S&P 500 overdue relief rally – flat, lacking significant momentum, not internally at its strongest – is here. Instead of projecting any healthy bear market rally targets (numbers around 10% are often thrown around), I‘m afraid that time it takes to ignite, would become a larger concern for the bulls. True, not enough have been sucked in, but buy the dip mentality is still there – we‘re now at a crossroads between either a very shallow reprieve protracted in time, or going more than a couple dozen points higher still. Just when the trap is ready, sellers would show up – the sentiment is still relatively bearish though – and that‘s an ally of today‘s bulls.

Q1 2022 hedge fund letters, conferences and more

Similarly to the precious metals, the risks of being out of the market outweigh those of being in. Just as I‘m not counting on a true slide in gold (or even silver, where the outlook is worse) no matter the miners‘ weakness, I think in stocks the rally would give way to a fresh downleg. Yesterday‘s 3,740s aren‘t a demonstration of convincing strength – liquidity keeps biting. I don‘t see the dollar as retreating much. Treasuries are lifting the pressure on the Fed to hike somewhat, but this reprieve looks to be temporary. The retreat in commodities isn‘t lighting up the fuse beneath value, and tech doesn‘t react to yields declining – something is amiss here, and would become apparent in the next 2%+ red day.

Cryptos keep highlighting the woes – there is no tide to lift all boats anymore. Once the Fed repo facilities rush gets complemented by money market fund inflows, we‘re in for another tightening engine firing up. The incentive is there, the move not yet so – which could change as fast as inflation expectations becoming (having become) unanchored. Crude oil still doesn‘t have topped, and similarly to my recent copper turn, crude oil is panning out well.

S&P 500 and Nasdaq Outlook

Still the short-term possibility with room overhead, but it would be up to the internals to decide the upswing‘s fate. The 3,830s zone is getting tested, and bulls would likely close above it today.

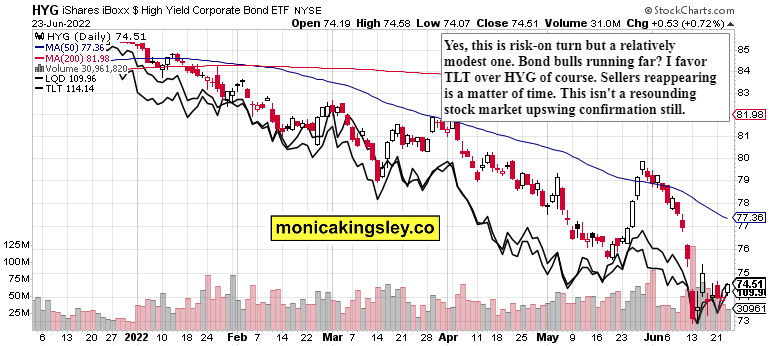

Credit Markets

Bonds look tired, and the quality ones haven‘t risen nearly enough. This is so different from the prior bear market rally circumstances...

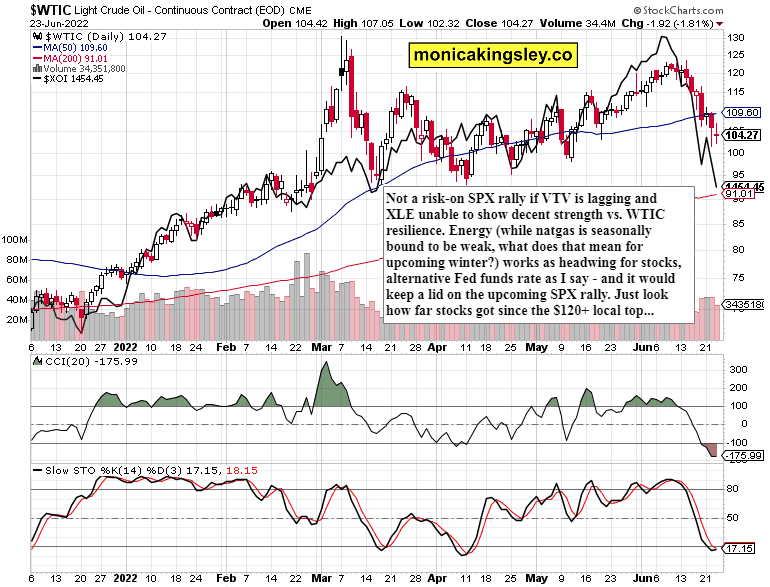

Crude Oil

Oil got too cheap, too fast – while there isn‘t enough (there isn‘t any) systemic deterioration in the real economy (or finance) to speak of just yet. Sellers are disappearing – and the tide is ready to turn.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

Updated on