It seems wherever you look at the moment, another talking head is warning of an imminent recession.

And who can blame them.

Inflation is at 40-year highs, interest rates are rising, and stock markets have had their worst start to a year in recent memory.

Now, many are asking whether it is safe to be investing at all. And if so, what kind of stocks should they be buying?

Q2 2022 hedge fund letters, conferences and more

To answer these questions, this article gives some historical context to investing during recessions and explains that - while not completely "recession-proof" - quality stocks provide the best form of protection in a recession.

Moreover, when these stocks belong to a "defensive" sector, like consumer staples, this provides an extra cushion to investors.

Should You Invest in The Stock Market During a Recession?

As we hurtle towards a recession, investors want to know one thing.

Should they "buy the dip", or "batten down the hatches"?

If we look at this from a historical perspective, we see that the S&P 500 actually posted positive returns in over half the 13 years with recessions since World War II - rising an average of 1%.

While this might sound surprising to some, it's important to remember that markets are forward-looking. Therefore, it's not unusual for a bear market to start months before a recession and end before its conclusion.

However, this is not always the case, as every recession is different. For example, the S&P 500 fell another 30% before bottoming after the 2001 recession officially ended.

Moreover, hindsight analysis doesn't really help us in real-time. Since we don't know how long a recession will last in advance, it's hard to know when to buy. In a long, drawn-out recession, markets can go down a lot further than you think before bottoming out.

Therefore, you need to assess whether you can stomach the volatility and hold out long enough for markets to turn. This is a function of your personal financial situation and specific investment goals.

If you are financially independent and have some cash that you won't need for a long time, you can probably afford to be patient and keep "buying the dips". After all, recessions present some of the best buying opportunities for long-term investors.

However, if you have shorter-term investment goals and don't have much capital to invest, you might be best waiting for things to improve first before dipping your toes in.

How to Find Recession Proof Stocks

If you are going to invest, then you need to make sure you're buying the right stocks.

Firstly, it should be said that most stocks go down together in a bear market, so there is technically no such thing as a "recession-proof" stock.

What can be said, however, is that certain stocks perform better than others. History shows that companies with healthy balance sheets, stable cash flows, and unique products outperform in a recession.

These are otherwise known as "quality stocks".

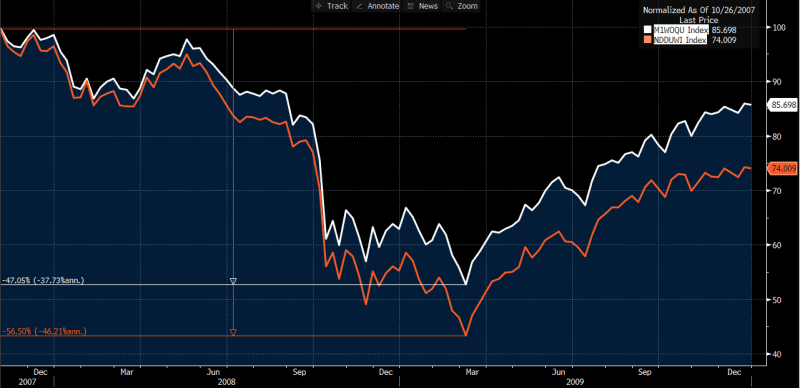

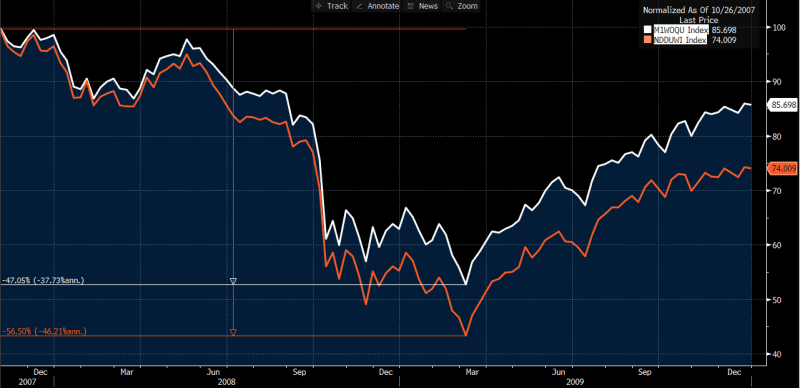

The charts below show that quality stocks outperformed the broader market in the last 2 major bear market recessions in 2007-09 and 2000-02.

I use the MSCI World Quality total return index (M1WOQU) as a proxy for quality stocks, and the MSCI World total return index (NDDUWI) as the market proxy.

2007-09

As you can see, quality stocks fell by 47% peak-to-trough in the 2008-09 recession, whereas the MSCI World index fell by 57%.

Source: Bloomberg

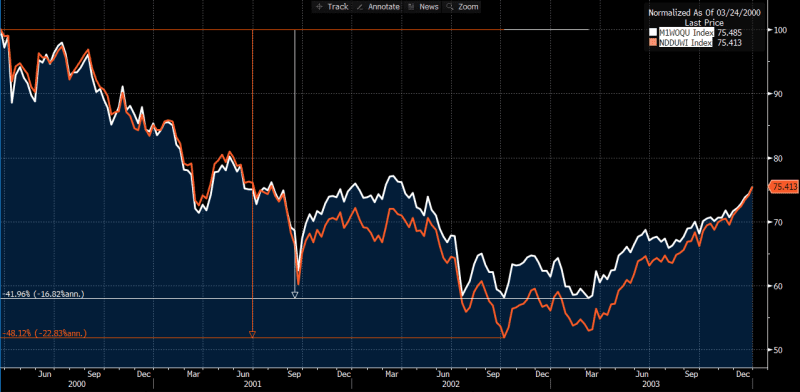

2000-02

Similarly, quality stocks fell 42% peak-to-trough in 2000-02 recession, compared to the 48% fall in world equities.

Source: Bloomberg

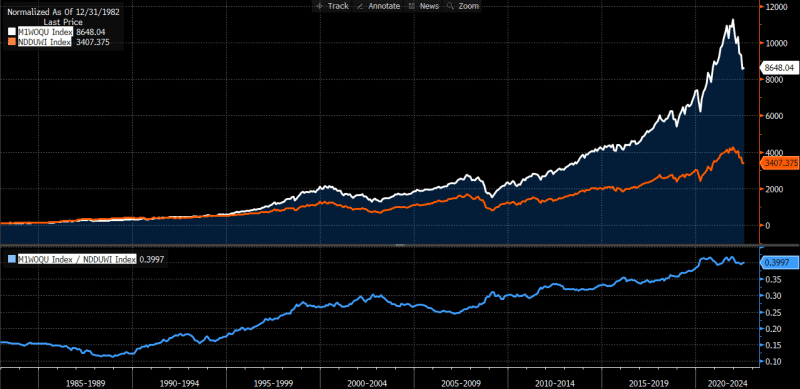

While these sound like small differences, the effects of compounding mean they grow into large ones over the long-term.

The chart below shows that over the last 40 years, returns from quality stocks have dwarfed those of the broader stock market.

Source: Bloomberg

Therefore, if you're looking for some bargains in this current downturn with:

1. Fantastic long-term prospects, and

2. Limited near-term downside relative to other stocks

You should consider adding some quality into your portfolio.

Likewise, if you run a long-short portfolio, you should bias your long-book towards these investments. Their relative outperformance during recessions can help you generate some alpha.

What are Quality Stocks?

While most of us have heard of value and growth stocks, quality stocks are a lesser-known part of the investment universe.

Put simply, quality stocks are those that possess strong competitive advantages.

These arise when a company has some exclusive niche that's hard to replicate or disrupt.

Examples of niches include:

- Unique Products

- Brand Strength/Loyalty

- Network Effects

- Patents

- Scale

- Technology Advantage

Warren Buffett refers to these as an "economic moat" - a hypothetical fortress that protects a business model from external threats.

Essentially, an economic moat creates barriers to entry for competitors and keeps consumers returning as repeat buyers.

The result? Quality stocks generate stable free cash flow; sustainably high returns on capital; and consistent long-term growth.

In other words, everything you need in the face of a recession.

How to Identify Quality Stocks

Market Share Growth

A company with better products and superior execution should regularly attract new customers from competitors and increase market share.

Pricing Power

Companies able to increase prices without a corresponding reduction in sales have substantial pricing power. Pricing power exists when consumers are insensitive to price increases - a direct result of strong competitive advantages.

Brand Strength

Strong brands attract loyal customers, which allows for premium pricing and gains in market share. The link between pricing power, market share and brand strength are strong.

Strong Margins

A combination of pricing power and efficient cost control allow quality companies to maintain high margins in good times and bad.

High Return on Capital

High returns on capital are a hallmark of competent management teams that allocate capital efficiently.

Balance Sheet Strength

Quality stocks tend to have strong balance sheets with healthy cash levels, minimal debt, and low leverage (debt-to-equity).

Consistent Dividends

Another trait of quality stocks is a consistent track record of stable or increasing dividend payments. This provides investors with a degree of certainty in a recession.

Note, it's not the amount of dividend being paid, or the dividend yield, that we're interested in. A high dividend-yield stock is more akin to a value stock, which comes with extra risk.

Quality Stock Screen

With all of this in mind, how can we actually find companies with these traits in practice?

The best way to do this is with a stock screener, since we can filter out stocks that don't meet our chosen criteria.

Below is an example of some quality stock screener criteria:

- 5-year average ROIC > 15%

- Gross Margin > Industry Average

- Net Debt/Equity < 0.5

- Current Ratio > 1.5

- Hasn't cut dividend in last 10 years

Some of the stocks currently passing this screen include: Microsoft, Nike, Zoetis, and Old Dominion. Great examples of niche businesses with insane track records.

Ok, so now we know what to look for in stocks at a micro level during a recession. But is there anything we should look for at a sector level too?

It turns out there is.

What Sectors Perform Best in a Recession?

Defensive sectors tend to perform best in recessions. These are sectors that sell products and services deemed to be essential items, such as food, medicine, and electricity.

No matter how bad the economy gets, people still need to buy these goods, which means their profits are relatively immune to the economic cycle.

Consumer Staples

Consumer staples are about as close as you can get to "recession-proof" stocks. They sell essential, repeat-purchase items, such as toilet roll, toothpaste, cleaning detergent, and food.

It is very unlikely that consumers stop purchasing these items because of a weak economy. They are more likely to cut back on are discretionary items like cars, clothing, and travel before they stop buying shampoo, cereal, and Coca-Cola.

Some of the most well-known consumer staples companies include: Procter & Gamble, Unilever, L'Oreal, Kroger, and Colgate.

Healthcare

The healthcare sector is another relatively recession resistant sector.

People take their health very seriously and are therefore unlikely to defer spending on medicine or life-saving surgeries.

Examples of these stocks include: Johnson & Johnson, Pfizer, Regeneron, Novo Nordisk, and Astrazeneca.

Utilities

The last group of relatively recession resistant companies are utilities. Demand for electricity, water, and waste collection remains pretty stable throughout a recession, so this sector tends to be a safe place to park your cash in a downturn.

Examples of utility companies include: American Water Works, NextEra Energy, and Waste Management.

Defensive Sectors are Outperforming in 2022

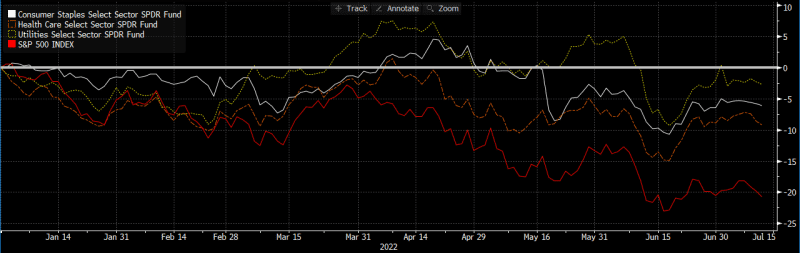

The chart below shows the year-to-date performances of the 3 aforementioned sectors vs. the S&P 500. As you can see, defensive sectors are living up to their name so far and outperforming the broader market this year.

Source: Bloomberg

Diversify Your Portfolio

Another general piece of advice when investing during a recession is to diversify.

This means owning companies across a wide range of sectors, particularly the recession resistant ones mentioned.

Recessions tend to reveal weak companies, so spreading your money across a large number of stocks can minimize the risk of suffering steep losses on one particular company.

Updated on