For weekend reading, Gary Alexander, senior writer at Navellier & Associates, offers the following commentary:

It’s humbling to realize that it took 205 years for our Republic to roll up its first $1 trillion in accumulated federal debt. At the close of Fiscal Year 1981, on September 30, 1981, the Reagan White House released the news that the U.S. national debt crossed $1 trillion for the first time.

At the time, I was working in the shadow of the Capitol, in Alexandria, Virginia as Consulting Editor for Personal Finance newsletter and manager of Alexandria House books for KCI Publications. In our editorial meetings, we debated whether the Republic could survive a debt load as huge as $1 trillion.

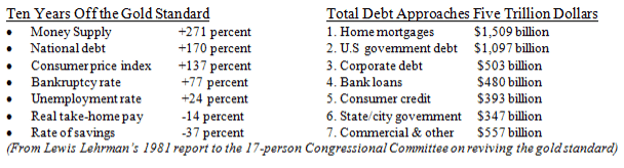

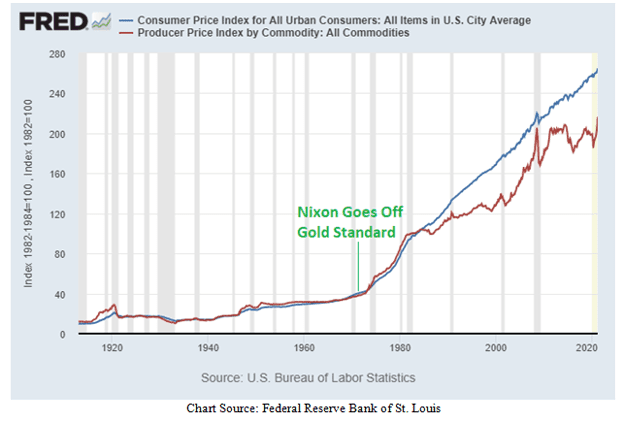

That month also marked 10 years off the gold standard after President Nixon closed the gold window on August 15, 1971. In my October 1981 edition of “Alexander’s Monthly Economic Newsletter” (AMEN), I quoted Lewis Lehrman’s litany of financial follies in the intervening decade of September 1971-1981:

Needless to say, we were outraged at this huge level of public debt, as were about 2,000 attendees at the 8 (November 18-22) 1981 New Orleans Investment conference – my first of 40 straight appearances.

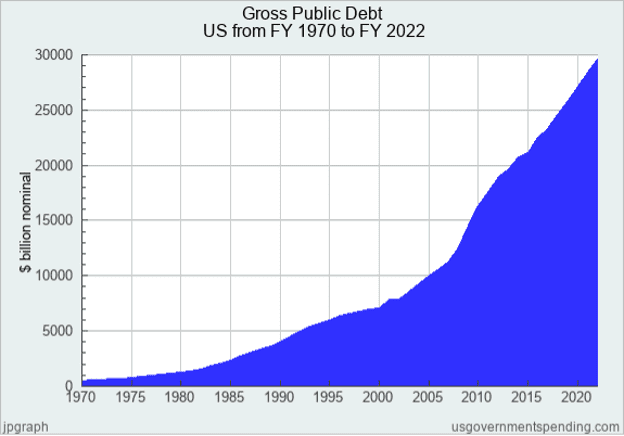

Little did I know that the rate of federal debt accumulation would accelerate rapidly in the next 40 years.

- After 205 for the first $1 trillion, it took just 15 years to reach $5 trillion in total debt, in 1996.

- It took another 12 years to add the next $5 trillion, reaching $10 trillion in debt in 2008.

- It took only 4 years to add the next $5 trillion, reaching $15 trillion in 2012 in Obama’s first term.

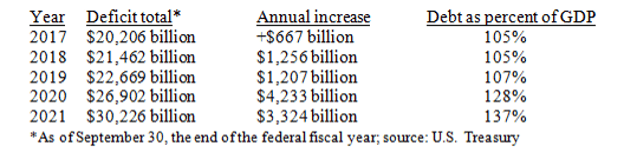

- It took five years to add the next $5 trillion: On September 7, 2017, the federal debt exceeded $20 trillion. The CBO projected debt would reach $25 trillion by 2027, but we hit $25 trillion in 2020.

We’ve seen a $10 trillion increase in just four years, from September 30, 2017, to September 30, 2021. The Congressional Budget Office predicted we would only gain $5 billion by 2027, not $10 billion by 2021.

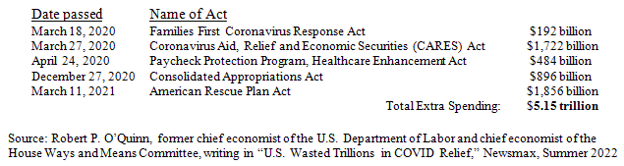

The main culprit in the 2020-2021 gain was a flood of new money caused by federal spending. During the pandemic, Congress passed over $5 trillion of extra spending bills, above and beyond normal spending:

This level of spending was greatly excessive. Beyond the second quarter of 2020, there was no recession requiring a “stimulus.” The economy was booming by late 2020 and in all of 2021. Much of this money went to states that were in surplus and didn’t need the cash. Paycheck “protection” or relief went to tens of millions of families that remained gainfully employed and did not need the money, working from home with savings from no commuting and limited travel and shopping or dining out. (My three children were all gainfully employed in good-paying jobs during the pandemic, yet all three received federal “relief.”)

This infusion of new money is the major source of 2022 inflation. The war in Ukraine has driven up food and fuel prices some more, but the trend was already well established before the Russian tanks first rolled into Ukraine on February 24, 2022. The Fed abandoned all monetary restraints, and that fueled inflation.

As this chart shows, our debt began to mushroom after 2001, and then faster after 2008. Since 2008, the Fed has kept interest rates near zero in 10 of 14 years, fearing to take much risk. Something destroyed our confidence and hope. The Fed launched several rounds of quantitative easing, as if America can’t survive without free monetary infusions at zero interest. There’s a certain feeling that we are a fragile nation and can’t risk anything like normal interest rates at 3% or more, or normal (slow) accumulation of money.

In some ways, it seems, the terrorists have won, scaring America from travel, scaring us from being the daring nation we once were. Our leaders have coddled us with low rates, free money, and checks we don’t need, locking us down from a disease that barely touched young Americans of school and working age.

At America’s 246 birthday, we need to ask if we can make it to 250 with such a fearful national attitude.

The best news I can leave you with is that the debt load is far worse in over-extended China, with a 300% debt-to-GDP ratio, as well as Japan and most of Europe, so the U.S. may be the debtor least likely to fail.

Updated on