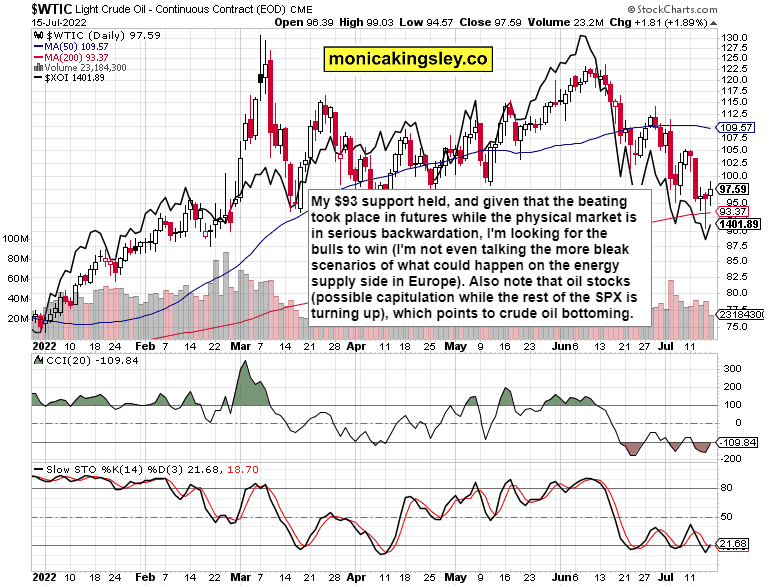

S&P 500 ended a losing streak thanks to the still fine retail sales data, and even consumer confidence edged up. In the flattening yield curve characterizing the move to a slow growth phase, it was (and will be) up to tech to outperform value. Also healthcare is likely to see brighter times ahead. If I were to pick two reasons for why I think stocks are bottoming here, it would be the risk-on turn in bonds accompanied by the 10-year yield soundly below 3.25%, and the capitulation in oil stocks (former star performer as these are likely to get pulled down among the last sectors while the key laggards such as tech are on the verge of starting to outperform) coupled with oil holding my $93 support.

Q2 2022 hedge fund letters, conferences and more

[This is approximately where I do imagine the end of freely available introduction of extensive articles, which would then be enriched with select chart section(s). Today exceptionally and only, I‘ll be making the full introduction available so that you can see what kind of a key analysis the premium subscribers get.]

True, economic growth is slowing, and we are likely to get a slightly negative Q2 GDP reading, but given the way GDP is constructed (this setback would be driven by inventories and trade balance), I don‘t see NBER as likely to declare the U.S. to be in a recession. Europe, that‘s another story entirely – in the worst case that the Fed doesn‘t succeed in its soft landing, we‘re looking at an early 2023 U.S. recession – regardless of the housing turmoil gathering steam, the States are largely insulated from the darkening clouds worldwide. I‘m looking for a quite good Q4 of S&P 500 gains, but at the same time, remember that the current bottoming is a process, and I view the approaching washout (give it 2 weeks to start roughly) as the likeliest scenario still. So, enjoy the positive seasonality of a few good weeks of July still ahead.

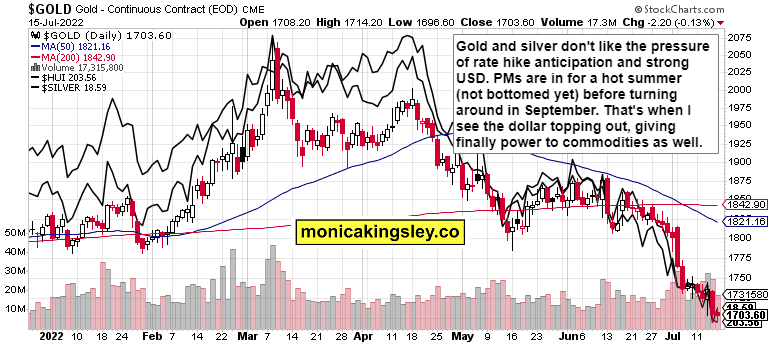

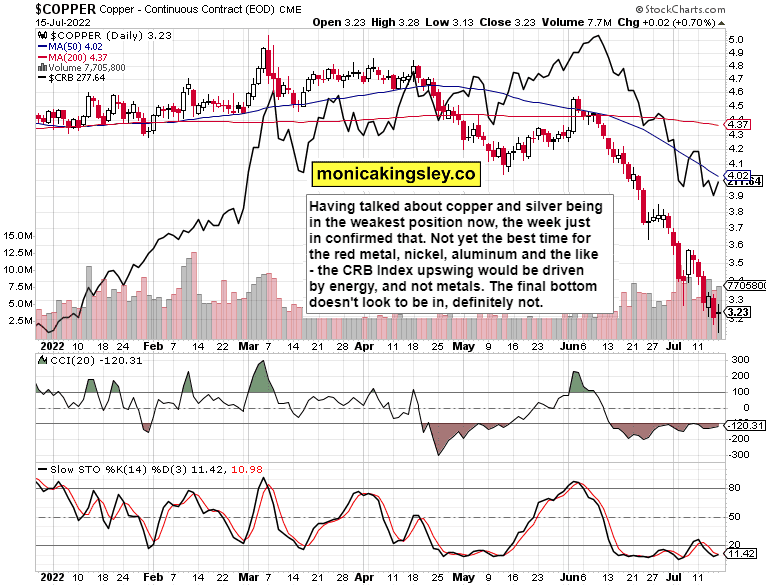

Precious metals don‘t like the strong dollar and tightening prospects ahead, and Powell essentially saying that if having to go into recession is the price of breaking inflation (breaking as in realisitcally driving it to 4-5% annualized), then so be it, doesn‘t help either. The Fed would be certainly in a more difficult position than it‘s in currently if the job market got weaker – having looked at the deceptively allegedly strong non-farm payrolls, something doesn‘t add up with the low figure of hours worked really. In short, this isn‘t yet time for any metals – on the Fed pause in hiking with September being the last one, brighter days are ahead to start the autumn in both precious metals and copper. Makes sense for the Fed to get tougher now, because getting tougher later would be much harder to execute.

Crude oil has likely turned up from $93, but the upcoming upswing would be a labored one. For all the reasons given in today‘s rich chart commentaries, I‘m looking for the next upswing in commodities to be energy-driven. Finally cryptos are likely to modestly participate in the risk-on turn developing (it would positively affect both paper and real assets), before the bears reappear relatively shortly (again around 2 weeks, perhaps a bit less) again.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

S&P 500 is powered to go higher next, and I‘m looking for 4,000 to be reached again. While tech isn‘t yet clearly outperforming, this is going to change – especially later in the second half of 2022.

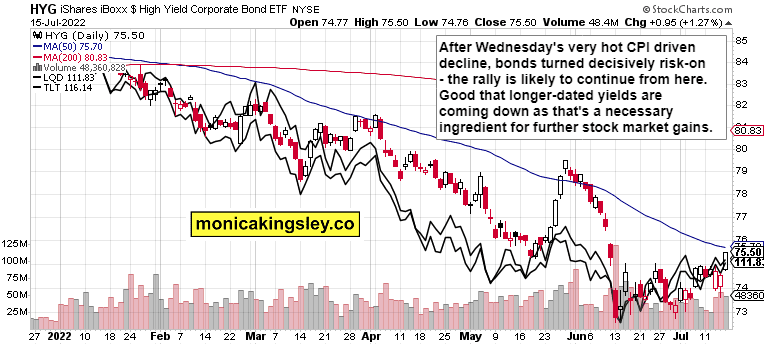

Credit Markets

HYG upswing is likewise only starting – the bond reprieve is very welcome, and it would be a fresh downleg in bonds (with 10-year yield breaking 3.25%) that would make me concerned as regards the prospects of a good finish to 2022 throughout positive Q4.

Gold, Silver and Miners

Precious metals aren‘t yet bottoming, the momentum has picked up since I last talked the sector, miners are down, and the miners to gold ratio hasn‘t yet turned. As the hawkish Fed turns neutral, a fresh upleg awaits. For now, leaner weeks are still ahead – the pain isn‘t over yet.

Crude Oil

Crude oil is turning the corner, and I‘m most optimistic about this part of the commodity sector. When the SPR (strategic petroleum reserve) stops being dumped into the market, prices would return to the uptrend with more ease. Not looking yet for a sharp appreciation, for that (similarly to other real assets), the dollar has to top first – we‘re getting near, and I‘m looking for September to be that time of greenback rolling over.

Copper

Copper lived up to my expectations of being the weakest of the weak – still. The reversal isn‘t yet on the table, reflecting the troubled real economy outlook just ahead. Not yet the time to buy even though we‘re likely to drift slowly upwards from here, in tandem with stocks.

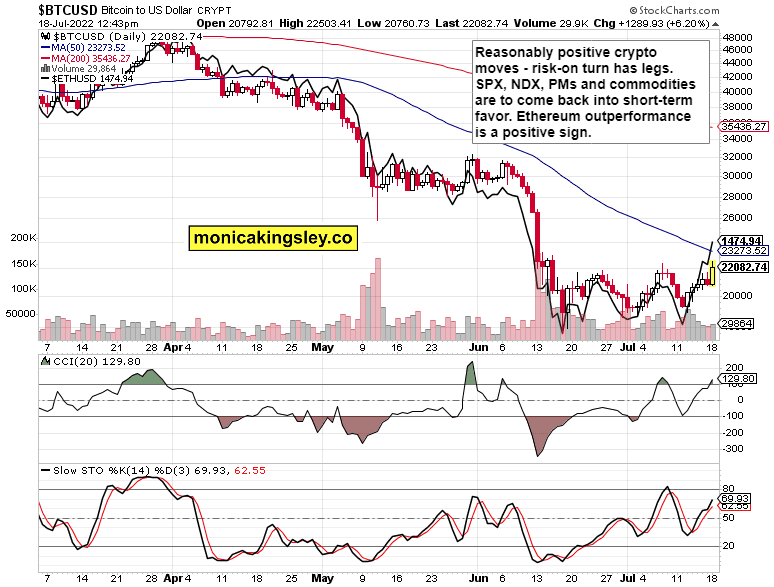

Bitcoin and Ethereum

Cryptos are turning up, and that provides a confirmation of the developing risk-on turn, with positive implications beyond Nasdaq and bond prices.

Thank you for having read today‘s free analysis, which is a small part of the premium Monica's Trading Signals covering all the markets you're used to (stocks, bonds, gold, silver, oil, copper, cryptos), and of the premium Monica's Stock Signals presenting stocks and bonds only. Both publications feature real-time trade calls and intraday updates. While at my homesite, you can subscribe to the free Monica‘s Insider Club for instant publishing notifications and other content useful for making your own trade moves. Thanks for subscribing & all your support that makes this endeavor possible!

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

Updated on