Q1 2022 hedge fund letters, conferences and more

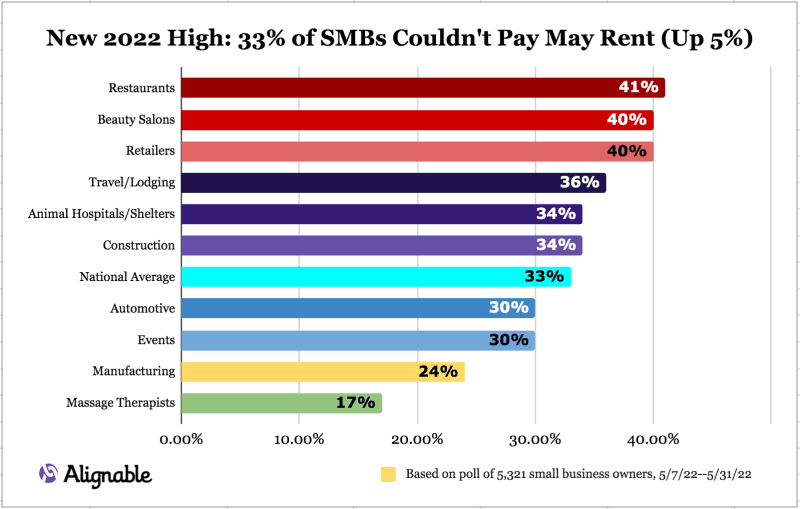

- 33% of all U.S. small businesses (SMBs) could not pay their May rent in full and on time, up 5% from Apr. This is the highest rate of U.S. rent delinquency among SMBs this year.

- Even more alarming, 56% of minority-owned businesses couldn’t afford May rent, up 20% from Apr. This is the highest rent delinquency rate for minority SMB owners since March 2021.

- States with the highest rent delinquency rates include MA (42%), GA (40%), NY (35%), CA (35%), MI (35%), & TX (35%). Rates increased dramatically in MA, GA, NY, TX and FL from Apr. to May.

- Rent issues abound for many sectors, including 41% of Restaurants, 40% of Beauty Salons, & 40% of Retailers. Restaurants, retailers and others reached new levels of 2022 rent delinquency in May.

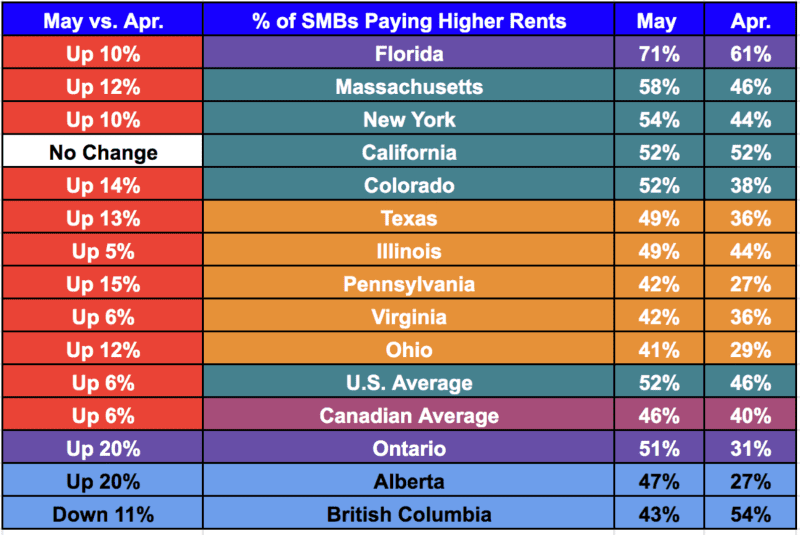

- One reason for increased delinquency rates is that rents are skyrocketing across the U.S. and Canada among the majority of small businesses. In May, 52% of all U.S. SMB owners reported higher rent costs, up 6% from 46% in April, breaking yet another rent crisis record.

- States with the largest percentage of SMBs reporting rent price increases include FL (71%), MA (58%), NY (54%), CA (52%), & CO (52%).

To see the full report, go here.

Updated on