S&P 500 took decisively to the downside late yesterday, and credit markets followed. No risk-on positioning, but selling across the board broadly translating into stock market weakness. Great for the bears, let the open profits grow.

How about today‘s CPI – would the reasonably hot data be viewed as an opprotunity to buy? Very counterintuitive but the dip buyers also appeared right after yesterday‘s open. My primary scenario remains that any buying would fizzle out as we have lower lows to make still in this downswing – nothing against bear market rallies, but we‘re too early on in the tightening, and there is still much focus on inflation as opposed on the increasing real aconomy pain when manufacturing growth can grind to a standstill over the next few months easily.

Q1 2022 hedge fund letters, conferences and more

The tough headwinds in positioning for today, can be seen in precious metals and cryptos – setbacks in both as the market pressure on the Fed to raise, goes on. Even the ECB indicated that it‘s a journey beyond July – big words from eurozone on sunsetting negative interest rates. Coupled with crude oil resilience around $122, the odds continue favoring stock market bears.

Before wishing you a great weekend, two charts to illustrate that amply - stocks:

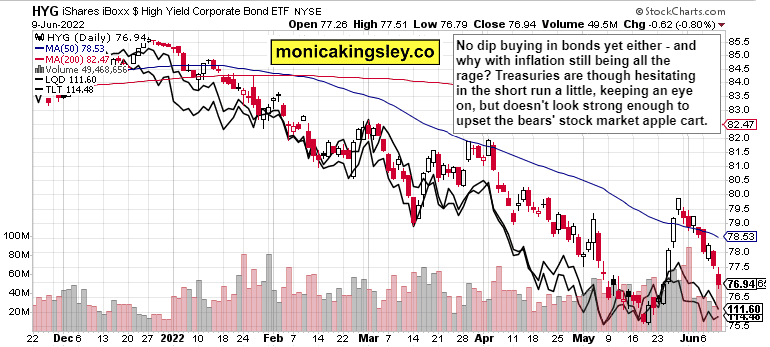

and bonds:

Thank you,

__Monica Kingsley

__

__Stock Trading Signals

__

Gold Trading Signals

__Oil Trading Signals

__

__Copper Trading Signals

__

__Bitcoin Trading Signals

__

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

Updated on