable. And it’s never coming back. I mean, that’s dead. Crypto based, stablecoin seems counterproductive, because then you have the volatility. It’s the US dollar I want to be the backing.”

Kevin O’Leary’s message for President Biden is clear. “The government may not think that crypto policy should be at the top of the mandate, but it shouldn’t be on the bottom either. This is the 12th sector of the economy engine, and the US is starting to fall behind. That’s the message.” He continued, “I think we should probably focus on one project at a time. Let’s give policy to crypto. Let’s give policy to stablecoins first, which is very topical right now, given what happened with Luna. So I would argue that it should be on President Biden’s agenda.”

President Joe Biden in the Roosevelt Room, Wednesday, March 30, 2022, at the White House. ( Photo by Erin Scott)

As America is in the midst of the primary election year, O’Leary’s guess is that the policy shift will happen after the primary elections. “My guess is it will be after the midterms. Because, I think the midterms look pretty ominous for the current administration, not not looking so good. So in fact, if they [Democrats] lose both chambers, I think that will probably help policy,” he said. “I don’t want that to happen,” O’Leary clarified.”I’m just saying what’s obvious to everybody what’s going on here. Every incumbent loses seats in the midterms, regardless what party you are, but this is going to be different. This is going to be brutal,” O’Leary shared his prediction. “It is what it is.”

As the big donors continue to put their money behind crypto-friendly candidates across the United States, O’Leary sees this as an evolving trend going in a good direction.

“What’s happened here in the last two years is that we’re past the tipping point. More than half of the US population is interested in cryptocurrencies as part of their long term investment, and the cat’s out of the bag. Their own representatives now have to listen to that, it’s not a situation where they can ignore it. And so that’s why you see Lummis [Senator Cynthia Lummis (R-WY)] . And that’s why you see Hagerty [ Senator Bill Hagerty (R-TN), Toomey [Senator Pat Toomey (R-PA)] and all these bills coming down, because they’re listening to their constituents, and rightly so. That’s what should be happening.”

I see no reason why I shouldn’t talk to the government.

Kevin O’Leary

O’Leary does not have plans to run for political office again. But does he feel at times that he could just come in and fix things himself?

“I was gonna do that. Obviously, I learned a lesson about that. And I’m glad I did it,” he said about his 2017 run to lead Canada’s Conservative Party.

“I put myself millions of dollars in debt with that thing, and it was expensive. But at the same time, you know, I feel there’s other ways I can interact with the government, as I’m doing now. I visit the senators on the Hill. I work with governors and senators, and I’m going to do the same thing in Canada,” he said.

Kevin O’Leary ( Photo: Daniel St. Louis)

“In jurisdictions where I invest, I see no reason why I shouldn’t talk to the government. I don’t see any reason why I shouldn’t be engaged. And to the extent that they invite me to talk to them, I’m happy to do it. It just makes sense. Because I think in big infrastructure projects, like data mining, like data centers, and infrastructure in power, that’s all government-based. And so I want to work with them. I can bring a lot to the table, certainly, in terms of capital. It’s a different form of engagement with the government, but it’s more what I do. I like to invest capital and to figure out where to deploy my money.”

In August 2021, O’Leary decided to make a long-term investment and spokesperson partnership with FTX. Sam Bankman-Fried, Founder and CEO of FTX, shared his excitement “to have a true icon” in their corner.

Sam Bankman has a different vision of how capitalism works and I think it’s a very healthy one.

Kevin O’Leary

As Sam Bankman-Fried continues to make bold moves in digital assets and philanthropy, I was curious what O’Leary would say that makes Bankman a superstar in financial innovation.

“Sam Bankman has a different vision of how capitalism works and I think it’s a very healthy one. First of all, he’s a very good trader. But he also wants to use his prowess to give back and that I think comes from his family culture,” shared Mr.Wonderful.

The crypto titan, Sam Bankman-Fried, the founder and CEO of the FTX crypto exchange / Photo: John Roach (RBP)

“I’ve met his father and his mother. It’s very much how they think. They’re professors. They want Sam to do good things. And he’s done great things. But he’s also creating an industry. He’s one of the top five players along with Binance, Circle, and probably you could count five big players, Coinbase,” said O’Leary.

“I mean, these guys really created this industry from scratch. I’m happy to work with them. It’s great to be around that kind of genius. It’s just very enjoyable. I talk to him, he’s got a different view on things and I have to respect that because he’s been wildly successful. So I’m very happy to be an investor.”

Kevin O’Leary says Twitter “is not worth” $54 a share

Kevin O’Leary does not take refuge in popular consensus. He does not dance around his views, and as a result makes everyone around him comfortable to speak their mind. To the investment world, O’Leary “did not come to make friends,” perhaps because he knows what he is talking about when he says, “I’ve made money with assholes, lots of them.”

“I respect execution skills, not social skills. I respect someone who’s able to take a mandate and execute on it.” Execution skills are, according to O’Leary, “extremely valuable, and very hard to find.” When he finds someone who has them, O’Leary says he “never let them go.”

We should understand that we can never stamp out the lunatic fringe. They’re there because we have free speech.

Kevin O’Leary

The Canadian powerhouse is trying to empower entrepreneurs, and “many of them are eclectic people that would not fit on the likability scale.” He knows that people want to criticize, but he“couldn’t care less” about it.

—How important is free speech to you? I put a question to O’Leary, uncensored.

“It’s very important,” he responded without hesitation. “I’ve lived in places where you don’t have any,” he recalled.

“To have free speech, you have to deal with the lunatic fringe because they get a voice too. It’s 2% to 3% of what you’d say, ‘Yes, it’s very radical,’ but I’m happy to pay that price, as long as the other 97% has true free speech. We should understand that we can never stamp out the lunatic fringe. They’re there because we have free speech. And that is the tax on free speech.” He paused. “You can never talk me into a place where I’m gonna let somebody else decide what I can say. That’s never going to happen. No matter whatever that price is, I don’t care. I don’t want somebody curating my content.”

—So you support this transition of Elon Musk overtaking Twitter?

“Yes,” O’Leary affirmed.” I don’t know if that deal is going to happen. I don’t think Twitter is worth 54 bucks a share; it’s probably worth $12. I mean, everything else is corrected 60, 70%. So I don’t think you should pay $54 for it, but I’m sure he’ll figure that out,” he shared his thoughts on Twitter acquisition.

“But I support Elon’s mandate to open it up. And I’ll decide what I want to read. I will decide. I personally will decide,” he affirmed the notion that he would neither hold back nor deny himself the right to say, hear and read something. “Nobody else will decide it for me.”

In Kevin O’Leary’s lexicon, the word censorship is not listed. The dialog continues. He would not have it any other way.