By Nicholas Earl

The future of collapsed supplier Bulb Energy (Bulb) could finally be settled in the coming weeks, provided the Government coughs up £1bn in taxpayer funds to support its takeover.

Octopus Energy (Octopus) has asked Downing Street for public money to seal the acquisition of its former rival, which fell into de-facto nationalisation late last year.

It is now nearing a deal with ministers to acquire the energy firm, according to Sky News, which is remains the country’s seventh biggest supplier despite its shocking fall from grace.

Taxpayer money is being sought because Bulb has not been allowed to hedge its purchases of wholesale gas.

This has left it exposed to soaring prices – which have spiked from already historically elevated levels since Russia’s invasion of Ukraine, and racked up its running costs.

The decision not to allow Bulb to hedge was criticised by Westminster MPs in the BEIS Select Committee report published earlier this week.

It argued the decision not to implement a hedging strategy may have led to the sale of Bulb being less desirable and significantly increased costs to taxpayers.

However, Business Secretary had described hedging as “very risky” and that the Treasury was opposed to taxpayer funds being used to make bets on price movements.

If Octopus does strike a deal for Bulb, it would take the likely total exposure to the government of Bulb’s collapse to more than £3bn, including the £1bn cash injection from the Government.

This would confirm its position as the biggest state bailout since the Royal Bank of Scotland in 2008.

We recommend that the Government implements a hedging strategy at Bulb. In the meantime we ask the Government to provide us with a detailed analysis of the cost implications for BEIS and the taxpayer of its decision not to purchase hedges to date.

BEIS Committee report into energy pricing – 26 July 2022

Bulb deal could be finalised within weeks despite headwinds

The deal involves Octopus paying between £100-200m to take on Bulb’s 1.6m customer base, City sources told Sky News.

Over time, the £1bn is expected to be repaid by Octopus in full.

It would also include a profit-share agreement, which would give the Government a return for several years on earnings from Bulb customers.

While there is optimism an agreement could be reached this summer, the complexity of the takeover could still prevent it from happening.

For instance, the Treasury’s approval will be needed to sign off any deal, while the issue of creditor’s debts would need to be resolved.

Bulb currently owes £585m to multiple creditors, and it is unclear how many will be repaid.

This includes Sequoia, an infrastructure funds its parent company, Simple Energy, owed £55m.

Currently, Octopus being advised by KPMG on the proposed takeover.

Administrators expose Bulb’s perilous financial state

Bulb’s administrator, Teneo Restructuring (Teneo), and the investment bank Lazard have been orchestrating the search for a buyer since November last year.

The supplier dropped into administration amid the lethal combination of soaring wholesale costs, price cap constraints and insufficient hedging.

Its collapse was the largest among dozens of supplier failures, with other firms entering the supplier of last resort process rather than being propped up by public money.

Ofgem has since faced sustained criticism for market conditions prior to the crisis, with the BEIS Committee raising doubts over its ability to reform the industry in its report earlier this week.

It has also faced disapproval for its handling of the crisis from the National Audit Office – which has put the clean up bill for the supplier of last resort process at £2.7bn – and from Citizens Advice.

Despite being propped up by transfusions of public money, Bulb remains in a perilous financial state, with the details of its losses and financial difficulties exposed in an administrator report last month.

Teneo revealed that Bulb has racked up an £886m loss in the six months since being taken over by administrators.

This means it has reported a loss of nearly £600 for every household it provides energy.

It also remains mired in scandal, after it was revealed that the taxpayer was paying chief executive Hayden Wood’s £250,000 per year salary, even though he oversaw its collapse.

Octopus set for vast ramp-up in customers

Octopus tabled the only final offer for Bulb ahead of the deadline last month, meaning ministers have few options for offloading the supplier.

City A.M. understands British Gas owner Centrica and Abu Dhabi-based energy group Masdar pulled out of making bids at the eleventh hour.

If Octopus wraps up the deal, its customer base would swell to over five million British households.

Earlier this week, it announced it had completed a $550m fundraising, with $325m committed to support the growth of Kraken, its technology platform.

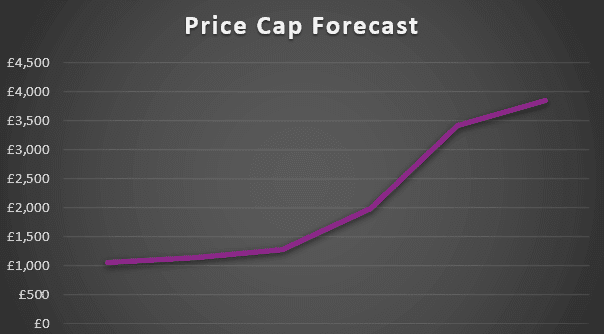

The scramble to secure the sale of Bulb comes ahead of the latest gloomy forecasts from Cornwall Insight and BFY Group, which both predict household energy bills will approach £4,000 per year this winter – when energy demands is at its peak in the coldest months of the year.

For context, the price cap was still £1,277 per year as recently as March, while the current cap – set at £1,971 – is an all-time high.

Teneo declined to comment.

BEIS, Octopus and Bulb have also been approached by City A.M..

The post Octopus Energy calls for £1bn in public money to finalise Bulb Energy deal appeared first on CityAM.