We at GlassHouse Research would like to present you with our highest conviction short idea Mercury Systems Inc (NASDAQ:MRCY). We believe that MRCY’s earnings quality risk is now the highest it has ever been based on our findings.

Roll-Up Model at Mercury Conceals Deteriorating Core Company

Mercury Systems (MRCY) is a technology company that produces components, modules, and subsystems for the aerospace and defense industries. Over the twelve-trailing-months, stated organic revenue growth was negative for the first time since FY2018, putting management in a precarious position. Our analysis on MRCY will reveal how management has used accounting gimmicks to obfuscate true economic earnings while concealing the decay of its core company.

Q2 2022 hedge fund letters, conferences and more

Our short thesis revolves around the following:

- Stated organic decline of 9.0% in the latest period is severely overstated (we calculate true organic decline well over double-digits).

- MRCY’s recent Physical Optics acquisition has been a disaster with all prior estimates falling well short of initial targets.

- Management has prematurely recognized revenue on significant projects boosting both revenue and earnings unsustainably.

- Program delays and lack of critical parts have wreaked havoc on inventory, which will negatively impact margins going forward.

- We believe recent acquisitions have been used to obfuscate true economic earnings with material non-GAAP exclusions employed over the TTM.

- The already dire stated TTM free-cash-flow of –$2.7 million is also grossly overstated as the company has been stiffing its vendors to conserve cash.

- Finally, exacerbating all these concerns, insiders hold near the lowest amount of company stock in the last 10 years.

On 08/03/21, management introduced a new cost-cutting program called “1MPACT”. “From a financial standpoint, 1MPACT is expected to yield estimated annualized net savings of $30-$50 million by FY2025, with approximately $22 million of this total expected to be realized in FY2022,” CEO Mark Aslett stated in the Q4 FY2021 earnings call. Time and time again, we have analyzed companies that introduced new strategic programs to reduce cost and increase earnings, only for them to use the restructuring program as a non-GAAP safe haven.

Based on our analysis, we believe this is happening at Mercury Systems, with management stuffing normal everyday expenses into its non-GAAP excluded “restructuring” expenses. It also appears that management is still gung-ho on continued acquisition expansion that will lead to heightened “one-time” charges.

Reported Organic Revenue is Greatly Overstated

Mercury Systems is non-apologetic about its growth strategy to $1 billion in sales for fiscal year 2022. Management is myopically focused on hitting this goal in Q4, through either non-existent organic growth or acquisitions. Discussing this goal with long-term targets, management introduced 1MPACT, a new program focused on increasing growth and efficiency in the FY2021 10K:

1MPACT

On August 3, 2021, we announced a companywide effort, called 1MPACT, to lay the foundation for the next phase of our value creation at scale. The goal of 1MPACT is to achieve our full growth, margin expansion and adjusted EBITDA potential over the next five years. Since fiscal year 2014, we have completed 13 acquisitions, deploying $1.2 billion of capital and, as a result, dramatically scaled and transformed the business. Over this time, we have extracted substantial revenue and cost synergies from these acquisitions.

Now, as we approach the milestone of $1 billion of revenue, we believe there is significant opportunity to realize further scale through consolidating and streamlining our organizational structure which will improve visibility, speed of decision making and accountability.

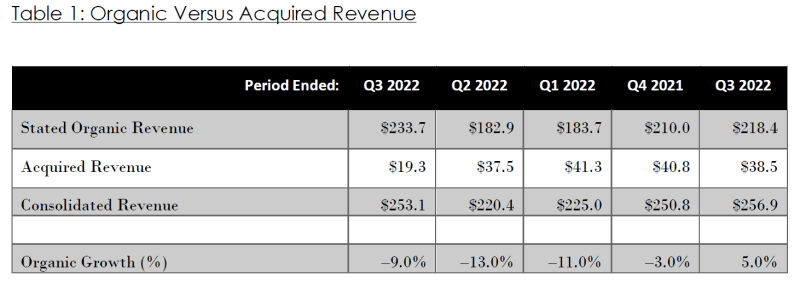

Since 08/03/21, Mercury acquired two more companies, Avalex and Atlanta Mirco in FY2022. A main focal point of our thesis revolves around management’s reckless aspiration of $1 billion in revenue by any means necessary. Illustrating this trend, MRCY’s organic growth has fallen off a cliff over the past fiscal year, trending negative from Q4 FY2021 onward. In the last four periods, organic revenue declined 3.0%, 11.0%, 13.0%, and 9.0% YOY, in periods Q4 FY2021, Q1, Q2, and Q3 FY2022, respectively. Organic growth has bifurcated from stated consolidated growth as the company only reported a consolidated revenue decline in the latest period of 1.5% YOY.

In the Q4 FY2021 earnings call, CEO Mark Aslett detailed the weakness in organic growth that afflicted the company:

Throughout fiscal '21 and as we discussed, our organic revenues were impacted by COVID-related modernization delays on SEWIP and other naval surface programs. Customer execution issues on the F-35 TR3 and a delay in a large foreign military sale. In addition to lowering bookings, these issues combined reduced our organic revenue growth by approximately 5 percentage points for the year. On our call last quarter, we previewed fiscal '22, expecting mid- to high single-digit organic growth, leading to total company revenue growth in the mid-teens.

Given our experience in fiscal '21, we've taken a more conservative stance on organic growth for fiscal '22. This includes reducing our expected fiscal '22 revenues from SEWIP and other naval fleet upgrades, the F-35 and certain FMS programs. The biggest change since our last quarter relates to LTAMDS. Raytheon at their recent Investor Day said that the next LTAMDS award will likely be in their next fiscal year. We have been expecting a large booking in the second quarter of fiscal '22.

This booking has now moved to our fiscal '23 with revenue spread over several years. Like SEWIP and F-35, LTAMDS is an important well-funded program. It's the largest single design win in the company's history to date and will be a significant driver of growth beginning in fiscal '23 and over the course of the next 5 years and beyond.

As Mike will discuss in detail, as a result of these changes, we're now expecting flat organic growth in fiscal '22. We're expecting approximately 10% total company revenue growth prior to future M&A, eclipsing $1 billion for the first time and record adjusted EBITDA. We're expecting a number of programs to drive growth in fiscal '22. These include revenue associated with the large FMS order that was delayed in Q1 last year.

In Q2, management revised organic revenue estimates downward after already doing so in the beginning of the fiscal year. CFO Michael Ruppert then disclosed the following in the Q2 earnings call:

For full fiscal '22, we're maintaining our prior guidance for revenue, adjusted EBITDA and adjusted EPS. Our updated guidance incorporates the acquisitions of Avalex and Atlanta Micro as well as a more cautious organic revenue outlook, primarily due to elevated supply chain risk. We continue to expect fiscal '22 to be weighted towards H2 and especially Q4 as margins expand and free cash flow begins to normalize. Given our backlog at the end of Q2 and forecasted Q3 bookings, we expect to exit Q3 with strong visibility into Q4.

Organically, the midpoint is a 3% revenue decline year-over-year, reflecting the supply chain and other risks I previously mentioned.

Management kept the fiscal year organic decline of 3% guidance (consolidated guidance of $1.00 to $1.02 billion) in Q3 even after posting another 9.0% decline. They also declined to give any guidance for fiscal year 2023. After organic revenue declines in four consecutive periods, we estimate that Mercury would need to report an organic growth rate of 18% in Q4 to hit their mid-point guidance,1 That’s a tall task for a company that revised their organic estimates downward twice in one year and delayed some of its largest projects such as the aforementioned SEWIP, F-35, TR3 and LTAMDS (AKA GhostEye).

Updated on