Del Principe O’Brien Financial Advisors commentary for the month ended March 2022, discussing their holdings in Salesforce Inc (NYSE:CRM), MarketAxess Holdings Inc. (NASDAQ:MKTX), PayPal Holdings Inc (NASDAQ:PYPL), and Warner Bros Discovery Inc (NASDAQ:WBD).

Dear Fellow Investors,

“You make most of your money in a bear market, you just don’t realize it at the time.” – Shelby Cullom Davis

Q1 2022 hedge fund letters, conferences and more

As we reflect on the previous year, let us reiterate that the philosophy of

Del Principe|O’Brien has remained, and will remain, consistent over time. We take a value-driven, quality-based, and analytical approach to investing, which allows us to create market-resilient portfolios. Our origins run deep into the tenets of value investing. We consider ourselves dyed-in-the-wool value investors. To us, losing money is nothing short of a catastrophe. To avoid such calamities, we demand a significant margin of safety, which means choosing value over price and concentrating our capital on our most promising ideas.

We also believe that securities are minority interests in real businesses. We must think and act like business owners. We look for simple and easy businesses to understand, have durable qualities of high value, and are run by competent and trustworthy managers. We view ourselves as business analysts, not traders or speculators. We do not concern ourselves with quarterly projections or short-term fluctuations in stock price, and those variables do not hold weight in our long-term thinking. We welcome such turbulence. As Ben Graham, one of our investment heroes, said so eloquently, “Investment is most intelligent when it is most businesslike.”

Timeless Wisdom from the Oracle of Omaha

“If a moody fellow with a farm bordering my property yelled out a price every day to me at which he would either buy my farm or sell me his – and those prices varied widely over short periods of time depending on his mental state – how in the world could I be other than benefited by his erratic behavior? If his daily shout-out was ridiculously low, and I had some spare cash, I would buy his farm. If the number he yelled was absurdly high, I could either sell to him or just go on farming.

Owners of stocks, however, too often let the capricious and often irrational behavior of their fellow owners cause them to behave irrationally as well. Because there is so much chatter about markets, the economy, interest rates, price behavior of stocks, etc., some investors believe it is important to listen to pundits – and, worse yet, important to consider acting upon their comments.

Those people who can sit quietly for decades when they own a farm or apartment house too often become frenetic when they are exposed to a stream of stock quotations and accompanying commentators delivering an implied message of “Don’t just sit there, do something.” For these investors, liquidity is transformed from the unqualified benefit it should be to a curse.

A “flash crash” or some other extreme market fluctuation can’t hurt an investor any more than an erratic and mouthy neighbor can hurt my farm investment. Indeed, tumbling markets can be helpful to the true investor if he has cash available when prices get far out of line with values. A climate of fear is your friend when investing; a euphoric world is your enemy.”

\- Warren Buffett 2013 Berkshire Hathaway Letter

News From JDP Portfolio

An essential component of our philosophy is focusing on the underlying value of the companies we invest in. We believe that it is pertinent for you to understand why we own them and what the potential risks may be. Here are a few brief sketches of the companies in our portfolio.

Salesforce.com, Inc. (CRM) | Ownership: 1%– 8%

We have invested in Salesforce Inc (NYSE:CRM) after the pullback of more the 30%. CRM (Customer Relationship Management) was founded in 1999 by current CEO Marc Benioff and three co-founders. CRM is a technology platform for managing your company’s relationships and interactions with customers and potential customers.

If you invested $1000 in Salesforce on October 1, 2014, it would have been $4,091 on February of 2022, while the same $1000 invested in the S&P would be $2,336. The CAGR (Compound Annual Growth Rate) for Salesforce during that time was 21%. Salesforce’s reported revenue in 2014 was $4.1 billion. The estimated 2022 revenue will be around $26.35 billion. The CAGR of revenue over the last 8 years has been 26%.

(Note: Salesforce is currently in the 4th quarter of fiscal year 2022.)

(See Chart below. Source: Salesforce Investor Day 2021)

MarketAxess Holdings Inc. (MKTX) | Ownership: 1%– 8%

MarketAxess Holdings Inc. (NASDAQ:MKTX), together with its subsidiaries, operates an electronic trading platform for institutional investors and broker-dealer firms worldwide. It offers access to global liquidity in U.S. investment-grade bonds, U.S. high-yield bonds, U.S. Treasuries, municipal bonds, emerging market debt, Eurobonds, and other fixed-income securities. Founder, Chairman, and Chief Executive Officer Rick McVey originally proposed the business model for MarketAxess in 1999 as part of JP Morgan’s Lab program and raised $24 million in capital. In 2000, MarketAxess was launched as an independent venture.

Timeline:

- 2001 - acquires TradingEdge, a full-service electronic platform serving the high yield, emerging market, corporate, and convertible bond markets

- 2002 - introduces bid/offer list trading technology and launches Corporate BondTicker

- 2006 - surpasses $1 trillion in total credit volume traded since inception

- 2008 - expands global dealer liquidity pool to over 90 primary, regional, and specialist dealers

- 2009 - breaks $100 million in revenue for the year

- 2011 - surpasses $500 billion in annual volume for the first time

- 2013 - acquired Trax® to deliver innovative fixed income post-trade and data solutions to the European investor and broker-dealer communities

- 2014 - breaks $250 million in revenue for the year

- 2016 - surpasses $1 trillion in annual credit volume for the first time

- 2019 - wins Waters Technology Rankings Award for “Best Artificial Intelligence Technology Provider”

Under his leadership, MarketAxess has emerged as the leading electronic platform for corporate bonds, creating an efficient and competitive marketplace for 1,800+ global institutional investors and broker-dealer firms to trade a broad range of credit products. MarketAxess has a market capitalization of approximately $14 billion as of January 2022.

As you can see from the chart below, MarketAxess Operating Profit has more than quadrupled over the last ten years while maintaining a 50+% Operating Margin. Because of the high barriers to entry, this has created a wide moat and duopolistic industry.

PayPal Holdings, Inc. (PYPL) | Ownership: 1%– 6%

This month, we initiated a long position in PayPal Holdings Inc (NASDAQ:PYPL), a platform that enables digital payments for consumers and merchants across the globe with a market capitalization of $130 billion. They offer payment solutions under PayPal, PayPal Credit, Braintree, Venmo, Xoom, Zettle, Hyperwallet, Honey, and Paidy. PayPal's payment platform allows users to send and receive payments in nearly 200 markets and 100 currencies, withdraw money from their bank accounts in 56 currencies, and manage their PayPal accounts in 25 currencies. Having a net revenue of $25.3 billion, PYPL generates nearly $6 billion in FCF (Free Cash Flow). They have one of the largest global digital donation platforms, supporting 1.4 million nonprofits. In 2021, the PayPal community donated approximately $19.6 billion to nonprofits and causes.

In 2021, they gained 49 million NNA’s (Net New Active Accounts) with 426 million active accounts and 34 million merchants using the iconic PayPal checkout button online. PayPal is the most accepted digital wallet in the industry by a large margin.

The following is a breakdown of the acceptance rate among the 1,500 most significant online retailers across North America and Europe:

Warner Bros. Discovery (DISCA) | Ownership: 2%– 12% (Merger)

AT&T will spin-off Warner Bros into Discovery Inc. The new company Warner Bros. Discovery will be a pure-play content company with nearly 200,000 hours of iconic programming, owning one of the largest libraries in the world, with over 100 of the world's most trusted brands. These include HBO, Warner Bros., DC Comics, Cartoon Network, HGTV, Food Network, the Turner Networks, TNT, TBS, Eurosport, Magnolia, TLC, Animal Planet, ID, and many others. With HBO Max and the recently launched Discovery+, Warner Bros. Discovery will have more than 100 million subscribers while spending $20 billion a year on content. WarnerMedia's storied library of valuable IP (Intellectual Property) will be combined with Discovery's global reach, local language content, deep regional expertise, and a trove of content in over 200 countries.

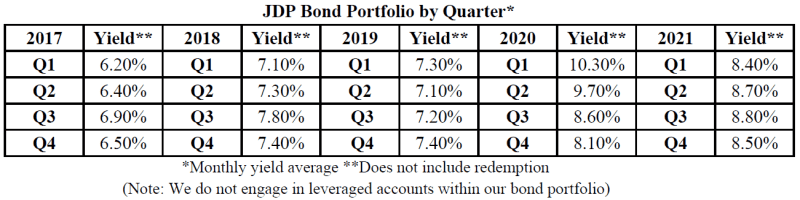

JDP Bond Portfolio

The following table provides a summary of how the JDP Bond Portfolio has performed on average over the last five years:

Due to the end of the largest Federal Reserve bond-buying program ever, we have been consolidating our portfolios. We are doing this by shortening our bond ladder and continuing to focus on quality fundamentals. It is just one way in which we combat inflation risk. Several of the bonds within our portfolio are trading at a premium. We continue to realize gains when they become substantially overvalued, though we do not include this in our bond yield numbers.

Also worth noting: Because of the timing in which the bonds in our portfolio pay, our June and December yield disbursements are equal to the other 10 months. We do not purchase bonds based on the payment of the coupon date; we purchase bonds based on what they pay (coupon), if they will pay (quality), and their yield (value).

“You have power over your mind, not outside events. Realize this, and you will find strength.” - Marcus Aurelius

Continuously dealing with uncertainty and volatility isn't the most comfortable experience. Nevertheless, we can take heart in the fact that adversity cultivates resilience, and resilience only makes us stronger. Rest assured that we are your true partners in this; we are investing our capital right alongside yours. Thank you for trusting the process and for trusting us. We will always work hard to remain worthy of your trust.

Cordially,

Joseph Del Principe

Updated on