Lines sold his entire ChargePoint stake in recent months

On Tuesday evening after market close, American EV infrastructure provider ChargePoint Holdings Inc (NYSE:CHPT) filed a Form 4 with the US S and Exchange Commission regarding share sales by director Michael Linse. The transaction was first seen in Fintel’s insider trading tracker on Tuesday evening.

ChargePoint’s Director Sells Shares

Lines sold 1.7 million shares at $13.57 per share on average for a total consideration $23 million.

Linse sold the shares via the two funds where he is managing director and founder called Linse Capital and Levitate Capital.

Q2 2022 hedge fund letters, conferences and more

The bulk of the sale occurred in the Linse Capital fund which sold 1,684,458 shares at $13.57. Levitate Capital sold the balance of 12,188 shares at $13.61 each on average.

The sale comes after ChargePoint’s share price failed to hold a 70% gain from annual lows below $10 per share seen in early May.

Linse sold the shares on the 7th of July when the stock rallied ten percent resuming its downtrend.

The last time Michael Linse had sold ChargePoint was in April, when he dumped 1.66 million shares were sold at about $15.50 per share.

According to the form 4, Linse now beneficially owns no shares in the company.

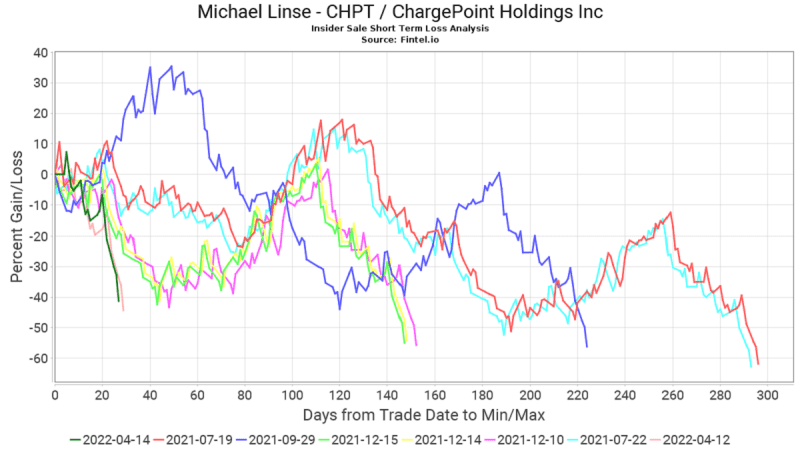

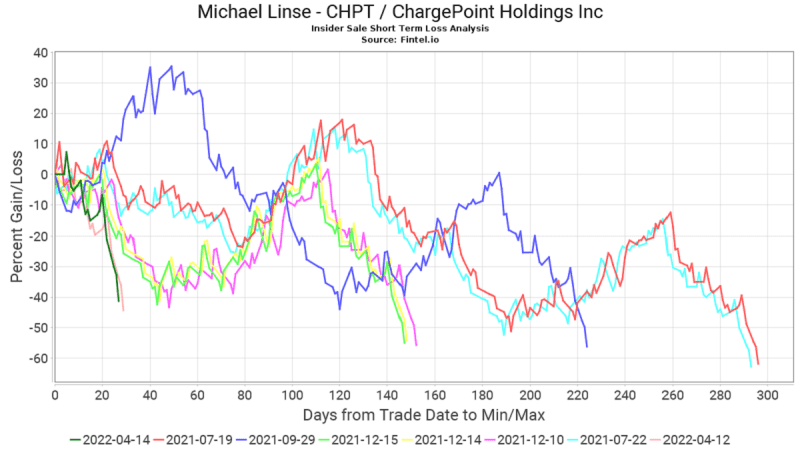

Linse has been very successful in avoiding further potential capital losses by selling down the funds positions in CHPT over the past 2 years. The graph to the right illustrates the short term losses that were avoided by each main parcel of sales that occurred.

Linse’s sale is one of many insiders who have sold stock over the last 90 days. According to Fintel research, CHPT has had 11 net insiders who have sold stock during this period.

The high level of insider sales in the stock are the primary reason why CHPT has a bearish insider accumulation score of 5.23.

Other news for ChargePoint in July included the filing of a mixed shelf S-3 registration by the company worth $1 billion.

The filing included a $500 million share sales agreement with institutions Goldman Sachs, Oppenheimer and Cowen. This has prepared the market for an equity raising at some point in the future.

In the month preceding, institution B Riley securities initiated coverage on the stock with a ‘buy’ recommendation and $20 target price. Analyst Christopher Souther noted that the bullish rating and price target was based on the company’s dominant market share, established brand and clear growth strategy.

Souther in the report highlighted that the company has over 70% market share in networked (level 2) in North America and about 5,000 commercial and fleet customers globally.

The analyst likes the businesses capital-light growth model as customers usually own their charging stations. This allows the company to focus on developing further products, focus on acquiring customers and public policy on the sector.

Analyst Bill Peterson and JP Morgan released an update on the company after hosting CHPT’s CEO, Pasquale Romano at their Energy, Power and Renewables conference. Following the conference, the firm came away noting that ChargePoint’s growth is broadly tied to EV adoption over the longer term but is growing faster than EV arrivals in the near-term by targeting the European market and other fleet opportunities.

Overall, CHPT holds a consensus ‘overweight’ recommendation and $23 price target which implies almost 100% upside in the share price.

Article by Ben Ward, Fintel

Updated on