Executive Summary

Hedge fund performance declined month-on-month in June, with Multi-Strategy funds among the hardest hit of all strategies.

Performance

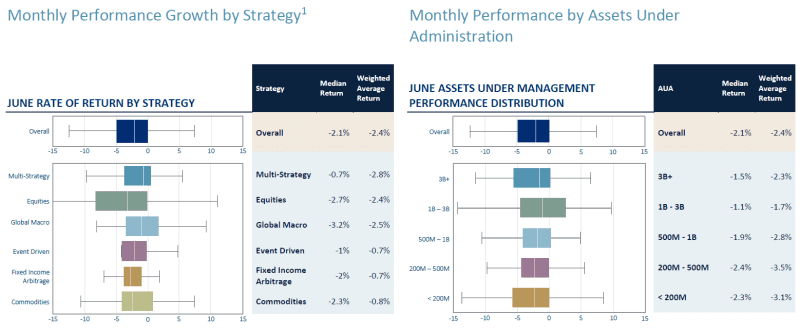

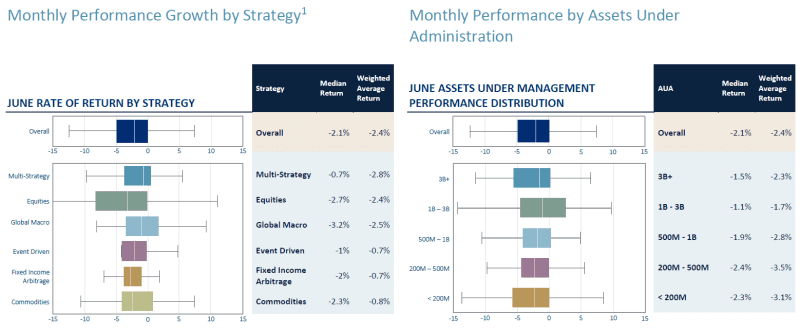

The overall weighted average return for hedge funds administered by the Citco group of companies (Citco companies) was -2.4% in June, worse than the -1.1% seen the previous month, as all strategies and fund sizes saw losses.

Q2 2022 hedge fund letters, conferences and more

Multi-Strategy funds saw the worst losses with a return of -2.8%, with Equities and Fixed Income Arbitrage the next worst at -2.5% and -2.4% respectively. Event-Driven and Global Macro funds held up the best in the face of declines but still experienced losses, with negative returns of -0.7% each.

At a fund size level, the smallest funds found themselves struggling the most, with $200-$500m funds seeing negative performance of -3.5%, and funds under $200m close behind at -3.1%.

Having been one of the few categories to deliver positive performance in May, $1-3B funds had the best performance in June, albeit with a loss of -1.3%.

Meanwhile, the gap between this month’s weighted average return of -2.4% and the median return of -2.1% indicated worse performance in larger funds.

In an all-round negative month, there was also a drop in the number of funds delivering positive returns. Just 28.5% of funds had positive returns in June, compared to 42.4% of funds in May.

Capital Flows

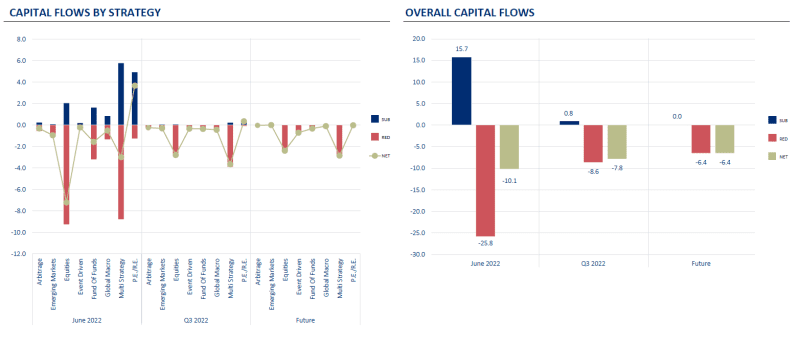

Hedge funds administered by Citco companies saw net redemptions in June as investors withdrew funds from all AUA buckets and most strategy types.

Even as inflows jumped to $15.7B, more than 50% higher than May, redemptions also spiked at $25.8B, resulting in total net outflows of $10.1B.

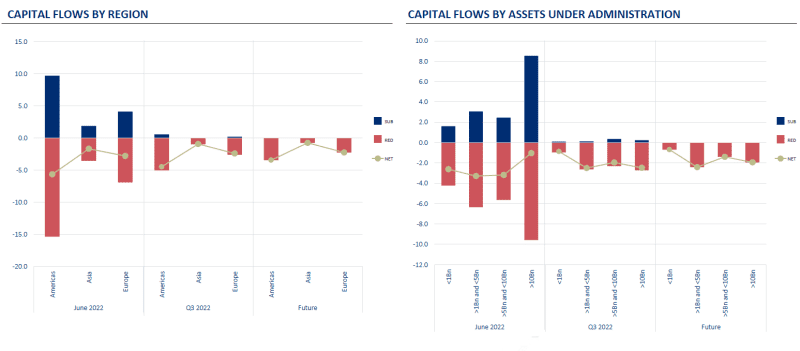

The largest funds with more than $10B of assets saw the lowest net redemptions overall at $1B, while funds with between $1B-$5B and $5B-$10B saw the largest net outflows, with investors withdrawing $3.3B and $3.2B respectively.

At a strategy level, Hybrid strategies saw overall net inflows jump to $3.7B, continuing May’s positive trend. However, all other strategies saw net redemptions in June, with Equities and Multi-Strategy funds accounting for the vast majority of redemptions. Equities saw the biggest net outflows of $7.2B, while Multi-Strategy saw net redemptions of $3B.

On a regional basis, all three regions saw net redemptions, with funds serviced the Americas experiencing $5.7B of net outflows, European serviced funds seeing $2.8B, and Asia serviced funds accounting for the final $1.7B of net redemptions.

For future dates we show redemptions of $7.8B currently forecast for the third quarter, and $6.4B expected at the end of the year.

Deep Dive On Automation - Citco Speaks To Aima On Future Proofing Asset Servicing

Last month, in an article for the Q2 edition of the AIMA Journal, Tim Mietus, Senior Executive Vice President of Innovation, Citco Technology Management, Inc. discussed automation in the asset servicing industry.

Looking at different machine learning technologies, Tim asked whether machine learning \- whereby humans not only train computers to mimic human tasks, but also learn through experiences to optimize processes - is essential for the asset servicing industry as it continues to grow.

While Natural Language Processing (NLP) and Robotic Process Automation (RPA) are already changing the way we do business, Tim gave examples of how machine learning could also have an impact on asset servicing.

Our Services

We are delighted to now be in a position where 100% of our staff are approved to work from our offices, with all 41 of our locations around the globe fully open. While the situation remains fluid in many regions, and as we continue to follow guidelines around the world and adjust our office staffing policies accordingly, it is nonetheless great to be back in the position we were in prior to the pandemic.

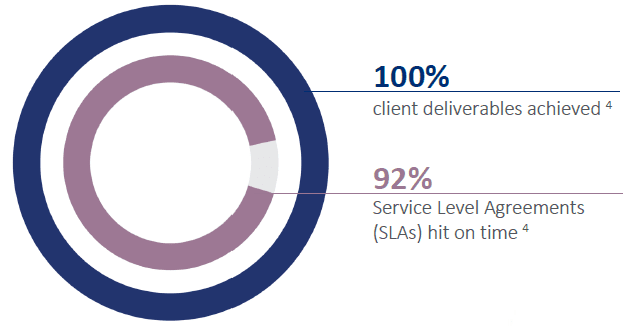

In June, 100% of client deliverables were achieved, with 92% of SLAs hit on time, totaling some 2,678 specific service goals.

Performance

Overview of Investor Flows

Insights into Trade Volumes

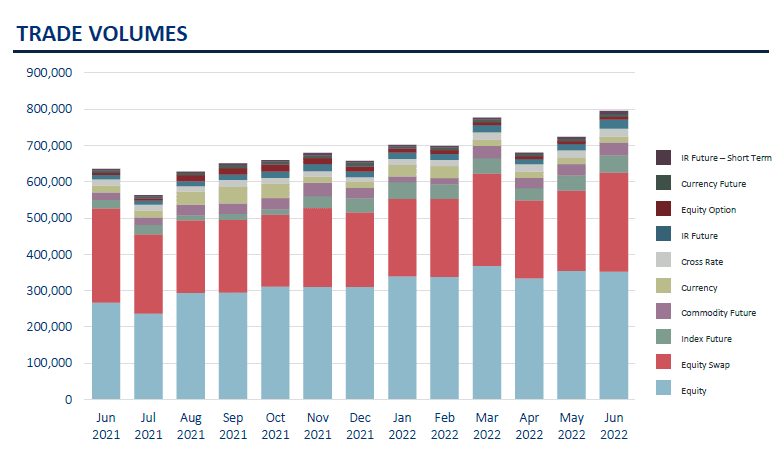

June trade volumes were the highest on record for Citco, up 9.8% month-on-month, and 2.2% higher than the previous peak in March of this year. The increase in trades was largely caused by market volatility, particularly in the crypto-currency space. Overall, average volatility was at 28.18 in June for the VIX Index, just below the peak for 2022 so far – which was seen last month, when the index hit 29.25.

The trend from May continued in June, with a combination of volatility - as well as new opportunities - causing a jump in trade activity across our hedge fund client base.

In terms of product mix, volumes in most classes were up, with Equities, Equity Swaps/ CFDs, and Commodity, Indices and Currency Futures all among the asset classes seeing the biggest increases. Citco’s trade ingestion STP rate for June was 98.3%.

Insights into Payments, Treasury and Collateral

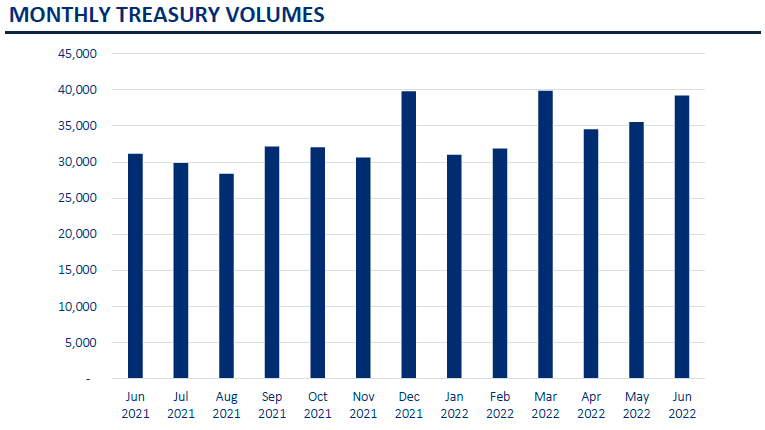

Ongoing market volatility and soaring trading volumes meant treasury volumes jumped back near to a record peak in June to round off our busiest quarter ever.

Having seen elevated volumes in April and May which were substantially above the average for the year, volumes rose back near to the 40,000 mark in June. Overall, compared to the second quarter of 2021, this year’s treasury volumes are 25% higher on average.

Volumes are up substantially as we continue to see high levels of OTC settlements as well as margin moves (both in terms of Variation Margin and Initial Margin), while cash also continues to be deployed to offset the volatility and uncertainty we are seeing in markets.

Service Level Summary

Updated on